Federal hearings seek to reverse Trump-era student loan rules

U.S. Department of Education officials are holding three days of virtual public hearings starting today that will focus on potential changes to Trump-era guidelines critics believe have made it more difficult to repay student loans.

The revisions include strengthening protections for borrowers harmed by misleading practices by their college. The department last week announced the approval of 18,000 borrower defense claims for former students of ITT Technical Institute, which exaggerated its job-placement numbers among other things. These borrowers will receive 100% loan discharges, resulting in approximately $500 million in relief.

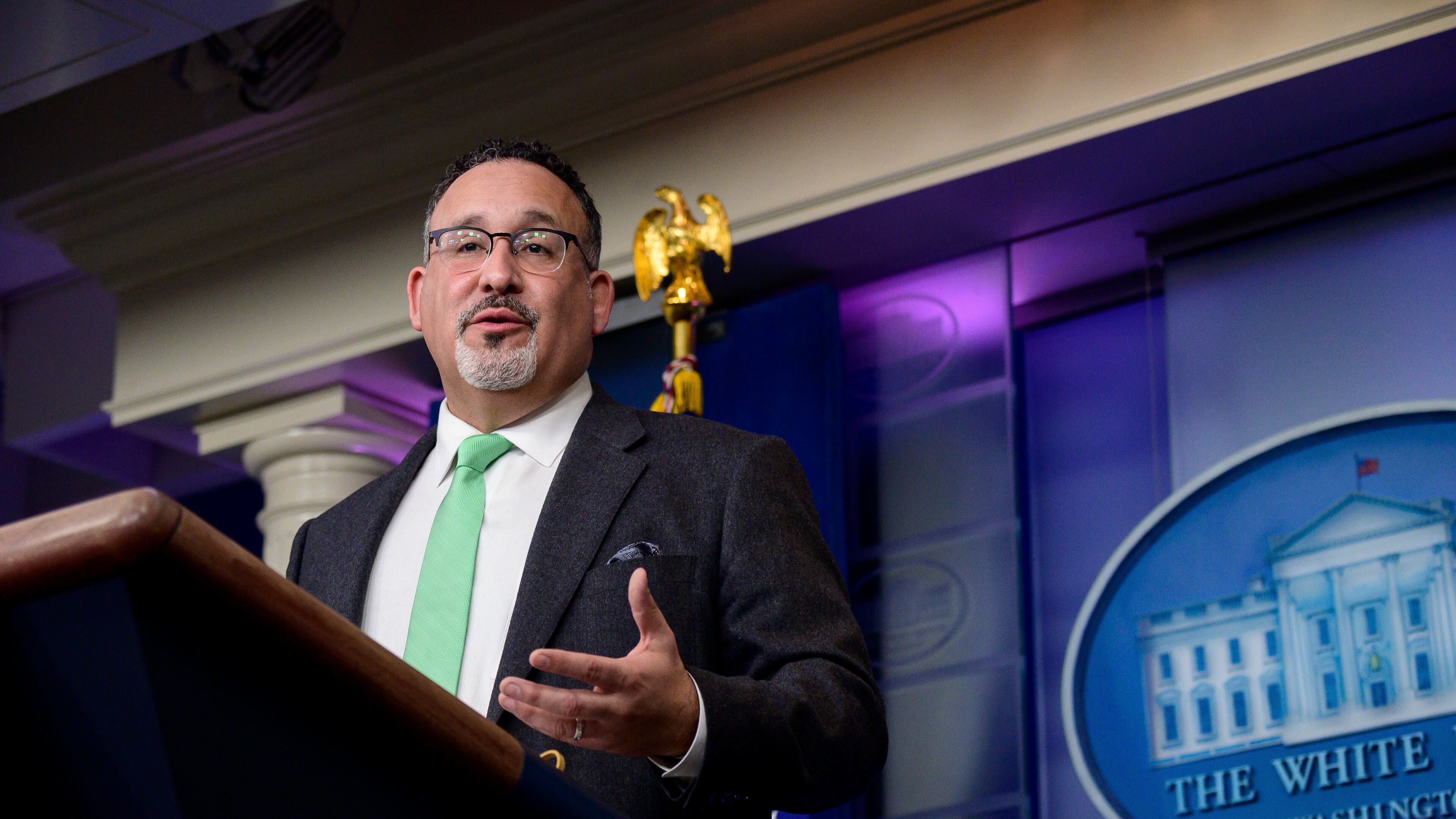

The department’s new secretary, Miguel Cardona, said in a statement announcing the hearings that he wants to take “a fresh look at a range of regulations to make sure they are not creating unnecessary barriers, but instead can ensure that institutions and programs serve our students well.”

