TOKYO (AP) — Asian shares mostly declined Friday after a U.S. Federal Reserve official said the central bank might not deliver any of the interest rate cuts that Wall Street has been banking on this year, citing concerns about inflation.

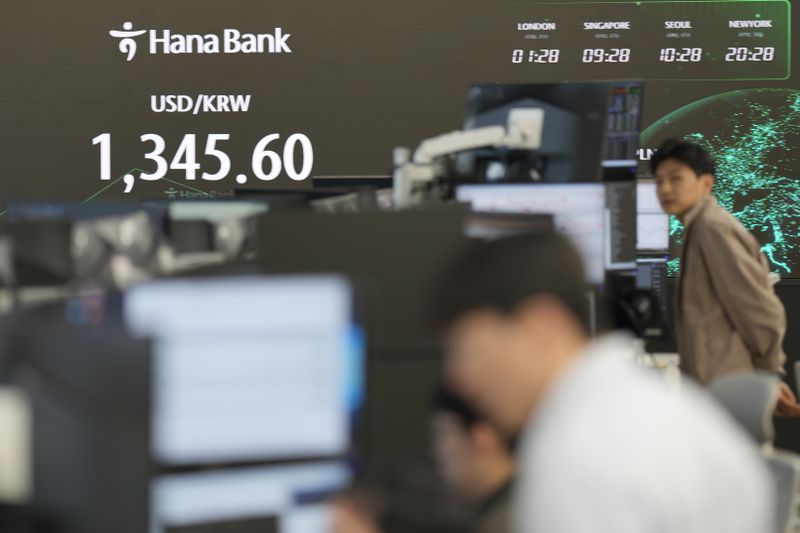

Japan's benchmark Nikkei 225 dove 2.4% to 38,812.24. Sydney's S&P/ASX 200 slipped 0.8% to 7,756.20. South Korea's Kospi dropped nearly 1.0% to 2,714.84. Hong Kong's Hang Seng lost 0.8% to 16,594.79.

Tensions in the Middle East added to the sense of pessimism. But some analysts suggested the Fed may cut rates at least once later this year.

“Already there are distinct signs of cooling in economic activity and conditions for sustained wage pressures,” said Tan Jing Yi at Mizuho Bank in Singapore.

On Wall Street, the S&P 500 dropped 1.2% for its worst day in seven weeks. Earlier in the day, a gain of nearly 1% had brought it to the cusp of its record set last week.

The Dow Jones Industrial Average swung 530 points lower, or 1.4%, after reversing a rise of nearly 300 points. The Nasdaq composite fell 1.4%.

Financial markets were already on edge as traders made their final moves ahead of a U.S. jobs report on Friday that could also shake the market.

A late-day spurt for oil prices amid continued tensions in the Middle East unsettled things, threatening to add more pressure on inflation following oil’s strong gains so far this year.

Around the same time, Treasury yields dropped in the bond market, which can be a signal of investors looking for safer harbors, and a measure of fear among U.S. stock investors leaped.

Stocks slumped after Minneapolis Fed President Neel Kashkari said he’s questioning the need to cut rates, as many areas of the economy look to be solid despite high interest rates.

He had earlier penciled in two cuts to interest rates this year, “but if we continue to see inflation moving sideways, then that would make me question about whether we need to do those rate cuts at all.”

“There’s a lot of momentum in the economy right now,” Kashkari said in an interview with Pensions & Investments.

Kashkari’s hypothetical, which he said depends on “a lot of ‘ifs,’” cut at one of the main propellants that drove the U.S. stock market up more than 20% from November into March. Lower rates boost prices for investments, while easing the pressure on the economy.

Traders had already drastically scaled back their predictions for how many cuts to interest rates the Federal Reserve would deliver this year, down from six at the start of the year to three more recently. That had them in line with Fed officials generally.

But several recent updates on the economy have come in hotter than expected, beyond some disappointingly high inflation reports at the start of the year that could be seen as temporary blips. A report earlier this week showing a surprise return to growth for U.S. manufacturing raised concerns in particular.

Kaskhari is not a voting member on the Fed’s policy-making committee this year, but that doesn’t mean he doesn’t have a voice at the table.

“The market remains highly sensitive to any indication that the data dependent Fed may need to curtail a rate easing cycle this year per Neel Kashkari’s comments this afternoon,” according to Quincy Krosby, chief global strategist for LPL Financial.

In the bond market, the yield on the 10-year Treasury fell to 4.30% from 4.35% late Wednesday. The two-year yield, which moves more on expectations for the Fed, slumped to 4.64% from 4.67% late Wednesday.

Wall Street is looking for the job market to cool enough to remove upward pressure on inflation, but not so much that it throws too many people out of work and causes a recession.

That’s raised the anticipation for a report coming Friday, where the U.S. government will show how much hiring happened across the country last month. Economists expect it to show a cooldown in March from February.

“As always, the monthly jobs report will have the final say,” said Chris Larkin, managing director, trading and investing, at E-Trade from Morgan Stanley.

All told, the S&P 500 fell 64.28 points to 5,147.21. The Dow Jones Industrial Average dropped 530.16 to 38,596.98, and the Nasdaq composite sank 228.38 to 16,049.08.

In the oil market, a barrel of benchmark U.S. oil climbed 14 cents to $86.73 a barrel. It rose $1.16 to settle at $86.59 Thursday. Brent crude, the international standard, rose 31 cents to $90.96.

In currency trading, the U.S. dollar fell to 151.24 Japanese yen from 151.30 yen. The euro cost $1.0827, down from $1.0841.

___

AP Business Writer Stan Choe contributed.

___

The summary of an earlier version of this story incorrectly reported the change in the S&P 500 as 1%.

Credit: AP

Credit: AP

Credit: AP

Credit: AP

Credit: AP

Credit: AP

Credit: AP

Credit: AP

Credit: AP

Credit: AP