Five years before the federal government accused a Woodstock millionaire of running a multistate, multimillion-dollar Ponzi scheme, Georgia regulators had evidence he was operating without a license, in violation of state law.

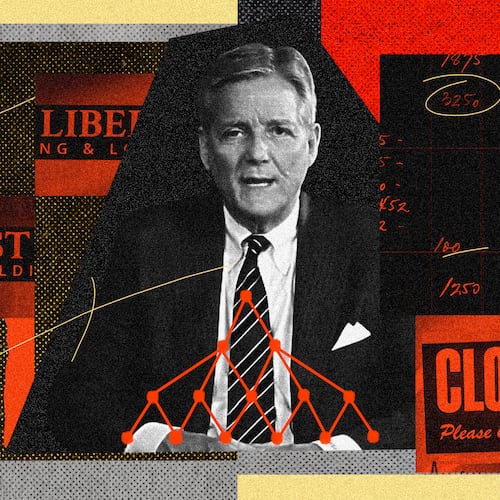

Insurance Commissioner Ralph Hudgens was told repeatedly that Jim Torchia was buying other people’s life insurance policies without state approval. Fraud unit investigators also had evidence Torchia’s company advertised directly to Georgians, offering quick cash for rights to insurance payouts. Legal experts say that is illegal without a license.

But Hudgens didn’t act to stop him, an investigation by The Atlanta Journal-Constitution found. No cease-and-desist order. No fines or criminal charges. No consumer alert.

“There just doesn’t seem to be anything we can do about it,” Hudgens reportedly told an industry insider who pestered him for years about why Torchia hadn’t been shut down.

Had the commissioner enforced the laws he was elected to uphold — including laws he personally sponsored back when he was a state senator — Torchia's operations might have been scrutinized, or even halted, years ago, the AJC found.

Swift action might also have sent a strong message to companies that invest in life insurance policies, as well as to other private industries, that Georgia takes consumer protection seriously.

Instead, the AJC's investigation revealed a state regulatory office with reduced ambitions under Hudgens, who campaigned on principles of less government and more individual freedoms and whose most notable battle has been against Obamacare. Hudgens' office might also have been hesitant to tangle with Torchia, who for years used incessant litigation to fend off prying state agencies, the AJC found.

Torchia went right on convincing elderly people and dying cancer patients to sell him rights to their insurance policies. By amassing more policies, he could woo more investors.

Flash forward to 2016, and the federal Securities and Exchange Commission has filed suit against Torchia, alleging his Credit Nation empire of companies amounts to an elaborate fraud. The U.S. Attorney's Office and Secret Service are also investigating, state officials said.

The government claims that businesses under Credit Nation's umbrella have debts exceeding assets by millions of dollars, placing hundreds of investors throughout the country at risk of losing their savings. Many are elderly and unsophisticated people who were drawn in by ads aired during Rush Limbaugh's radio show.

Torchia treated their money “as his personal piggy bank,” the feds allege, transferring funds to himself, casinos, his Canton home and his son’s auto dealership.

Torchia denies running a Ponzi scheme or misappropriating funds. He has said the SEC doesn’t understand how to value life insurance policies or how his business works. “I can tell you, I’m totally relaxed with it,” Torchia said of the lawsuit in January, “because I’ve done nothing wrong.”

The case is now before a federal judge, who is considering whether to freeze Credit Nation’s assets and appoint a receiver to unravel the various accounts and try to salvage as much of investors’ money as possible.

“Credit Nation Capital investments were made, in general, by folks who can’t afford to just lose all of it,” said Jeremy Hyndman, a Cobb County-based investment fraud attorney who has two clients who invested in Torchia’s companies. One is a retiree who had been helping his daughter, a single mother, pay for child care so she could work. Bracing for heavy financial losses, he’s had to cut that expense.

“There’s a lot of pain out there that could have been avoided if the state had done its job and held Credit Nation accountable for flouting regulations,” the attorney said.

