» THE NEXT LIVE CHAT: Got an Obamacare question? Tweet yours to #ajcObamacare or email us at ajchealthcare@ajc.com and our reporters will answer live Thursday 1-3pm on myajc.com

» SPECIAL COVERAGE: The Affordable Care Act in Georgia | Interactive calculator

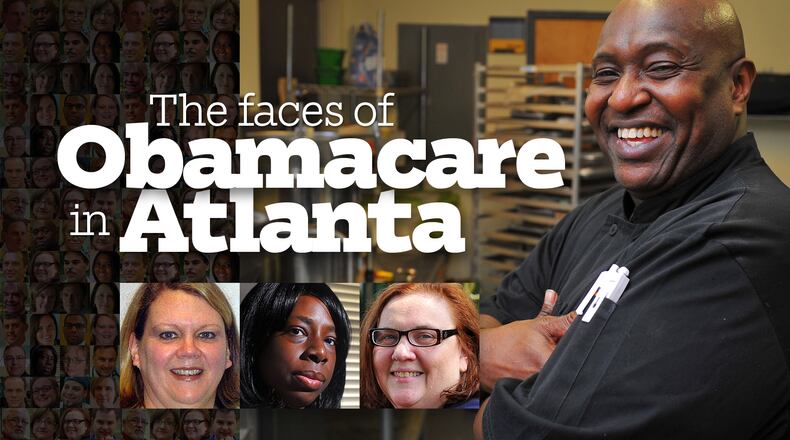

About this series: The uninsured.

Georgia has one of the highest rates of uninsured people in the nation: 1.9 million residents, about 19 percent, have no coverage. The Affordable Care Act was designed to reach these very people in one of two ways: the sale of private coverage on the Health Insurance Marketplace, also called an exchange, combined with a greatly expanded Medicaid program. The exchange opens Oct. 1. But Georgia decided not to expand Medicaid, which will mean that hundreds of thousands of people remain without coverage. Many uninsured will continue to do what they’ve done for years: live without health care until a condition turns into an emergency and forces a trip to the ER.

Ellen Wall

Age: 46

City: Norcross

THE SITUATION: A nanny for nearly 20 years, Wall often doesn't receive health insurance through her work. Her income fluctuates, making it hard to afford the rent, much less health insurance. She has gone without insurance now for six months. Wall, who is single, does not qualify for Georgia's Medicaid health program for the poor, which mostly covers pregnant women and children.

IMPACT OF ACA: Wall could benefit greatly under the ACA. If she makes $13,000 a year, federal tax credits would cover all but about $260 for a middle-of-the-road "silver" health plan sold on the exchange. At her income level, she could also qualify for help covering her copayments and deductibles. Since she is close to the federal poverty line, she will have to be careful to keep her income up. People with incomes below the poverty line will not be eligible for the tax credits. The law envisioned that people in Wall's position would be eligible to go on an expanded Medicaid program. But Gov. Nathan Deal has decided not to expand Medicaid in Georgia.

WALL'S VIEWS: A social worker tried to find ways to help me out. I felt really bad. I hated that anybody would have to pick up my bill for me, and I couldn't pay for myself. I don't feel entitled to anything. The majority of times, my employer was not able to pay my insurance, which is understandable.

It’s so disheartening. I take care of these children, and I love them with all my heart. This is what I do. I guess it’s the nature of the business, and it’s the nature of the self-employed. I pay taxes. I’m paying into (Medicaid) that would help me and thousands of others. They’re hardworking people, and (a Medicaid expansion) would help them. If I have an ache or pain or something that doesn’t feel right, I kind of just wait and see how things go first. I don’t want to take from anybody. I work really hard. I try to handle things myself. I have to realize, though, that my No. 1 priority is taking care of my rent. I haven’t had insurance for about six months, and I hope that will get better. It’s kind of an off and on thing. It’s very scary. Anything could happen.

Jimmie Peterson

Age: 50

City: Atlanta

THE SITUATION: Jimmie Peterson runs the kitchen at a fudge company in Atlanta through a program that helps the homeless get back on their feet. He does not get insurance through his employer and does not qualify for Medicaid. Peterson suffers from back and groin pain, caused in part from his time in the Army. When he needs medical care, he goes to Saint Joseph's Mercy Care Services or Grady Memorial Hospital. After graduating from culinary school, Peterson is now applying for jobs that would provide insurance.

IMPACT OF ACA: With his income just a few thousand dollars above the federal poverty line, Peterson could qualify for tax credits that would cover all but a few hundred dollars of his annual insurance premium. He could also qualify for help paying his co-payments and deductibles.

PETERSON'S VIEWS: Grady has phenomenal doctors. But the volume (of patients) is so great, you don't get a chance to get a relationship with one doctor. You're seeing different doctors all the time.

If I make sudden movements, the pain is unbearable sometimes, but I know I’ve got to do what I’ve got to do.

