Student loan debt also a problem for many Georgia parents

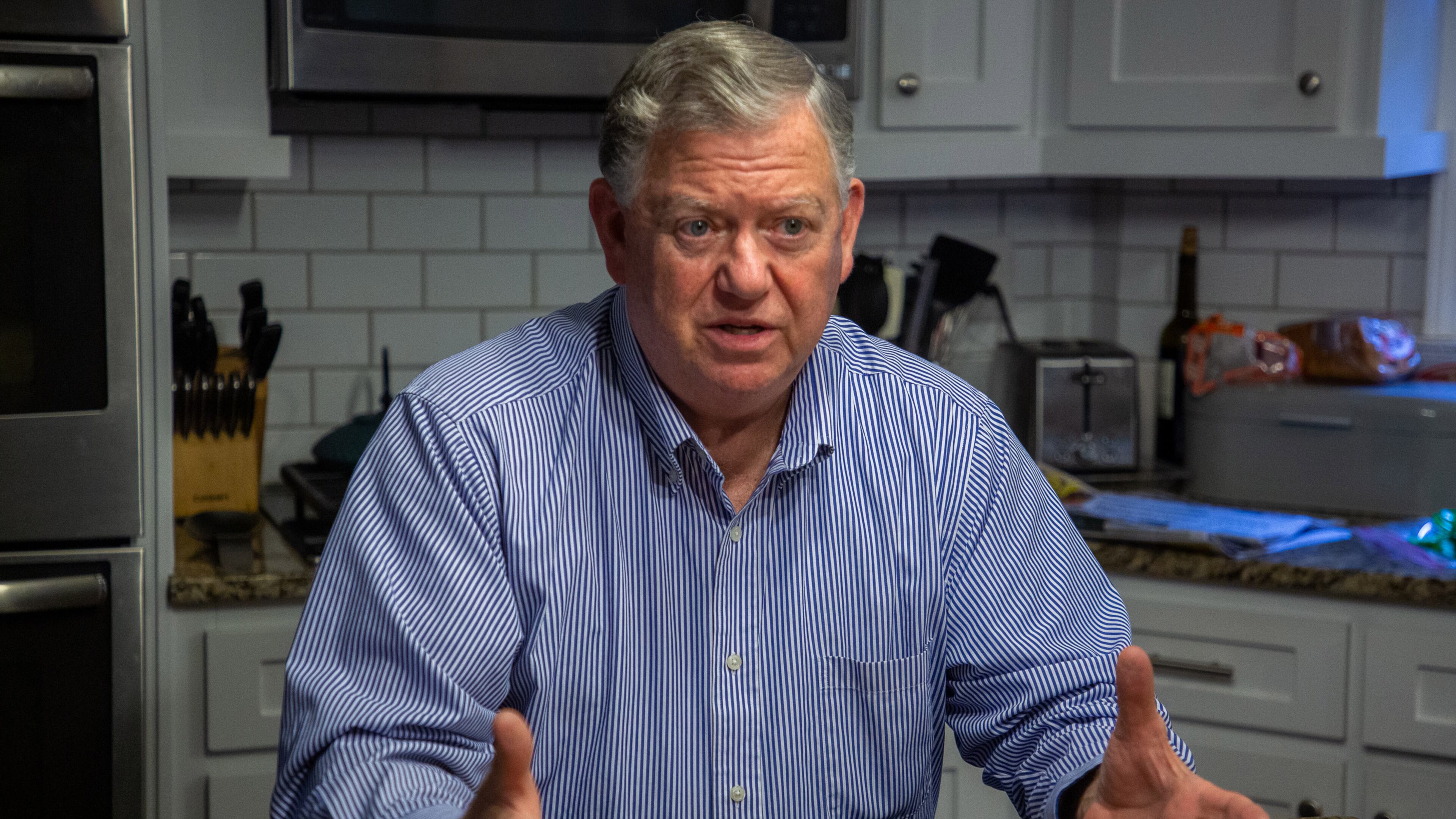

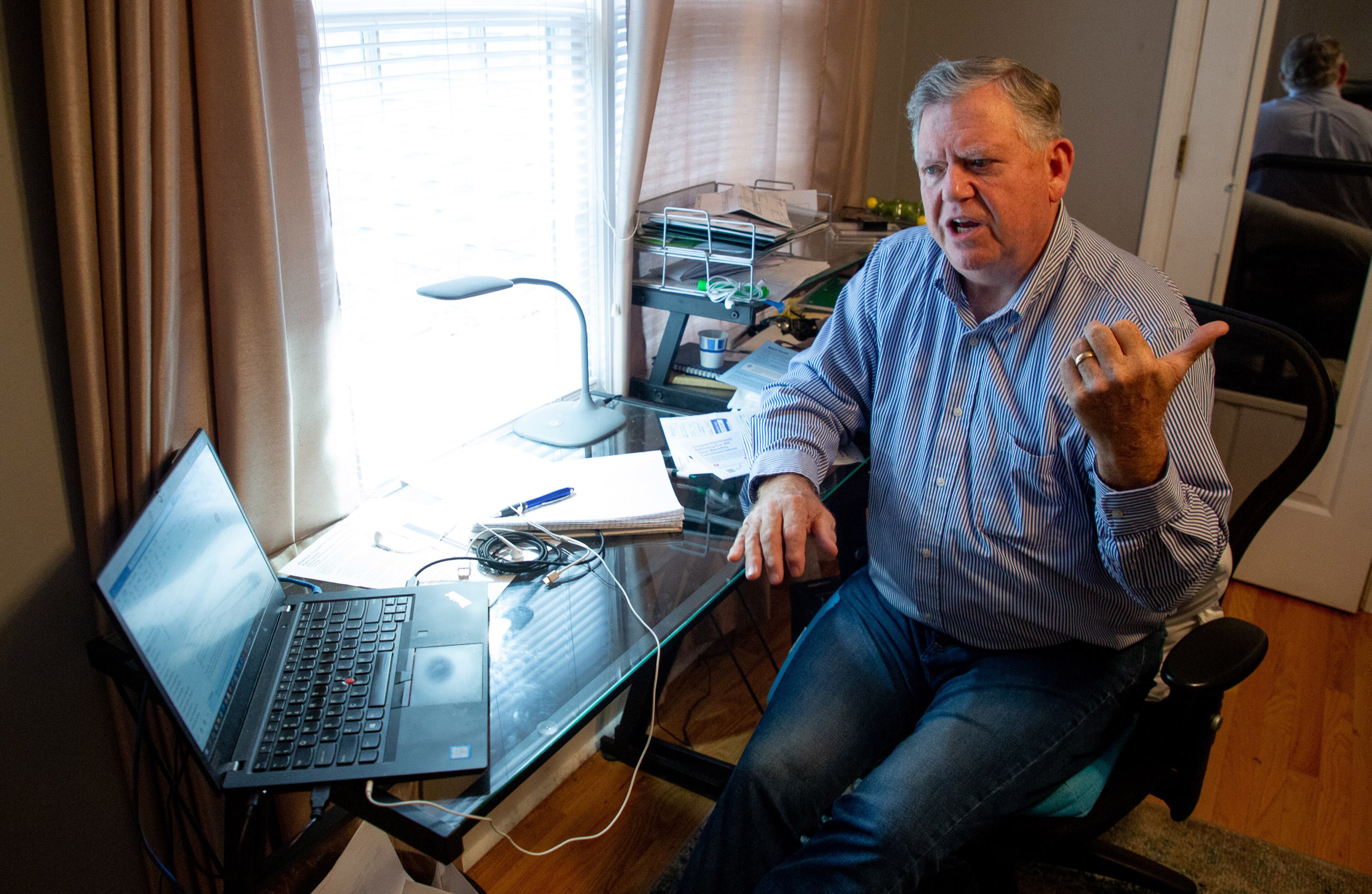

Alpharetta resident Randy Michael, 66, knows the amount of money he owes in student loans for his four children to the dollar.

$119,910.

Three of the four children had the HOPE Scholarship, which paid for nearly all of their tuition costs to attend public universities in Georgia. The kids also held part-time jobs in college. Yet, they had other college expenses they could not afford, so he took out federal Parent PLUS loans.

Federal education officials in recent weeks have announced changes to address aspects of the student loan debt problem, which some Democrats and Republicans have called a “crisis.” The changes have included loosening the rules to one of the complex federal loan forgiveness programs, making it easier for certain borrowers, like teachers or firefighters, to have their debts erased through public service work.

Education advocates have pushed for more changes. Congressional lawmakers and President Biden have pitched various proposals that would cancel thousands of dollars of debt for borrowers, but not everyone is on board. Conversely, a coalition of 11 conservative groups on Tuesday wrote a letter to U.S. Department of Education Secretary Miguel Cardona demanding he not use one program to “support wholesale student debt forgiveness.”

Meanwhile, one area that hasn’t been tackled is loans taken out by parents — specifically Parent PLUS loans.

“The Biden administration has shown a desire to award student loan relief, but in a very targeted way, and Parent PLUS Loan holders have been kind of left out of that,” said Andrew Pentis, senior writer at Student Loan Hero, a company that helps borrowers manage and eliminate debt.

Many education experts, like Pentis, say the program should be scrapped or retooled because it allows parents to borrow too much money and it has high interest rates.

