TOP STORY: New details, reaction to SunTrust merger with BB&T

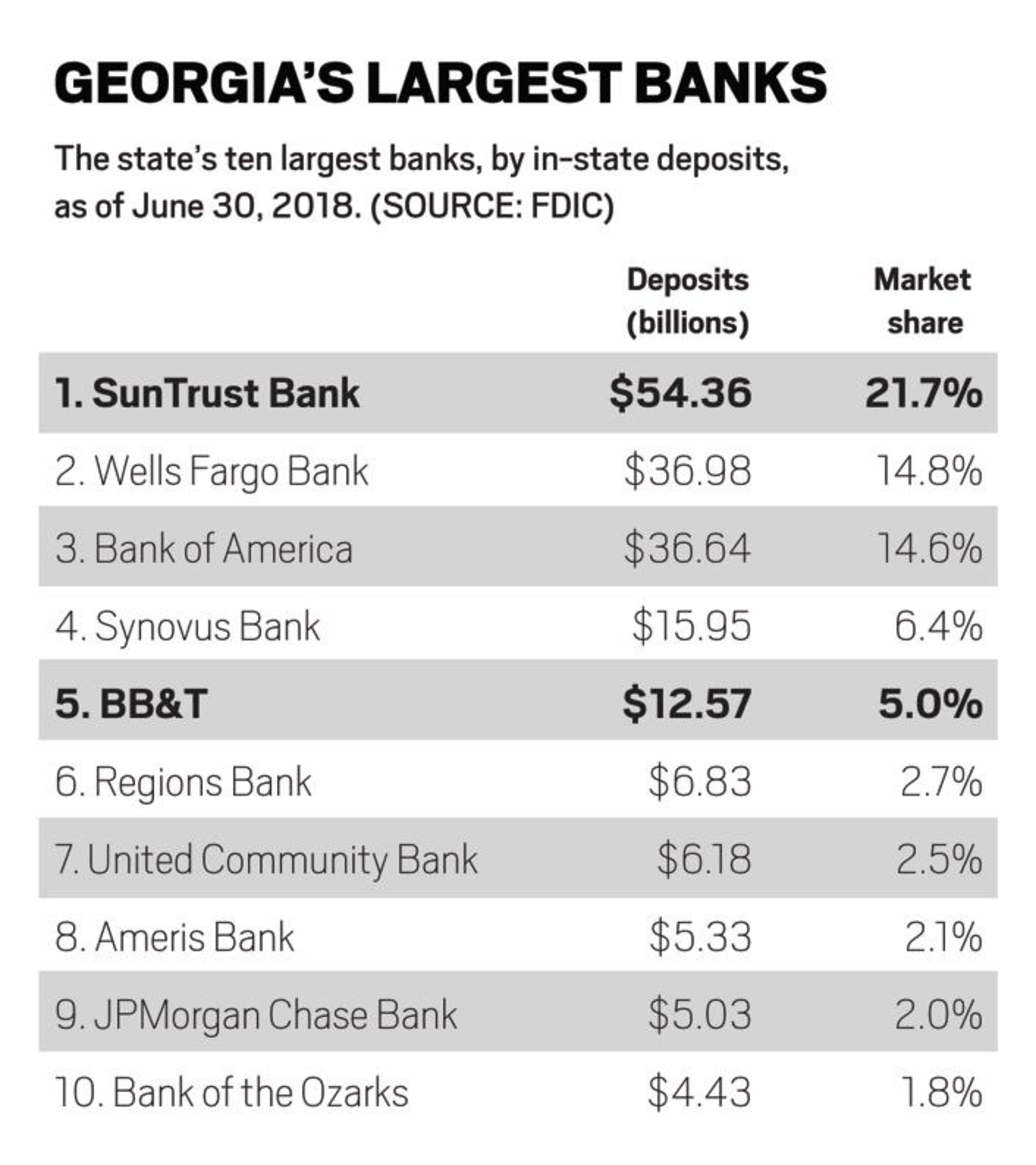

Atlanta-based SunTrust Banks and its Southeastern rival, Winston-Salem, N.C.-based BB&T, said Thursday they will merge in a $66 billion all-stock combination to create the sixth-largest bank in the U.S., a marriage that will cost Atlanta a Fortune 500 headquarters.

The combined company, which will merge under a to-be-determined name, will be based in Charlotte, while Atlanta will be home of the new company’s wholesale banking operations.

