What some Georgians in Congress say

"You've got to haul them out of the water, scour the barnicles off the hull, patch up the holes and send it out to sea again. That's what we need every quarter-century" for the tax code — Rep. John Barrow, D-Augusta

"It can be done, but it's going to require the elimination of almost all — if not all — tax deductions and tax credits." Sen. Saxby Chambliss, R-Georgia.

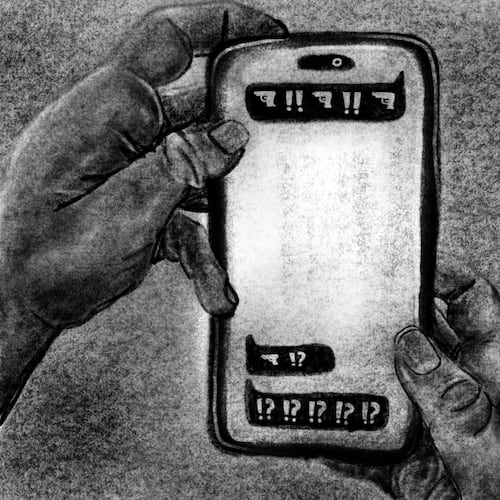

"The ability to solve problems has descended into a hellish fight that results in only … a my-way-or-the-highway style of governance and that is the gridlock that results," — Rep. Hank Johnson, D-DeKalb County.

"I'm not speaking for any of our leadership, but I think it's going to be terribly difficult for them to get 218 votes for a tax increase." — Rep. Lynn Westmoreland, R Coweta County

A contentious election is behind them but the central dispute remains for the White House and Congressional leaders as they negotiate to avoid a “fiscal cliff:” their parties’ stances on taxes.

Congress returns this week, and leaders have been saying nice things about working together on a way to avert the looming economic blows and ease the long-term debt crisis.

But voters kept the same key players: President Barack Obama, House Speaker John Boehner and Senate Majority Leader Harry Reid; and the parties have not budged on taxes. Democrats want to raise taxes on top earners; Republicans don’t.

Those positions remain the biggest impediment to a deal.

A report last week by the Congressional Budget Office outlined consequences of inaction: If the fiscal-cliff actions take place next year, the report predicted the economy would fall back into recession and the jobless rate would jump to 9.1 percent.

The cliff is the result of a series of policy punts by Congress in recent years, and involves marginal tax rates, the Alternative Minimum Tax, unemployment benefits, Medicare payment rates for doctors, and $1.2 trillion of across-the-board spending cuts split between the military and other programs. Also awaiting not far into the new year is a decision on raising the country’s borrowing limit, and funding for the government expires in March.

All these issues have provoked fights and probably will again, but the tax-rate problem is most vexing for the parties’ unyielding approach so far.

One of the key members of Congress working to thread the needle between the parties is Sen. Saxby Chambliss, a Georgia Republican and co-leader of the Gang of Eight, a group that has been working nearly two years on a way that can get through Congress to shave $4 trillion from future deficits.

Chambliss said tax revenues can be increased significantly without raising tax rates, by eliminating deductions. This approach, when framed as “closing loopholes,” evokes the idea of wealthy tax dodgers. But Chambliss said the three most lucrative “tax expenditures” are popular with many taxpayers: the home mortgage interest deduction, charitable deduction and health-care deduction. To get revenue without raising rates, those might have to go.

“It can be done, but it’s going to require the elimination of almost all — if not all — tax deductions and tax credits,” Chambliss said. “You can’t do it without that, and that’s going to be difficult.”

According to a pre-election poll by the Atlanta Journal-Constitution, 64 percent of Georgians prefer a combination of tax increases and spending cuts to close deficits.

Some voters seem more willing to negotiate than they think the officials they elected are.

“I’m a Republican and I’m disappointed in the election but we’ve got to compromise,” said Michael R. Johnson, Sr. of Dunwoody, a retired Army lieutenant colonel who voted for Mitt Romney. “If we don’t compromise we’re going to crash over this fiscal cliff.”

Johnson said military cuts go against the grain, but that and increased taxes may have to be on the table for the right deal (just not his own Army pension).

