So ... the rich and powerful aren't rich and powerful enough? That's our problem?

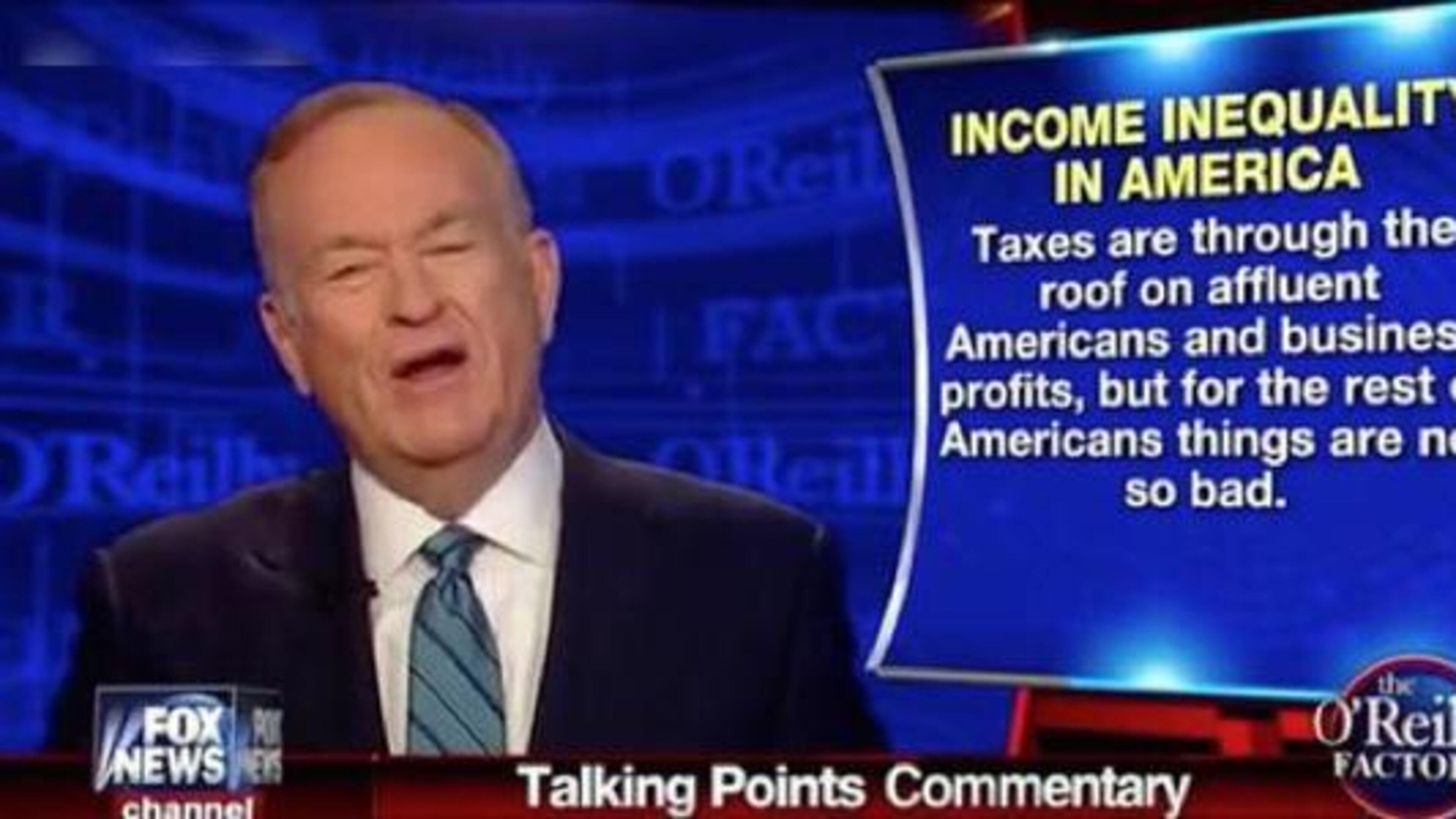

Bill O'Reilly -- aka the Falklands Fusilier or the Malvinas Marauder, depending on which side you took in that conflict -- decided the other night to treat his audience to a dissertation on income inequality, an issue that is likely to dominate the 2016 elections. The general thrust of O'Reilly's argument is reflected in the screengrab posted above: He and others in his tax bracket deserve our sympathy for the abysmal, abusive conditions under which they are forced to operate, while everybody else in the country has it pretty good.