- AJC FLASHBACK PHOTOS: Trust Company of Georgia through the years

- TIMELINE: SunTrust's history, in its own words

Thursday’s stunning announcement is an echo of the bank consolidation waves of the 1980s, 1990s and 2000s, when top Atlanta banks were gobbled up by their North Carolina rivals, diminishing Atlanta’s clout as a banking town and propelling Charlotte among the nation’s financial services capitals.

Wachovia, which was later absorbed by Wells Fargo, traces its roots in part to First Atlanta Bank. Bank of America was once known as NationsBank, whose predecessor institutions included C&S/Sovran, a storied Atlanta lender.

Now, this latest combination consumes SunTrust, founded in Atlanta in 1891 as Commercial Travelers' Savings Bank and later known as Trust Company of Georgia. So entwined in greater Atlanta and Georgia’s history is SunTrust and its predecessor institutions, that in 1919, Trust Company was an underwriter for the Coca-Cola Co., and one of the earliest holders of Coke’s stock.

For decades, Trust Company and later SunTrust secured the beverage giant's secret formula in its vault.

SunTrust, which has its namesake tower in downtown Atlanta, made a splash a few years ago putting its name on the new Braves stadium in Cobb County. A Braves spokeswoman declined comment, but the ballpark will likely see its name changed only a few years after it opened to the new company's moniker.

The new bank will have an estimated $442 billion in assets, $301 billion in loans and $324 billion in deposits, the companies said, serving 10 million households in the U.S.

"This is a true merger of equals, combining the best of both companies to create the premier financial institution of the future," BB&T Chairman and CEO Kelly S. King. "It's an extraordinarily attractive financial proposition that provides the scale needed to compete and win in the rapidly evolving world of financial services. Together with Bill's leadership and our new SunTrust teammates, we're going to bring the best of both companies forward to serve our clients and communities."

The merger is expected to be completed by the end of this year. In the news release, King will be the chairman and chief executive of the combined banking company until Sept. 12, 2021 and then transition to the role of executive chairman until March 2022 and remain on the board through 2023.

The future board will be evenly split among SunTrust and BB&T directors.

William H. Rogers Jr., the chairman and CEO of SunTrust, will be the president and chief operating officer of the combined bank, assuming the role of CEO after King steps down from that position. Rogers also will serve on the board.

"By bringing together these two mission- and purpose-driven institutions, we will accelerate our capacity to invest in transformational technologies for our clients,” Rogers said in a news release. “Our shared culture embraces the disruption of technology and we will take this innovative mindset to expand our leadership in the next chapter of these historic brands.”

In an analyst conference call, Rogers said the new bank will continue to invest in its “historic” hometowns of Atlanta and Winston-Salem.

Hala Moddelmog, CEO of the Metro Atlanta Chamber, called the tie-up an “undeniably smart business decision.”

“While we’re disappointed that the new company’s headquarters will not be in Atlanta, SunTrust has long been a strong community partner,” she said in a statement. “We are encouraged that the new company is committing to increasing community investment in our region.

Atlanta as head of the wholesale bank will be in charges of functions such as commercial banking and payments, critical functions with the combined entity, said Chris Marinac, analyst with FIG Partners.

Though Atlanta loses a Fortune 500 headquarters, the city will remain a vital part of the new bank’s infrastructure.

“It’s the nucleus of a big commercial bank,” he said. “Having Atlanta with the headquarters of wholesale is terrific.”

The merger, Marinac said, is being driven by the need of both banks to advance their technology platforms to cope with a banking system being disrupted by new technology such as online transactions and products that can be delivered by smartphones and the internet.

In combining the two Southern banks, the new bank will lean on SunTrust’s strengths in corporate and investment banking and BB&T’s stronger positions in community banking and insurance services.

But overlaps in the markets they serve will undoubtedly lead to branch closures and job cuts as the two behemoths combine and find redundant operations.

In the release, the companies forecast about $1.6 billion in annual cost savings by 2022. The savings, or “synergies” as it was euphemistically called in the release, primarily will come from “facilities, information technology/systems, shared services, retail banking and third-party vendors.”

SunTrust and BB&T both weathered the financial collapse and the Great Recession in part due to billions in bailout funds from the federal government. But the post-recession boom that followed has been good for both banks, which paid back the government loans and returned to healthy profits.

Thursday's announcement marked the second mega-merger involving an Atlanta area company in just three weeks. First Data, which has its corporate headquarters in Sandy Springs, announced it will merge with rival financial technology company Fiserv in a $22 billion deal that also will cost the Atlanta region a major headquarters.

More as this story develops…