Deal to next governor: Slow your roll on major tax changes

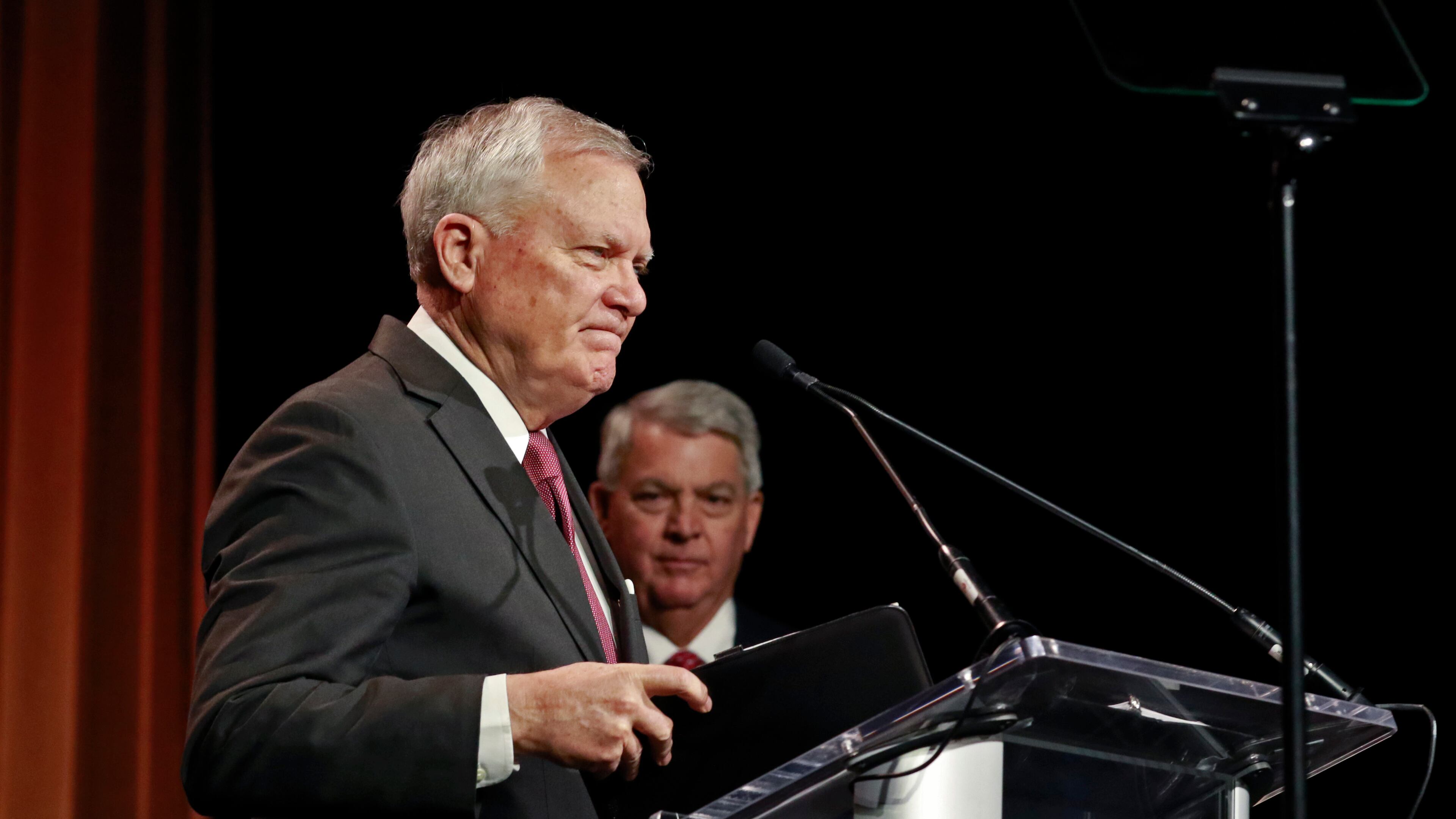

Gov. Nathan Deal could soon consider a string of tax breaks for a handful of business and industries, but he urged whoever succeeds him to resist the "temptation" of broader changes to the tax system that he warned could jeopardize the state's revenue base.

“There are easy decisions in the short term that turn out to be problems in the long term,” he said. “Businesses, when they are looking for places they want to go, they want to go to a state that’s demonstrated it has its own fiscal house in order.”

Deal, who cannot run for a third term in 2018, made the comments on Monday at a Georgia Chamber conference. He last signed a major tax overhaul in 2012, inking a measure that included eliminating state sales tax on energy used in manufacturing and replacing an annual property tax on motor vehicles with a one-time fee.

The governor said it can be tempting during an economic upswing to whittle away at the revenue base, but he cited states that put themselves in “embarrassing” situation because of deep tax cuts.

“They cannot balance their budgets,” he said. “If you can’t sustain a financial base to pay your teachers, your law enforcement, if you get on shaky ground, you’re going to see business leaders looking around and saying, ‘Maybe we don’t need to be here.’ That’s the great temptation.”

The governor and his allies have sparred with anti-tax groups over the years, including fights over the "bed tax" Medicaid provider fee and the 2015 package of fees and tax hikes to fund transportation improvements. Both measures were backed by business boosters.

And Deal has made the rebuilding of the state’s rainy day fund a point of personal pride. The state’s reserve fund hovered just about $100 million when he took office in 2011, he told the crowd; now it has topped $2 billion.

To some anti-tax crusaders, the growing bank account is a sign the state is collecting too much taxes. But Deal said it sends an implicit message to business leaders that the state’s financial health is brimming.

“Sometimes, it is easier to make hard decisions in bad times then it is in good times,” he said. “In good times you’re susceptible to making bad decisions.”