“PLUS loans are plus-size,” the conservative Heritage Foundation wrote in a report a few years ago. “Cut them to slim down college debt.”

Federal education department officials did not respond to a request for comment.

There are roughly 3.6 million Americans with Parent PLUS loans, and they owe a combined $100 billion, according to some estimates. Many of those borrowers are past retirement age. As of June, 68,000 Georgians 62 and older owe money on student loans, an increase of 6,500 borrowers since September 2020, federal data shows. They owe, on average, $50,150.

Michael and others believe the national conversation concerning student loan debt relief should include parents. Some federal lawmakers have proposed eliminating $50,000 in debt per student borrower. President Joe Biden has said his limit would be $10,000 per student borrower. Little has been said about parent borrowers.

Michael recalled a conversation with a student loan company official who said the loans would be paid off immediately if he dies.

“Isn’t that something to look forward to,” said Michael, who has a wry sense of humor.

Michael, who works at an energy company, says he likely will never be able to retire. He believes it’s going to be “real tough to float (the loans) on Social Security.”

The PLUS Loan program was created in 1980. Initially, there was a limit on how much a parent could borrow, but the cap was removed in 1993.

That allowed more lower-income parents to help their children pay for college, but it also created more debt for those families. On average, borrowing increased from about $5,000 a year in 1993 to more than $16,000 by 2014, according to a 2020 study by the Federal Reserve Bank of Dallas and Trellis, a nonprofit that aims to help students graduate and pay their loans. Many experts believe removing the cap also led to colleges increasing tuition.

In 2011, federal officials tightened eligibility requirements to be in alignment with the credit industry. Despite the changes, borrowing continued to increase. The 2020 study showed total borrowing rose from $65 billion in 2014 to $96 billion five years later. Default rates also increased, according to some research.

Another problem: PLUS loans typically have higher interest rates. The Parent PLUS interest rate is currently 6.28%. The direct federal loan rate for undergraduate students is currently 3.73%.

Billionaire investor Robert F. Smith was so struck by stories he heard about high debts, including among parents, when arriving in Atlanta to give the commencement address at Morehouse College in May 2019 that he decided to pay off the debt — $34 million — for each member of the graduating class and parents. About 400 students and parents had their loan debts paid off.

Smith, who last year settled in a federal tax fraud case, is now involved in an effort called the Student Freedom Agreement that allows students to pay a portion of their post-graduate earnings toward their college education. Morehouse and Clark Atlanta University are partners in the initiative.

Jenna Robinson, president of the James G. Martin Center for Academic Renewal, a nonprofit institute dedicated to improving higher education in North Carolina and the nation, believes Parent PLUS loans are “predatory” and should be discontinued.

Robinson expects the Biden administration will explore ways to lower borrowing costs, such as increasing the maximum federal Pell grant for low-income students.

“But in the long run, schools will just keep increasing tuition,” Robinson said.

“The ideal fix for most of our student loan issues is to put universities on the hook for some portion of defaulted student loans,” she continued. “That would incentivize them to change their ways: to care more about whether students graduate, to make sure students don’t borrow too much, etc. Right now, universities have no skin in the game and they behave irresponsibly. They are the real culprits behind parents’ student loan woes.”

Still, parents want to help. Over 40% of families are giving their adult children some level of financial support, including student loans, according to a study by Atlanta-based financial expert Wes Moss.

Michael’s parents couldn’t help him pay for college, so it was important to him to assist his children. Michael, who is married, took out all of the loans in his name. Michael, a do-it-yourself home improvement kind of guy, has not asked his children to repay his debt. They, too, have student loans.

Federal officials paused loan payments at the start of the coronavirus pandemic, but they’re scheduled to restart at the end of January. Michael said the monthly loan payments will be $641.38 for a few months, and then higher. By 2040, Michael said the final monthly payments will be $1,200.

Michael said he understands the argument that debtholders should meet their commitment without government help.

“I get it,” he said. “I’m not looking for a handout. Just think about all of the people out there. Don’t forget about those who took out a lot more than their children.”

AJC coverage: Student loan debt

The student loan debt for Americans is a combined $1.7 trillion, more than the nation’s total auto loan debt. Georgia borrowers account for $66 billion of that. The debt is impacting the overall economy by keeping borrowers from doing things like owning a home. As the debt has grown, so has the discussion for helping borrowers pay off their debts and even erase them altogether.

The Atlanta Journal-Constitution is covering the student loan debt issue from multiple angles. In addition to reporting the latest news on debt forgiveness proposals, we are also digging deeper to report the impact of student loan debt on particular borrowers, including students of color, veterans and this story highlighting parents who take out loans for their children’s education.