"Taxes are everywhere on affluent Americans and business profits," O'Reilly complained in his monologue. "But how much more? How much more can the government take from the affluent without crashing the entire free-market economy? That's the real question in Campaign 2016."

On the most basic, factual level, O'Reilly's thesis is fraudulent. When we came perilously close to "crashing the entire free-market economy" in 2008, for example, it came after a succession of tax cuts for the wealthy. In addition, taxes on corporate profits and high-income Americans are not "through the roof," as he claims. They are well in line with where they have been throughout American history, and in fact below the post-WW II average..

In 1989, the year that the sainted Ronald Reagan left office, corporate taxes amounted to 1.9 percent of GDP. In 2014, "through-the-roof" corporate taxes amounted to ... 1.9 percent of GDP.

In 1989, after eight years of tax-cutting Reaganomics, the average effective tax rate on the richest 1 percent of Americans was 28.3 percent. In 2011, the most recent year for which we have data, the average effective tax rate on the richest 1 percent was 29 percent. It has probably ticked up a point or two since then, but it is still below levels in the 1990s, when we experienced the longest economic boom in our nation's history.

Theoretically, taxes on capital and investment would be a legitimate concern in an economy that is struggling with capital formation. But this is not such an economy, to put it mildly. To the contrary, we have an economy that is all but drowning in available capital, with most of it concentrating at the very top of the income scale.

In the chart below, for example, O'Reilly's aggrieved and struggling top 10 percent are represented in red, while those supposedly doing well in O'ReillyWorld are represented in blue. As you can see, average income for the bottom 90 percent has fallen during the recovery, while income has soared for those in the pitiable top 10 percent.

The metrics go on and on. Corporate AFTER-TAX profits are at an all-time high. As a share of the national economy, corporate after-tax profits and dividends are more than twice their post-war average. The stock market is at record highs. And wealth?

The richest 10 percent of the richest 1 percent now own 23 percent of the nation's wealth, far exceeding anything seen in this country for the last 100 years and once again demonstrating that capital formation is the least of our problems in this economy. A shortage of customers with enough income to buy goods and services, and with enough economic security to spend what money they do have -- THAT is the problem.

OK. But why spend so much time and attention dismantling the rants of a cable-news bloviator? It's a good question, but it has a good answer: Because O'Reilly is hardly alone in his preachments.

The sentiment that animates the graphic displayed above also animates the economic policy of the entire Republican Party, including the tax-reform proposals that it champions at the federal and state levels and the platforms of every single one of its presidential candidates. It is also the primary cause of the various billionaires who are adopting individual GOP candidates as if they were horses with whom they hope to win the Kentucky Derby.

Given all that, it's almost humorous to see the "but, but ... Hillary is rich!" counter-argument coming from Republicans. Yes, she certainly is rich. She and her husband have taken full advantage of the opportunities presented to them. It is also quite true that as a Democratic senator from New York, Clinton was deeply solicitous of Wall Street and its interests. Her instincts are naturally those of the old-fashioned, moderate, Midwest Republican background from which she came, rather than those of the populist left.

Compared to the modern Republican Party, however, those now-extinct old-fashioned moderate, Midwest Republicans would look like raving socialists. They have certainly been expunged from the party that was once their home.

Put another way, the terms of the political debate have swung so far to the right on economic issues that a centrist like Clinton now looks downright liberal. And in a general election contest against a Republican candidate who attributes our problems to an insufficient fealty to the wealthy, in defiance of data and common sense, I doubt that attacks on her own large bank account will pay the dividends that would justify the investment.