Tracking Trump’s tariffs: Here’s what to know

Editor’s note: This story has been updated to reflect new tariffs announced April 2.

President Donald Trump has levied or threatened tariffs on a broad range of countries covering a wide range of products as he tries to use access to the U.S. market as a cudgel for various policy aims — from job growth to raising tax revenue to border security and combating drug trafficking.

He dubbed Wednesday “Liberation Day” and announced a slate of import taxes known as reciprocal tariffs, or taxes on countries that have enacted trade barriers or tariffs on the U.S.

Trump has said automotive tariffs will start Wednesday as well, with collections beginning on Thursday.

Trump has at times pulled back or delayed implementing new import taxes at the 11th hour. So where do things stand? Below is a status report on some of the biggest tariff announcements made by Trump since he returned to office.

But first, you might ask: What is a tariff? A tariff is a tax on goods or services from outside of our country brought into the U.S. Tariffs are slapped on products at the port of entry and paid by the importer or buyer. Those taxes typically are passed along by businesses to the buyers of products, whether the buyers are manufacturers obtaining parts that go into other things or a consumer shopping at a store or online.

They also do not happen in a vacuum as other countries tend to retaliate.

China

Status: Enacted

U.S. action: In February, the Trump administration enacted a 10% across the board tariff on goods from China and doubled that figure to 20% in March. On April 2, Trump announced Chinese goods will be hit by Trump’s reciprocal import taxes at a rate of 34%.

China’s response: China retaliated in February with levies on agricultural and other heavy equipment and vehicles. In March, China put in place more tariffs, hitting agricultural products, including chicken, Georgia’s top agricultural product.

Canada and Mexico

Status: Enacted in part. Full measures put on pause. Trump also said his 25% foreign automotive tariffs, which include vehicles from Canada and Mexico, will go into effect April 3. Automotive parts from Canada and Mexico will eventually be taxed as well.

U.S. action: In February, the U.S. threatened Canada and Mexico with steep tariffs — including 25% taxes on most goods from Mexico and 25% tariffs on most goods from Canada, except for energy products such as oil, which were to be hit with 10% tariffs. But Trump paused those tariffs until March, when they went partially into effect.

That month, Trump allowed tariffs to go into effect for all products briefly and then amended his order for those not in compliance with the United States-Mexico-Canada Agreement or USMCA, the free trade deal Trump negotiated in his first term.

The exception made for products in compliance with the USMCA could lapse as soon as April 2. The White House also paused planned tariffs specifically on automobiles entering the U.S. from Canada and Mexico to April 2, which is now rolled into a broader plan for import taxes on foreign vehicles, listed below.

Canada and Mexico’s response: Canada has retaliated, but so far Mexico has not. Canada instituted tariffs on about $30 billion in U.S. goods and is prepared to slap tariffs on a similar amount of U.S. products as soon as April 2. Mexican President Claudia Sheinbaum has said her nation is prepared to retaliate.

Automobiles and auto parts

Status: Collections on foreign made vehicles and parts start April 3, Trump said April 2 at a White House event. Tariffs on parts made in Canada and Mexico for vehicles assembled in the U.S. that are compliant with the USMCA are expected to go into effect when a process for taxing “non-U.S. content” is developed, likely in May.

U.S. action: The U.S. has announced 25% tariffs on all automobiles assembled in other countries and on auto parts imported into the U.S. The announcement replaced previously announced tariffs on just those automobiles and auto parts entering the U.S. from Canada and Mexico had been put on hold.

The automotive supply chain is complex. U.S. brands assemble many vehicles in Mexico and Canada that are then sold in the U.S. Parts for many vehicles assembled in North America hop across borders multiple times before finished vehicles rolls off assembly lines.

Several foreign automakers, including ones from Germany, Japan and South Korea, have U.S.-based factories but might receive parts from overseas that could be taxed under the new tariffs.

International response: Leaders of other nations have largely condemned the Trump administration’s plans. Canada and other countries have said they will retaliate with countermeasures.

Across the U.S., autos (nearly $93 billion) and auto parts (nearly $78 billion) are the top two imported products from Mexico, data from the Census Bureau show. Autos (about $43 billion) and auto parts (about $14 billion) are also top products from Canada sold in the U.S.