It took me eight months to get an MRI. I see a lot of physician assistants. I would really like to have a primary care doctor. We could have gotten down to the bottom of (what was causing my pain) immediately. In order just for me to get a physical therapy appointment and the MRI, Mercy Care, one of their doctors went far beyond the call of duty. He did everything he would do in his private practice.

Some of the referrals I get, without insurance, you can’t get through the door. Medications are (often) too expensive. Certain pain medication would have probably helped me, but without having proper medical insurance, it’s hard. After a while, you learn to deal with it. A lot of staffing agencies and restaurants don’t offer insurance. I need to educate myself a little more about (the health care law).

Jameca Barrett

Age: 36

City: Fairburn

THE SITUATION: Barrett is a survivor of a blood cancer known as multliple myeloma. She does not qualify for Georgia's Medicaid health program for the low-income. She She hopes to hire on with a large technology company that would provide her with insurance, although Barrett is unsure of whether she would be able to afford it. A previous job she held and was laid off from offered insurance, but she could not afford the premiums. Before her diagnosis, Barrett had been treated in an emergency room but was discharged because she lacked insurance. She eventually underwent chemotherapy and a stem cell transplant and became a patient of Emory Healthcare.

IMPACT OF ACA: She made $25,000 last year, putting Barrett's income at 218 percent of the federal poverty level. That means she will be eligible for a federal subsidies through the new health insurance exchange. If Barrett purchased a "silver"-level plan on the exchange, the annual premium cost would total roughly $3,700; however, she would only pay about $1,730 and the federal government would pay the rest. Barrett's out-of-pocket costs would be capped at $5,200, Kaiser data shows. The law also requires insurance companies to provide coverage to people like Barrett who have pre-existing conditions.

Barrett's view: I spent three months in Grady (Memorial Hospital), and I always promote Grady because I went to a (different) hospital previous to that and I was discharged because of lack of insurance I believe. I had to go to one of the Grady clinics, and they rushed me to the hospital in an ambulance. At diagnosis they were shocked because (in my condition) I should have been in a coma or already dead. I became a patient of Emory and Grady. Emory would offer assistance with some of the programs they had and just saying you're our patient and we're going to take care of you. At the same time, bills just started to mount up. Within the last year, I've had to have three scans, CT scans, MRI scans. I have right now, two $10,000 bills. The blessing is because of me being just a part of the Emory system, they at least did it. but they still say, you are responsible for this bill. I lost my job in 2011, so I've been uninsured and unemployed, I've just had no options within these last two years. If you're working, you can at least throw $10, $20 at it and feel like you're at least doing something. But when you're unemployed, you have to (say) my health is most important and I'll deal with that later. From what I know, (the health care law) is definitely beneficial for patients, even if people don't realize it — especially with the way that the economy and society is with employment, being able to lose your job at a moment's notice or a company failing. I think it's something a lot of people don't realize is valuable for them. They don't understand the significance and the role it's going to play in being abe to afford … the medications that they need and the treatment that they need to go forward."

Sara Foster

Age: 56

City: Tucker

THE SITUATION: Foster is a registered nurse who is self-employed as a freelance medical writer. Over the years, she has obtained insurance through employers and also paid for her own plan. Recently, however, she weighed her options and her limited budget and decided to go without coverage. She is paying for health care out of pocket, including her recent eye surgery. Foster would like to have coverage, but she doesn't think the government should force her to buy it.

IMPACT OF ACA: Foster will face the law's penalty if she doesn't opt for a plan. The penalty is $95 or 1 percent of her income – whichever is greater. By 2015, the penalty will increase to $695 or 2.5 percent of income.

FOSTER'S VIEWS: I'm very much a libertarian and I'm very much a believer in individual rights and responsibility. I am so angry about this whole quote-unquote Affordable Care Act that is in no way affordable for individuals or the country.

I just don’t understand how in a country where people are supposed to be free to live their lives, how the government can tell me that I have to buy this product.

I am willing to take care of my health care on my own to the extent that I can and it’s like anything else – if I can’t afford it. I won’t have it. I don’t have children. I only have myself to be concerned about. If you have children, that’s a different story.

What I think a lot of people are not really understanding about Obamacare is that not only are they telling you that you must have insurance. They’re also going to pick and choose which kind you can have. Excuse me?

You can’t get just a catastrophic coverage plan. That, to me, is just the insult to the injury.

I wish insurance was like the Piccadilly Cafeteria. You walk down the line and pick what you want. All this mandated coverage is crazy. I should be able to choose what I want. That would make it less expensive as well.

I do want to try to find something if I can afford it. Right now, my budget is so tight I really can’t afford it. Yes, I know the government will “subsidize it” for your income, but that really goes against the grain with me. Somebody else’s money is going to pay for my insurance? I just think that’s wrong.

About the Author

Keep Reading

The Latest

Featured