Elizabeth Ann Daugherty, an 84-year-old widow living in Dunwoody, has been investing with Torchia since the early 2000s and considers him a kind, upstanding businessman. She has about $250,000 invested in the company, receives $2,200 per month in interest payments, and sends Torchia a Thanksgiving card every year.

“I pray that this is not going to fall apart,” Daugherty said, “because that will hurt me terribly.”

Hudgens, through a spokesman, declined to speak to the AJC for this story.

An attorney for his office reiterated what he purportedly said years ago to the insider concerned that Torchia was operating without a license. “We were not able to gather any information that was actionable at that time,” General Counsel Margaret Witten said. “We can second-guess whether we had enough evidence or not, but we don’t feel that we had enough.”

The Insurance Commissioner’s office wanted to find people who had sold policies to the company, she said. Whether investigators took steps to locate them is unclear. Witten said she doesn’t know what investigators did five years ago.

The AJC asked Torchia and his attorney, Marc Celello, in an email to explain how the company can advertise to buy policies without a license. Neither responded.

‘Financially drained’

Marie Connally thought her cancer was in remission, and when it returned it put her life in a tailspin. She has multiple myeloma, an incurable blood cancer that eats away at bones and ravages kidneys. Every day is a fight for life, the pain draining her energy and treatment costs depleting her savings.

In the life settlement and viatical business, Connally's affliction makes her a sound investment.

The niche industry sprang up amid the AIDS crisis in the 1980s. Investors buy rights to life insurance policies from the terminally ill and the elderly, paying less than face value, but far more than cash value, and taking over premium payments.

The sick receive cash to pay bills, travel or spoil themselves while they still can. The investors get a payday when the insured person dies. The biggest risk is the person living longer than expected, causing premium payments to crash the investment.

Last year, Connally was waiting for an appointment at the Emory Winship Cancer Institute when she spotted a stack of brochures in a plastic holder.

"Relieve Financial Stress," said the pamphlet from Asset Funding Corp. She called the 1-800 number.

“At the time, I was so financially drained, because you go back and forth to the doctor so much,” Connally, 53, said. “It’s a lot of wear and tear on your car. The loss of work. You incur a lot of debt.”

Within months, she said, she had sold rights to a $50,000 life insurance policy for $25,000. She used the money to buy a car, pay off bills and help her children.

The transaction, though, represented what experts say is a breakdown in how the life settlement/viatical business is supposed to work in Georgia.

Asset Funding is a marketing arm for the Credit Nation network of companies, according to correspondence from Torchia to an investor, obtained by the AJC.

None of the companies, nor Torchia himself, nor anyone working for him, has licenses to buy life insurance policies, advertise to residents, negotiate with policyholders or broker deals.

Georgia is one of 44 states that requires such licenses, a way to ensure that elderly and sick people aren’t taken advantage of. To maintain a life settlement license, a company must provide audited financial reports and open its books, revealing details about policies being bought. A history of regulatory run-ins in other states can derail an application, and Torchia has a track record.

"If I was a regulator," said Atlanta attorney James Maxson, a board member of the Life Insurance Settlement Association, or LISA, trade group, "I would take the position that if you are contacting residents of my state, for the purpose of incenting, enticing or otherwise getting them to enter into a life settlement, that you should in some way be licensed."

Over the past few months, the AJC found the pamphlets in several waiting rooms around metro Atlanta. Representatives of the Emory Winship center and Northside Hospital said they were put in without permission and would be removed.

But the AJC found that the pamphlets have apparently been out for years — and the Insurance Commissioner's office knew about them as far back as 2010, just before Hudgens took office. Doug Gaddis, a former state fraud investigator, learned that on his last day of work, late that year.

Chit-chatting during his retirement party, Gaddis said, his supervisor told him that another fraud unit investigator had found brochures left in hospital and nursing home waiting rooms.

“The very last conversation I had, as I walked out the front door, was that that’s what they were going to work on,” Gaddis said.

Facing scrutiny

By that time, he said, his bosses had grown weary of tangling with Torchia.