Many Georgians are paying close attention.

The average federal loan debt among Georgians is nearly $42,000, according to a federal database. Only Washington, D.C. and Maryland have higher averages. Georgia’s total student loan debt, including private loans, is more than $81 billion, according to a March report by Student Loan Justice, a citizen group that wants the cancellation of all federally owned student loans by executive action, and the return of bankruptcy protections to all student loans.

“The whole system is horrible,” said Hillary Meister, 62, a Georgia State University web coordinator involved with the group.

Meister borrowed about $40,000 in 1991 to pursue a master’s degree at the University of Georgia. Meister said her interest rate is 8%, more than her mortgage rate, and her debt is roughly $78,000 after past deferments. Her monthly payment before the pandemic was nearly $275 a month. She wants the federal government to, among other things, offer loan forgiveness to people near retirement. Meister also wants to see clearer rules about loan forgiveness. Federal data show, less than 6% of applicants for the Public Service Loan Forgiveness program were eligible for the program, which forgives loans for borrowers working for the government or a nonprofit who have made 10 years worth of loan payments.

More attention has been paid to student loan debt in recent years as the combined total held by the federal government has reached $1.6 trillion, which is more than the nation’s total auto loan debt. There’s been pressure on President Joe Biden to cancel up to $50,000 per borrower. Biden has proposed canceling $10,000. Federal officials at the start of the coronavirus pandemic paused required payments and lowered interest rates to 0%. The pause is scheduled to end Sept. 30.

Much of the ire of borrowers and student loan reform advocates is focused on for-profit and online colleges. The loan default rate at those schools operating in Georgia is often greater than 10%, much higher than the state’s public and private colleges and universities.

The schools typically recruit military veterans and working adults pursuing degrees to advance their careers. For-profit colleges were the only sector of higher education that saw enrollment increases on the undergraduate and graduate level last fall, 3% and 9% respectively, National Student Clearinghouse statistics show.

Many for-profit schools have been under scrutiny in recent years for deceptive marketing practices, trouble students have had transferring credits and getting jobs after graduation. A few, such as Argosy University, which had an Atlanta-area campus, have shut down, giving little notice to students.

Federal education officials have what experts say is a large agenda of items they hope to address through the rulemaking hearings. Some are focused on for-profit schools.

One potential change is reviving guidelines crafted by the Obama administration that were aimed at for-profit colleges by limiting federal aid to schools that inadequately prepared students to find jobs. The Trump administration overhauled the “gainful employment” guidelines, saying in part it was too broad.

Trump’s education secretary, Betsy DeVos, argued the Obama administration rules often overreached in protections for students. She argued most borrowers got some educational value from for-profit colleges and merited partial, not full, relief from their federal loans. DeVos bashed the idea of complete debt cancellation and free tuition as “government gift giving.”

The Biden administration, in general, has a different approach.

Whitney Barkley-Denney, senior policy counsel for the Center for Responsible Lending, a nonprofit with offices in Washington, D.C., North Carolina and California, believes these hearings could be the start of major changes that could help borrowers.

“This feels like a course correction in hopefully getting to revisit some of the most damaging policies of the Trump administration’s Department of Education,” Barkley-Denney said.

Barkley-Denney is also curious to see what happens concerning enrollment contract clauses — primarily at for-profit colleges — that mandate arbitration in disputes between a school and borrowers instead of allowing students to pursue resolutions through lawsuits. The Obama administration effectively banned those contracts, but the Trump administration reversed those changes.

Yan Cao, a senior fellow at The Century Foundation, a progressive think tank with offices in New York and Washington, hopes the hearings will result in a greater focus on students. She said colleges and universities are typically involved in rulemaking discussions, not student representatives.

Cao, an expert on higher education policy, said the department has not used tools already in place to address some of the challenges that will be discussed this week.

“It’s really a question of enforcement and implementation ... We just need to use them,” Cao said.

Continuing Coverage

Student loan debt nationwide is greater than the amount of money Americans owe on their auto loans. The Atlanta Journal-Constitution is taking a periodic look at this issue. This is the latest report. To register to watch or speak at the hearings, go to https://www2.ed.gov/policy/highered/reg/hearulemaking/2021/index.html.