A House Republican hopes to breathe new life into a stalled bill that would amp up a tax credit for donors who pour money into the state's crumbling rural health system.

State Rep. Geoff Duncan's measure, House Bill 54, failed to reach a vote at last week's crucial Crossover Day deadline. But he said he's found a new avenue for the bill – by tacking it onto legislation sponsored by state Sen. Dean Burke involving rural hospital rules.

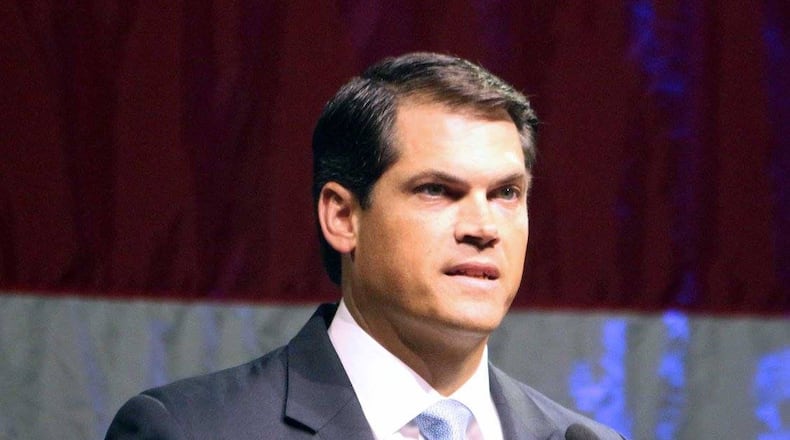

"Rural Georgia is expecting us to do something now," said Duncan, a Cumming health executive with an eye on higher office. "I can't sit back and let good policy die."

Duncan was behind a plan last year that offered tax credits for donors to rural hospitals – he pitched it as a lifeline for struggling medical centers - but few have applied for the credits. At least eight have shuttered since 2001 and more than a dozen others are on the verge of failing.

His measure initially sought to raise the tax credit from 70 percent to 90 percent for donors to rural hospitals. He said Thursday his new plan would raise it to 100 percent, making it a dollar-for-dollar incentive. It sets a statewide cap of tax credits at $60 million over the next three years.

“If I asked anyone in this state if we could raise $60 million virtually overnight for 49 rural hospitals, how could they say no?” he said. “For the life of me, I cannot figure out why it doesn’t have the momentum rural Georgia is expecting.”

He’s aiming for a hearing in the House Ways & Means committee as soon as next week.

About the Author