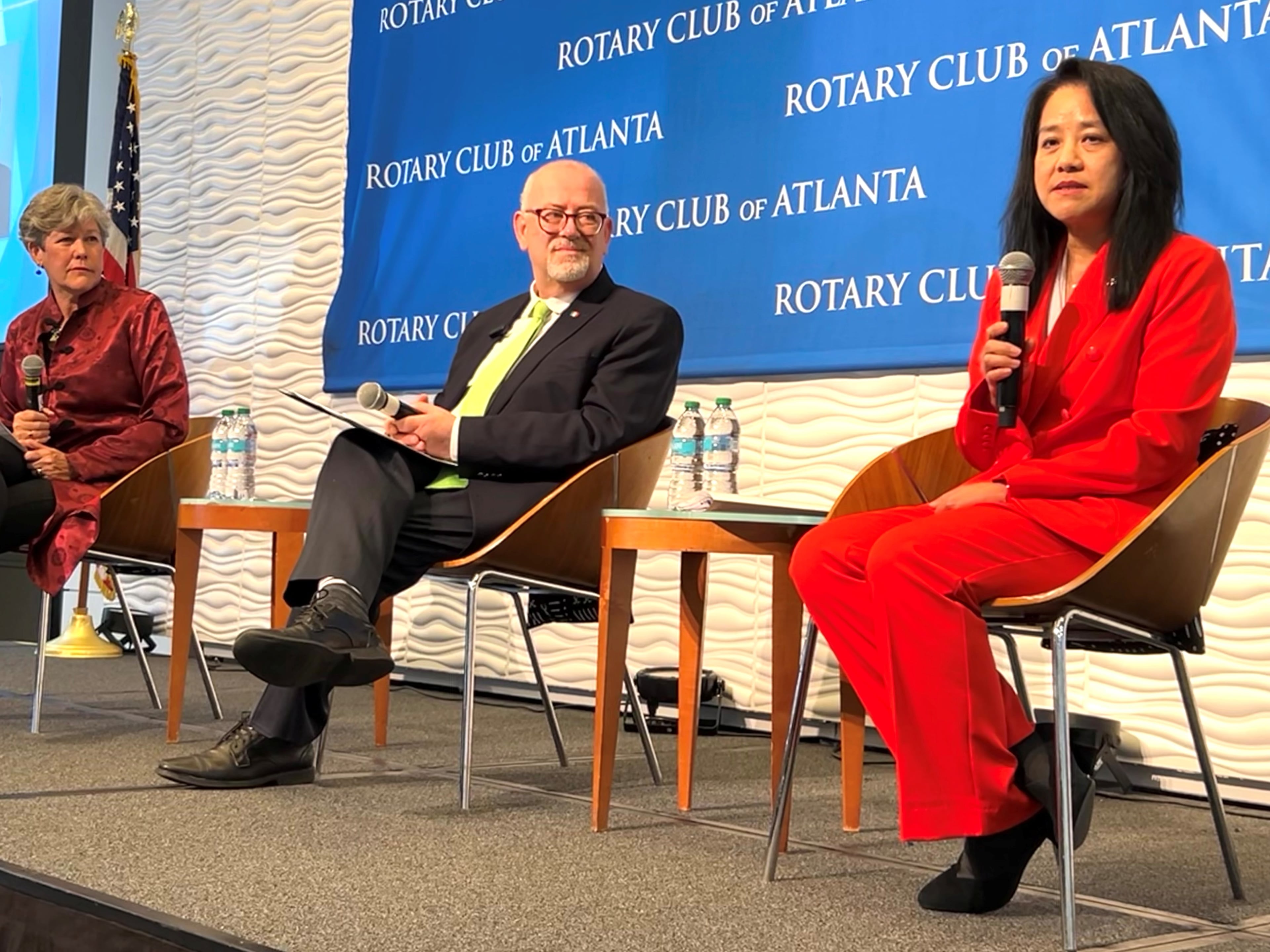

Highlighting the entwined nature of the North American automotive sector, Consul General of Mexico in Atlanta Javier Díaz de León told the Rotary Club of Atlanta recently, “These cars happen to be North American.”