Rajai Steward, an Atlanta Democrat who voted for Obama, couldn’t disagree more with Johnson about military spending: Taxes are okay to fund education and Medicare, he said, “but not to blow up buildings in Iraq.” However, he said, “We have to give to get.”

Unfortunately, neither Johnson nor Steward thinks those in Washington will be rational enough to cut a deal.

If they fail to compromise, Steward said, “as the middle class we’re going to get the brunt of what they’re fighting about.”

The 2001 tax cuts are scheduled to expire at year’s end, and Senate Democrats have passed a bill to extend them for all but the top two brackets. That means the rate for families making $250,000 per year would rise from 33 percent to 36 percent; above $400,000 per year, the marginal rate would rise from 35 percent to 39.6 percent.

The president campaigned fiercely on returning to Bill Clinton-era tax rates on top earners, a notion that polls well. Republicans charge that any tax increase is bad for the economy and it does not make sense to tax the folks who create jobs, particularly at a time of high unemployment.

On Friday, Obama said voters chose his approach by re-electing him. “We have to combine spending cuts with revenue, and that means asking the wealthiest Americans to pay a little more in taxes,” he said.

Boehner insisted Friday there were other ways — notably reforming the tax code and eliminating loopholes — to raise revenue and strike a deal. “The problem with raising tax rates on the wealthiest Americans,” he said, “is that more than half of them are small business owners.”

Steve Bell, a former Congressional staffer and budget expert for the Bipartisan Policy Center think tank, said: “I truly believe both Republicans and the president are absolutely set in concrete on the Bush upper-income tax cuts. … I think the odds are more than 50-50 that we’ll go off the fiscal cliff in part or in whole.”

Liberal Democrats took some academic ammunition from the Congressional Budget Office report released Thursday. The CBO estimated the extra benefit to the economy of keeping taxes at their current level for households making more than $250,000 would be less than one-quarter of 1 percent of the Gross Domestic Product, while costing $1 trillion.

Rep. Sander Levin of Michigan, the top-ranking Democrat on the tax-writing Ways and Means Committee, said in a statement that “this undermines the Republican argument” and “House Republicans must end their intransigence on tax cuts for the very wealthy.”

Rep. Lynn Westmoreland, a Coweta County Republican, said that will not fly.

“I’m not speaking for any of our leadership, but I think it’s going to be terribly difficult for them to get 218 votes for a tax increase,” he said.

Rep. Phil Gingrey, R-Marietta, said closing loopholes is the way to go, not increasing rates. “The majority of the House majority are more conservative, and we will be watching all of that very closely.”

Boehner raised some eyebrows Wednesday when he said the GOP would be open to more revenue as part of a tax deal, but he did not get into specifics. Republicans and many Democrats have long argued that a fundamental overhaul of the tax code is necessary, but how to get there remains unclear.

Chambliss’ Senate group is working off the framework of the president’s fiscal commission, known as the Simpson-Bowles plan, that reduces tax rates as it raises revenue by eliminating deductions. Rep. John Barrow, D-Augusta, said he would work to build support for a similar approach in the House.

Barrow invoked the same historical analogy as Boehner: The 1986 tax deal that President Ronald Reagan struck with House Speaker Tip O’Neill that lowered marginal rates and simplified the code. Barrow compared the tax code to boats.

“You’ve got to haul them out of the water, scour the barnacles off the hull, patch up the holes and send it out to sea again,” he said. “That’s what we need every quarter-century.”

One revenue-generating part of that plan could be to cap the amount of deductions a taxpayer could take. That would make many higher-income taxpayers pay more while not increasing their marginal rates. And it would not start a war with lobbyists over specific deductions.

Obama has proposed a deduction cap of 28 percent for top earners. Even Roswell Republican Rep. Tom Price, one of Obama’s most outspoken critics, said it was not a bad idea.

“That’s one of the things that we ought to be talking about,” Price said. “It may be part of the way to get to the point where you’re not picking those winners and losers within the tax code.”

Those kind of policy agreements were rare in the past two years.

“The ability to solve problems has descended into a hellish fight that results in only … a my-way-or-the-highway style of governance and that is the gridlock that results,” said Rep. Hank Johnson, D-DeKalb County. “I don’t want to see us do business like that.”

About the Author

Keep Reading

The Latest

Featured