Cash or credit? Consumers furiously swiping cards

Consumers once again swiped their credit and debit cards in August more than they had in more than a year, eager to take late summer vacations and take advantage of back-to-school sales.

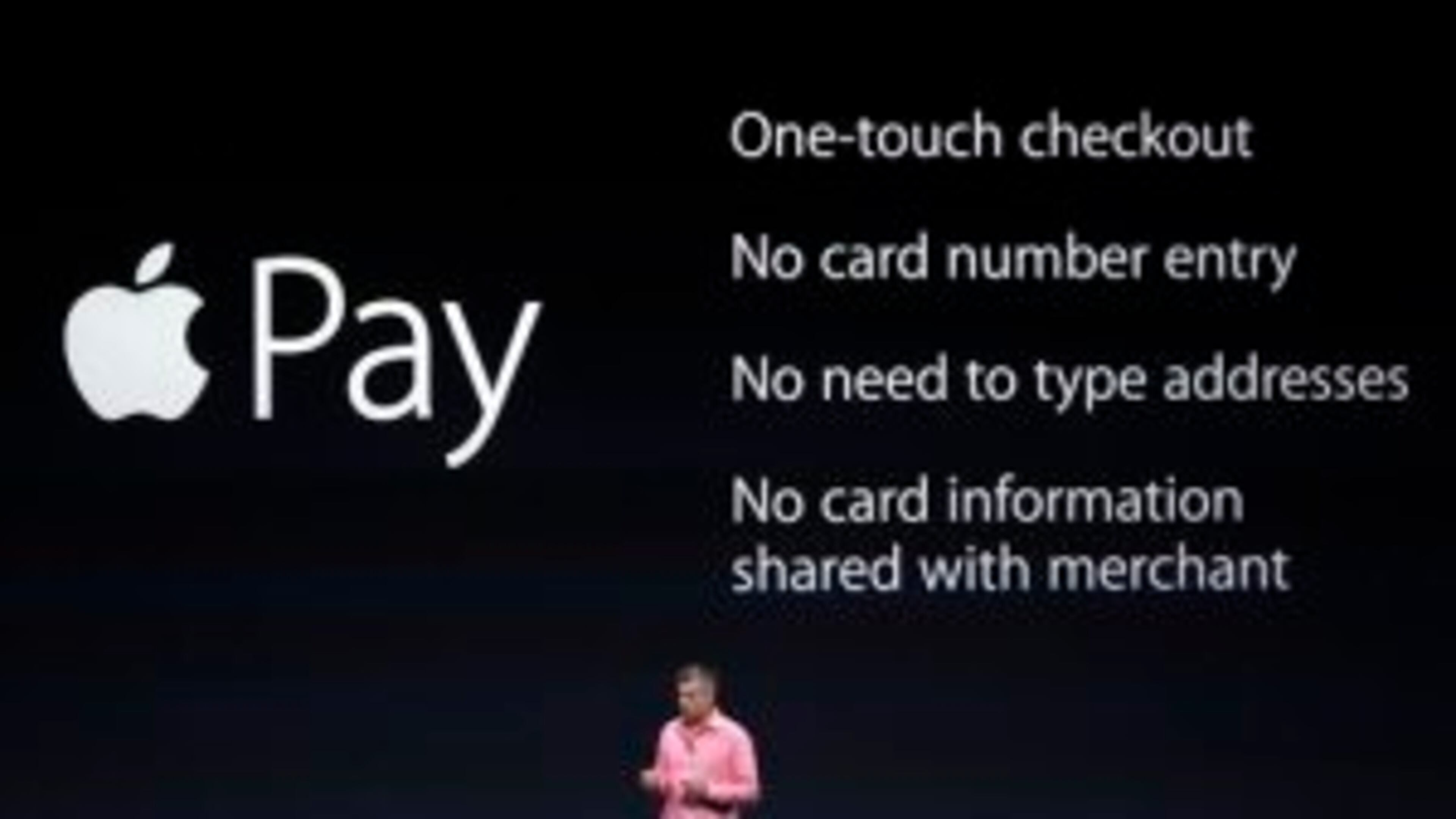

Eddy Cue, Apple senior vice president of Internet Software and Services, discusses the new Apple Pay product on Sept. 9 in Cupertino, Calif. (AP)

Atlanta-based First Data reported consumer spending with credit, debt and other cards in August was up 3.9 percent. While lower than the 7.3 percent growth in August 2013, it was the highest monthly rise since then and matched last month’s results.

The report was another sign that consumer spending, the engine that powers economic growth, remained relatively strong in recent months despite mixed signals in other areas of the economy.

“Two important factors – back-to-school spending and late summer vacationing – contributed to strong overall consumer spending in August and despite stagnant wage growth and a moderate housing market, consumer confidence rose in August,” said Krish Mantripragada, First Data’s senior vice president for Information and Analytics Solutions.

Hotel and travel spending was up 9.3 percent and 5 percent, respectively, in August compared with 7.9 percent and 4.6 percent, respectively, in July. Retail spending with cards was up 2.8 percent in August, compared with 2.6 percent in July.

First Data noted that credit card spending, up 5.8 percent, continues to lead other categories of card spending, a finding supported by an earlier report from Atlanta-based Equifax.

Equifax reported last month that metro Atlantans had nearly $11 billion in credit card debt in the second quarter this year, up 4 percent from the level of debt a year earlier. Atlanta was No. 6 among the top 25 U.S. metropolitan areas in percentage increase in credit card debt in the second quarter.

Consumers may be benefiting from having more money in their wallets due to falling gasoline prices, which should continue to drop as stations switch to cheaper winter-blend fuel,

First Data said gas stations reported a 2.3 percent drop in sales by cards in August compared with a drop of 0.2 percent in July as gas prices fell, and the drop continues.

The average price nationally for unleaded was $3.390 Monday, compared with $3.523 a year ago. The average price for unleaded in metro Atlanta was $3.397 a gallon, down from $3.441 from a year ago.

First Data’s SpendTrend report tracks card transactions at nearly 4 million merchants.

The big question now may be will Apple's entry into the financial sector with its new smartphone-based Apple Pay payment system eventually render card-swipe machines (and credit cards) obsolete?