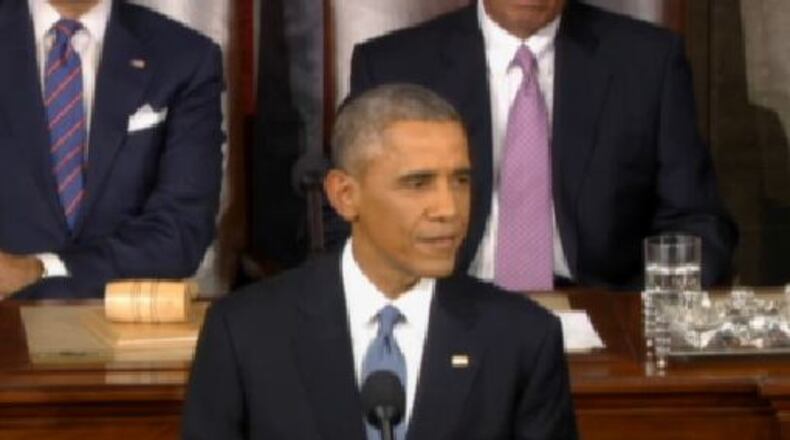

It's not often you see a proposal talked about in the State of the Union Address abandoned a week later, but that's what has happened in the case of one plan from President Obama, which would have taken away favored tax treatment for 529 college savings plans.

Republicans had denounced the original plan, and they quickly celebrated the news that the White House had backtracked.

"The President’s dropping his misguided plan is a victory for common sense," said Sen. Charles Grassley (R-IA).

The original plan was part of an effort by the White House to argue that 529 savings plans were tilted in favor of higher income earners; the President's own team had described it as an "upside-down" education savings incentive - it was described this way:

Credit: Jamie Dupree

Credit: Jamie Dupree

On the night of the State of the Union, the White House even tweeted out the idea that forcing the wealthy to pay capital gains taxes on college savings - to pay for other programs - was a popular idea:

But from the beginning, Republicans had attacked the Obama plan to limit college savings for those making over $200,000 a year, arguing that it would force many families to instead take out government loans.

"For the sake of middle class families, the President oughta withdraw this tax increase when he submits his budget," Boehner said at a news conference.

Hours later, he got his wish.

A White House official meanwhile said it was obvious the plan lacked support.

"Given it has become such a distraction, we're not going to ask Congress to pass the 529 provision so that they can instead focus on delivering a larger package of education tax relief that has bipartisan support," the official said.

As word of the decision to take the 529 plan out of the President's budget, Republican lawmakers celebrated the news.

"Good news for middle class families saving for college," tweeted Rep. Larry Bucshon (R-IN).

About the Author