SAVANNAH — The Georgia Ports Authority’s rapid growth brings many unintended consequences to the neighborhoods near its Savannah terminals. Truck traffic. Long freight trains. Noise, light and air pollution.

And now, a housing crunch.

The state-run entity is addressing this latest growing pain just as it has the others: By throwing large sums of money at the issue. The Georgia Ports Authority (GPA) is contributing $6 million to a public-private affordable housing initiative, the Savannah Affordable Housing Fund. Established in conjunction with the Savannah city government, the fund’s aim is to invest $100 million by 2032 to improve, develop and purchase dwellings for 15,000 buyers and renters in Savannah and neighboring municipalities.

“These hard-working people have helped make our successes possible, and it is our duty to help them make their housing dreams attainable,” said Griff Lynch, GPA’s president and CEO.

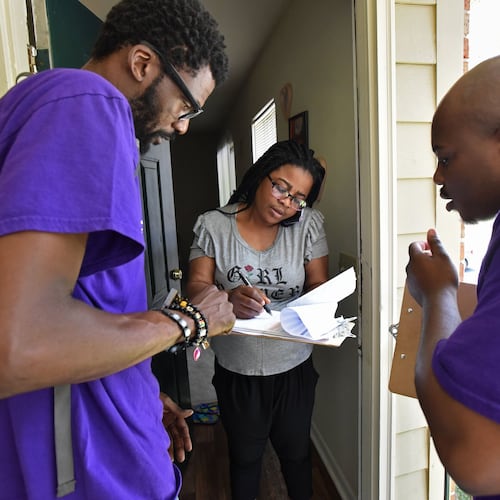

Credit: Stephen B. Morton for The Atlanta Journal Constitution

Credit: Stephen B. Morton for The Atlanta Journal Constitution

The contribution is the first of its kind for the Georgia Ports Authority, which has spent hundreds of millions in recent years on infrastructure and efforts to green its operations. The ports regularly works with the state Department of Transportation to build new and wider roads. The authority has expanded a huge on-terminal rail yard to ease traffic and keep trains from blocking crossings. GPA has even invested in quieter, electric-powered equipment to reduce emissions.

Housing posed a different kind of challenge. The GPA is aggressive in acquiring developable property but prioritizes that land to build container storage yards and transfer facilities and to expand terminals, not to develop housing.

Contributing to the Savannah Affordable Housing Fund, which can leverage donor dollars to attract matching funds and grants, maximizes the return on the investment. Savannah City Manager Jay Melder estimates GPA’s $6 million will mean an additional $3 million in available capital.

“This is recognition by the ports that housing is just as important a part of their economic development infrastructure as roads and bridges and canal widenings and terminals,” Melder said. “We hope that others recognize this in the same way.”

The ports’ investment will be directed toward improvements to the neighborhoods located nearest to port facilities. Ocean Terminal abuts several west Savannah communities, many of them among the most impoverished in the city. The Garden City terminal sits upriver from Savannah within the Garden City limits and is bordered by another municipality, Port Wentworth. Residents of those cities will be eligible to apply for down payment assistance for first-time home purchases.

The makings of a crisis

Savannah’s housing crunch has grown into a crisis as the area’s economy has exploded since the end of the Great Recession, buoyed by the ports and tourism. Container traffic, for instance, has nearly doubled over the last decade.

A 2021 study by the Housing Savannah Task Force showed Savannah’s housing costs have outpaced incomes at a 2-to-1 pace in the previous 30 years. The study estimated that 40% of Savannah households, or about 21,000, cannot afford quality housing.

Savannah housing prices have continued to climb since the report’s release. The average home price is up more than 5% compared to last year, and the average apartment currently rents for $1,600 per month.

Homebuilders are struggling to keep pace. According to Georgia Southern University economist Michael Toma, permit activity for single-family homes is down year-over-year, even as construction has accelerated on the Hyundai Metaplant, an electric vehicle factory that is expected to add more than 15,000 jobs, directly and indirectly, to the Savannah area over the next eight years.

However, recent months have seen growing momentum in multi-family development. Toma reports that the Savannah area saw more units permitted in April, May and June of this year than in the previous 12 months combined. He said the 18-month rolling average of new multi-family construction has returned to pre-Great Recession levels, and he expects the increased supply to ease pressures on the market.

Credit: Stephen B. Morton for The Atlanta Journal Constitution

Credit: Stephen B. Morton for The Atlanta Journal Constitution

Other housing initiatives are underway, including efforts in Savannah to relax city codes to allow for more auxiliary dwelling units and to require newly built market-rate developments in certain parts of town to include a percentage of affordable units.

In addition, the state government has launched a Rural Workforce Housing Initiative, targeting areas near the state’s major economic drivers, such as the Georgia Ports Authority and the Hyundai Metaplant. The Georgia General Assembly earmarked $35.7 million for the program this year.

Complicating Savannah’s affordable housing efforts is an ongoing land rush — one driven by current and projected ports growth. According to a recent report from real estate firm CBRE, Savannah is the nation’s second-fastest growing market for “big box” warehouse development, or warehouses of more than 200,000 square feet.

Savannah’s warehouse vacancy rate is currently at 0.9%, with the GPA moving to increase annual container capacity to 9.5 million by 2025 — up from 6 million in 2022.

With land to build housing limited, the ports’ contribution to the Savannah Affordable Housing Fund is a hollow gesture to some, such as GPA neighbor MonaLisa Monroe. She leads the Garden City Housing Team, a nonprofit that supports homeowners in the municipality.

She learned of GPA’s affordable housing initiative through the media and has been unable to get answers on how much of that $6 million is earmarked for Garden City and when the city will receive it. More frustrating to Monroe is that because Garden City doesn’t have a housing department within its city government, those funds must be used for first-time homebuyer assistance in a city with almost no homebuilding activity.

“There’s no housing to be had,” she said. “The only housing being built in Garden City is on the outskirts, and it’s not affordable housing. Them giving $6 million is great, but for that money to not go to building affordable housing is ridiculous.”

About the Author

Keep Reading

The Latest

Featured