Peachtree Center office towers, mall face possible foreclosure sale

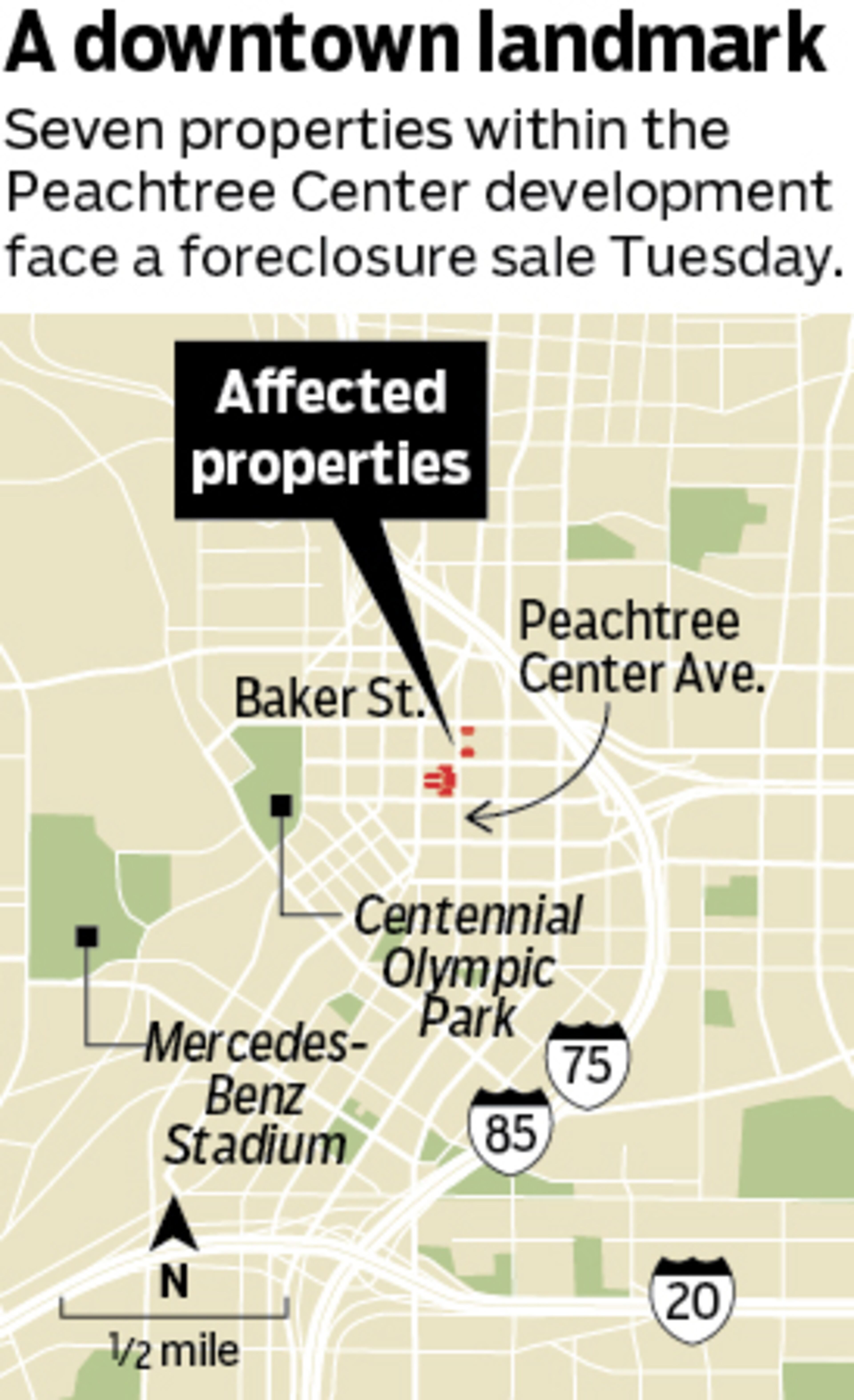

Six towers and the mall at Peachtree Center, a landmark office and retail development in downtown Atlanta, are scheduled for a foreclosure sale the day after Labor Day, an event that could foreshadow financial pain for other commercial landlords in a post-pandemic world.

The properties, which are owned by Miami-based Banyan Street Capital, are listed in a foreclosure notice published in recent days in the Fulton County Daily Report. The towers and mall, if taken back by the lender, would rank among the largest Atlanta commercial foreclosures since the fallout of the Great Recession.

Developers handing over the keys to their lenders were sadly common occurrences more than a decade ago amid the global economic meltdown. But high-profile foreclosures have been far less common during the recent commercial real estate boom.

The foreclosure notice lists a pair of loans on the properties totaling more than $140 million.

Demand for office space remains in flux as employers grapple with changing needs in a post-COVID world, and fears of recession grow. But Peachtree Center could be a harbinger for older towers.

“This is the canary in the coal mine,” Henry Lorber, a distressed real estate expert with Henry Lorber and Associates, told The Atlanta Journal-Constitution. “I think you’re going to see more foreclosures.”

The notice lists towers Marquis I and II, and the towers known as 225, 229, 233 and 235 Peachtree. The shopping mall at 231 Peachtree is also listed in the advisory.

The notice, first reported by Atlanta Business Chronicle, states that the properties will be sold Tuesday on the steps of the Fulton County Courthouse.

It is possible the owner of the Peachtree Center debt, a commercial mortgage-backed security, could come to an arrangement with Banyan Street that would forestall a foreclosure ahead of Tuesday.

Banyan Street, which acquired the complex in 2016, spent years and millions renovating the Peachtree Center towers and shopping mall.

