A Henry County man says he is living a nightmare after his credit card company accidentally declared him dead.

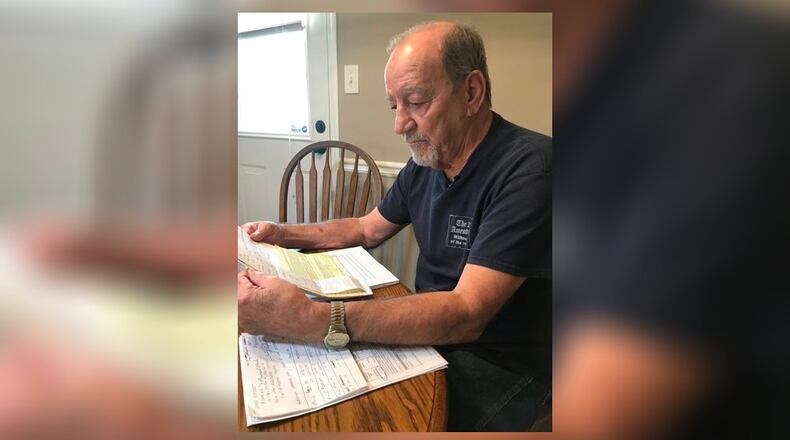

Leon Turner told Channel 2 Action News his health care credit card, issued through Synchrony Financial, sent a letter asking for payment by the person in charge of the estate.

“I thought at first it was somebody playing a joke,” Turner told the news station.

The letter expressed condolences and asked who would be paying Turner’s credit card bill.

Turner said things only got worse when he pleaded his case.

“As you can see, I’m alive and well,” he told Channel 2.

But he said he wasn’t able to connect with anyone at the company who could tell him why they thought he was dead.

Turner said Synchrony Financial charged-off his CareCredit card, meaning they reported the balance of more than $3,000 was unlikely to be collected. The accounting term is most often applied to unpaid debts that a creditor could sell to a collection agency to help collect payment.

As a result, Turner’s credit score took a dive from near perfect to somewhere in the 600s, he said.

“I’ve been refused on two loans,” Turner said. “If something drastic happened right now that I need to get my hands on money, I’d be up the creek.”

So instead of rolling over, Turner hired an attorney, who sent a letter to the credit card company saying a mistake had been made.

After that yielded no response, Channel 2 made calls about the case and the company issued a statement:

“We are working on the account and my colleagues in customer service are going to call Leon on his cellphone to provide him with that information and he can loop back with you on how it’s being rectified.”

When Channel 2 made a call during the interview with Turner, a woman who answered the phone at Synchrony Financial apologized and admitted a mistake had been made.

“I understand that you had some accounts with us that were inadvertently coded as being deceased,” the woman said. “Unfortunately, I don’t have an answer right now.”

Synchrony Financial told Turner they would remove the charge-off and try to fix the situation.

In other news:

About the Author

Keep Reading

The Latest

Featured