Hyundai Motor Group announced a $21 billion plan in March to expand its U.S. production capacity. The plan includes production expansions at its factories in Georgia and Alabama. The company also announced a new nearly $6 billion steel factory in Louisiana to help it avoid tariffs.

Steel and aluminum

Status: Enacted

U.S. action: The Trump administration ended exemptions for certain countries on steel and aluminum imports, creating an across the board 25% tariff on those metals that started in March.

The lifting of the exemption hit trade partners such as Canada, the European Union, Japan, Mexico, South Korea and the United Kingdom.

International response: The European Union and other nations have responded with plans for countermeasures, including some by the EU that will go into effect Tuesday.

Other “delayed” retaliatory measures by the EU include taxes on bourbon and motorcycles that could hit by mid-April. To that, Trump has threatened 200% tariffs on European alcohol imports such as French champagne.

Reciprocal tariffs

Status: On April 2, Trump signed an executive order instituting the tariffs. A flat 10% tax on most all imports starts April 5. Specific measures against other countries go into effect April 9.

U.S. action: After floating numerous ideas for what he called “reciprocal tariffs” that ranged from dollar-for-dollar levies on other countries to a flat 20% tax on all foreign goods, Trump announced his plans April 2.

Trump announced a 10% baseline tariff on most all foreign goods. Imports into the U.S. total about $3.3 trillion. But tariffs on many key U.S. trade partners will be higher.

Based on a U.S. Trade Representative report on import taxes, currency manipulation and nonmonetary trade barriers imposed by other countries, the administration placed a tax value that it said those nations charge U.S. goods. Trump said a dozen countries will pay half of what Trump said those countries charge the U.S. Trump called them “kind reciprocal” tariffs.

For instance, the reciprocal import taxes to be charged on goods from major trading partners include 34% on goods from China, 20% on the EU, 46% on Vietnam, 32% on Taiwan, 24% on Japan, 26% on India.

Trump signed a memorandum in February ordering his administration to study trade arrangements with other nations and develop a plan to restore what the White House called “fairness” in trade relations.

Or as Trump has put it: “What they charge us, we charge them.”

These tariffs would be on top of other announced import taxes, Trump has previously said.

International response: Foreign leaders will undoubtedly respond but how might not be clear until after the White House announces its plans.

European Union

Status: On April 2, Trump signed an order slapping “reciprocal tariffs” on many countries and the EU. The EU import tax level is 20%.

U.S. action: In a cabinet meeting in February, Trump announced plans to slap tariffs of up to 25% on goods from the EU, which includes 27 nations. Trump threatened to hit cars and “all other things.”

On April 2, Trump signed an order slapping “reciprocal tariffs” on many countries and the EU. The EU import tax level is 20%. The tariffs on foreign autos and auto parts of 25% would also apply to EU-made parts.

The EU tariffs were separate from levies against steel and aluminum.

International response: The EU vowed to retaliate if the U.S. moves forward on the threatened tariffs.

Venezuela

Status: Pending.

U.S. action: Trump announced in March plans to slap 25% tariffs on goods imported into the U.S. from countries that buy oil from Venezuela as soon as April 2.

In other words, it would hit the goods of Venezuela’s trade partners that those partners sell here. The levies would come on top of other tariffs, Trump said.

The U.S. itself, incidentally, is also a buyer of Venezuelan crude. Trump has put pressure on the South American nation over immigration and gang violence he blames on undocumented immigrants.

International response: Unclear. But many countries purchase oil from Venezuela, including China, which is already subject to Trump’s trade action and has blasted the plan.

Semiconductors

Status: Pending

U.S. action: Trump has proposed tariffs of perhaps as high as 25% on foreign-made computer chips. But the effective date is not yet known.

Pharmaceuticals

Status: Pending

U.S. action: Trump has proposed tariffs on foreign-made pharmaceuticals. But the rate and effective date are not yet known.

“We have to bring pharmaceuticals, drugs and pharmaceuticals, back into our country,” he told reporters in late March in video published by The Associated Press.

Wood products

Status: Pending

U.S. action: In March, Trump directed his administration to produce a report on the importation of lumber and other wood products and how they threaten “national security and economic stability,” claiming overreliance on imports threaten security, the construction industry and the U.S. economy.