The company said it has been unable to “reach an acceptable arrangement” with SitusAMC, a special servicer or distressed debt company, which manages the Peachtree Center loans.

An ownership change, if it happens Tuesday, probably won’t affect current tenants in the complex, which include law firms and local, state and federal government agencies.

Peachtree Center was designed and built by famed late Atlanta developer and architect John C. Portman Jr. The complex is a defining feature of the city, lending its name to the surrounding business district and a MARTA station.

Developed from the 1960s to 1980s, it includes several blocks of office high-rises, convention hotels, a shopping mall, as well as what is now known as AmericasMart. The merchandise mart and hotels, including the Hyatt Regency and Marriott Marquis, are not part of the foreclosure proceedings.

Large tenants have left Peachtree Center for glitzy new workplaces in other areas of the city. Occupancy has dipped to 55%, and two large tenant leases expire in the next two years, according to financial documents obtained by the AJC.

Banyan Street said it remains fully committed to its downtown Atlanta assets, including the neighboring 191 Peachtree office tower, the Ascent Peachtree residential project and multiple parking garages.

In its statement, Banyan Street said downtown civic group Central Atlanta Progress “expects approximately $3.8 billion to be invested into Downtown’s core over the next five years.”

“That level of investment paired with the submarket’s growing number of residences will make it an exceptional place to be,” the company said. ”The best is yet to come for Downtown Atlanta.”

Reinvigorating old offices

Metro Atlanta is famous for its boom-to-bust real estate cycles, and the region is currently still riding a development wave that started after the Great Recession. Employment growth remains strong, and jobs are a huge driver for office demand.

But there are storm clouds on the horizon.

The Federal Reserve’s efforts to tame inflation could trigger an economic slowdown that dampens office demand, and rising interest rates could make refinancing commercial mortgages more difficult.

The pandemic and the emergence of work-from-home and the hybrid work schedule created instability in the office market, and large employers and landlords are still trying to adjust. The office vacancy rate across metro Atlanta was 21.3% at the end of June, according to data from real estate services firm Jones Lang LaSalle.

Downtown’s vacancy rate is slightly better than the metro average, but downtown has some of the oldest commercial buildings, which can be at a disadvantage to newer towers. Many need investment or re-invention to remain competitive, experts say.

“We are cannibals in the office building business,” Lorber said. “The newer buildings being built and those that have been built up in Midtown are eating the tenants from downtown.”

Fewer tenants puts pressure on office owners, and that squeeze is being felt.

Tyler Wright, a forensic accountant and CPA with Moore Colson, said he’s seeing more banks and building owners trying to restructure their loans. He said forbearance agreements, where lenders and debtors agree to lower or pause payments temporarily, are becoming more frequent.

‘They’ve been stalwarts’

AJ Robinson, who used to manage Peachtree Center in the 1990s, said the financial and leasing issues facing the area’s office towers are signs of the ongoing challenges facing aging buildings.

“It’s disappointing to see. They’ve been stalwarts since the 60s in Atlanta’s downtown landscape,” said Robinson, who is now president of Central Atlanta Progress and the Atlanta Downtown Improvement District.

Portman’s investment downtown was an outlier in a time when many developers focused their attention in Buckhead and the northern suburbs.

But Peachtree Center had its critics. The complex was also a product of its time — built as a sort of fortress, focused inward with a network of sky bridges that allowed workers to avoid the streets. Urban designs now focus on active street life.

Portman underwent some financial strife in the late 1980s, which prompted Peachtree Center to go through foreclosure in 1990. Robinson, who oversaw the foreclosure process, said the office towers are designed in a way to persevere through tough times.

“Iconic assets tend to live long no matter what the current crisis,” he said.

Adaptive reuse

In 2016, Banyan Street launched an overhaul of several of the Peachtree Center buildings and its mall.

The mix of restaurants and shops changed and plans involved upgrades to Peachtree Center’s outdoor plaza to make the complex more inviting to the street.

In April 2021, Truist Financial Corp. vacated the two Marquis towers as part of consolidation of its corporate real estate. That exit represented more than a fifth of Peachtree Center’s rent, according to a report from investment firm Morningstar.

Chris Meyer, an assistant vice president at Morningstar, said his firm estimates it could take three years for a new owner to get tenant occupancy at 70% or more, which is still below the vacancy rate for downtown Atlanta.

He said Peachtree Center’s age could work to an owner’s advantage as long as rents remain comparatively cheap.

“They’re not going out there trying to get top-tier rents, so I think that might be helpful,” Meyer said.

It’s possible a new owner could pursue different uses for the buildings, and that wouldn’t be unprecedented within Peachtree Center. The development’s first office building, known as 230 Peachtree, was re-acquired by Portman and transformed in 2016 into a Hotel Indigo, refreshed office space and an upscale restaurant.

Other nearby office buildings have also received second lives. An aging office building Piedmont Avenue near Atlanta’s flagship Hilton hotel is now high-rise apartments, and the old Candler Building is now a boutique hotel. Several real estate experts said the pandemic could accelerate that repurposing process.

Lorber said utility access such as sewage and gas would make it a logistical nightmare to transform the Peachtree Center office towers into apartments, but Robinson was more open to the possibility. He said it’s definitely something to consider.

“Whether it’s office or housing or something else, they’re iconic,” Robinson said. “Maybe in the next 50 years they have a different use.”

THE STORY SO FAR

Six office towers and the mall within Peachtree Center face a foreclosure sale Tuesday. The property’s owner, Banyan Street Capital, has so far been unable to refinance its loans worth more than $140 million. The potential foreclosure could serve as a bellwether for Atlanta’s office market due to current economic headwinds and the changes brought by the COVID-19 pandemic.