In 2001, when C. Earl Peek founded Diamond Ventures, an Atlanta-based venture capital firm, he envisioned establishing a $150 million purse that he would tap to make investments in start-up companies in the technology, construction and government contracting sectors.

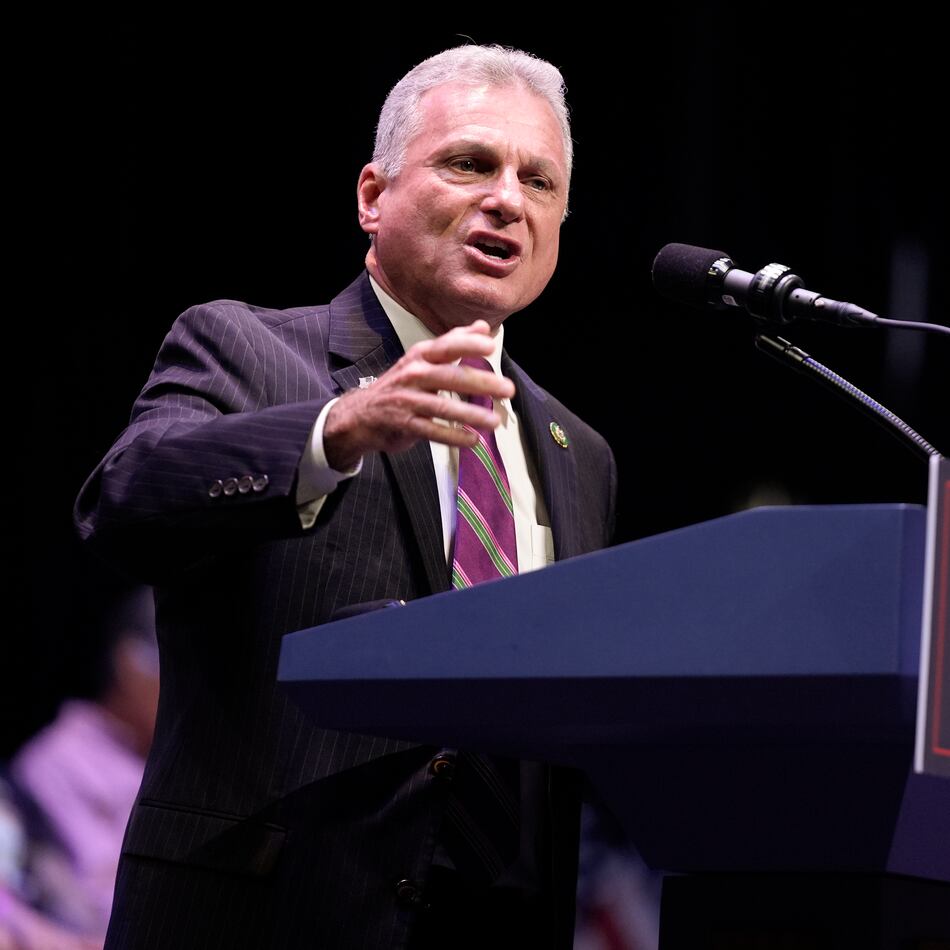

It has not been so easy. Peek, who shuttles weekly between Atlanta and Washington, D.C., where Diamond also has an office, has been embroiled in a nearly seven-year-old lawsuit with the Small Business Administration, over what he says is the agency's discriminatory policies in providing loans to minority-owned investment firms.

Now with the case is in mediation, the two sides may soon hammer out an agreement.

The SBA-licensed Small Business Investment Company program, which is the focus of the Peek's lawsuit, serves as the bridge between start-up firms and traditional lenders.

In the lawsuit, Peek seeks SBIC certification, damages for the loss of capital he said the firm had obtained from investors, lost investment opportunities and legal fees.

Privately owned and managed investment funds, SBICs use capital they raise privately along with matching funds obtained through SBA loan guarantees. Those funds are used to invest in qualifying small businesses and start-ups.

The SBA doesn't directly invest in the small businesses. Last year, the program provided about $1.8 billion that was ultimately invested in 1,477 companies, agency statistics show.

But Peek, who is also vice president of commercial lending at a Washington bank, , said the agency has stymied his firm's efforts, repeatedly denying Diamond Ventures' request for SBIC certification. Certification would give his firm access to matching SBA funds, which Diamond Ventures would use to invest in minority and economically disadvantaged communities.

Diamond Ventures' application for certification was rejected twice, Peek said, adding the firm had planned to raise $50 million and had additional commitments of $15 million from investors, which was $10 million more than what the SBA required.

"There is a pervasive view at the SBA that at every level, minorities and women are not capable or qualified to be licensed to manage SBICs," Peek said. "They don't consider it to be qualified or give you credit if you're African-American or a woman."

The SBA does not comment on cases in litigation, but a spokesman said race and ethnicity aren't factors for qualification and cannot be considered in the ultimate decision.

The agency is seeking to expand its pool of minority candidates, SBA spokesman Michael L. Stamler said.

"SBA absolutely is committed to licensing minority applicants as SBICs and is working diligently to expand growth of the program by attracting management teams from more locations and from teams that are more representative of the population," he said.

Those SBICs also are urged to invest funds in low- and moderate-income communities and minority- and women-owned firms, he said.

The SBA tracks those investments, with more than 20 percent going to low- and moderate-income areas and about 11 percent being invested in minority-, women- and veteran-run firms.

Peek questioned SBA's commitment, charging that his application was denied in part because of his firm's focus on investment opportunities in low-income areas.

"There were multiple instances of bias and discriminatory behavior," he said. "They said trying to do deals in minority communities weren't quality deals."

About the Author

Keep Reading

The Latest

Featured