Gaddis’ unit had raided Torchia’s office in 2001, accusing the company of selling insurance without a license and misleading investors. Torchia challenged the search warrant, and after he hired away one of the state’s top enforcement lawyers, the Insurance office backed off, Gaddis said. Torchia also prevailed against the Secretary of State’s office, which tried to stop him from offering viatical investments.

Over the years, he and his ex-chief financial officer also had faced scrutiny from other states’ enforcement agencies, records obtained by the AJC show. He prevailed in some states that tried to rein him in, but he couldn’t shake a cease-and-desist order from Florida, which fined him $120,000 for selling unregistered securities and said he “repeatedly demonstrated incompetence.”

After the Georgia Legislature passed its Life Settlements Act in 2005, requiring companies to be licensed, Torchia sued then-Insurance Commissioner John Oxendine, trying to have the law declared unconstitutional. A federal judge dismissed the suit.

Several years later, in 2009, Torchia formed a new company, Stone Mountain Settlements, and applied for a Georgia license. Insurance officials voiced suspicions even then that he was operating without a license, the application file shows. "Do we have evidence that Torchia was engaged in the business for which he is now applying for a license prior to licensure?" Witten, the attorney, asked an enforcement division supervisor in an internal email.

Torchia maintained that his company hadn't bought or brokered any policies illegally since the new law went into effect, the file shows.

The state dropped the application because he failed to turn over some required documents. “Be advised,” said a letter from the Insurance Commissioner’s enforcement division to Torchia, “any action taken by this unlicensed ‘Company’ in the life settlement business in the state of Georgia is illegal and will subject the ‘Company’ and its principals to fines, penalties and criminal actions to the extent the law allows.”

That didn’t stop him from acquiring more policies. In several transactions identified by the AJC, he used a license-holding company near the Georgia coast called The Settlement Group to close the deals, a practice known as “license renting.” In a past AJC interview, Celello, Torchia's attorney, said Credit Nation acts only as a “funding agency” while another company acts as the life settlement provider. In that case, he said, Torchia doesn’t have to have a life settlement license.

But a company treads a legal line by recruiting policy sellers on the front end, using a licensed entity as a pass-through buyer, then taking ownership of the policies on the back end, according to Atlanta attorney Brian Casey, who has worked in the industry for 22 years.

The brochures found by the AJC go well beyond the line, Casey said. They say “AFC may be able to purchase your existing life insurance policy and provide you with financial peace-of-mind.”

“A regulator would take the view that they’re advertising that they can buy the policy, and thus are leading the public to believe they are a provider,” Casey said. “I think that would be conducting business as an unlicensed life settlement provider.”

Tip from a donor

Phil Loy, a board member of the life settlements trade organization, said he was offended by what he called Torchia’s blatant disregard for regulations. He spent two decades in the industry drawing up mortality reports, or death predictions, for investors.

Loy, who has donated $7,000 to Insurance Commissioner Hudgens’ campaign over the years, said he personally told him on multiple occasions that Torchia was trading in life insurance policies without a license.

“He just said, ‘We’re looking into it,’ ” Loy recalled.

“I think (Torchia) would have been shut down, if they’d taken it seriously,” Loy said. “Georgia is a license state. He’s not licensed. You have a brochure in your hand that says he’s doing the transaction, and he’s still not licensed.”

What Hudgens did with that tip is unclear.

Witten said requests for investigations should be submitted in writing, but what the commissioner reportedly told Loy about the case being stalled makes sense.

“I find it surprising that the commissioner would be in the weeds to know that,” Witten said. “He may have inquired with the fraud division whether they were looking into it, but that’s speculation.”

She denied that the office was intimidated by Torchia.

Also unclear is why Hudgens didn't pounce on a potential violation of the Life Settlements Act. It was Hudgens, as a state senator and chairman of the Senate Insurance and Labor committee, who sponsored that bill when it passed the Legislature in 2005, as well as when it was revamped in 2009. The LISA trade group even presented Sen. Hudgens with its 2009 Consumer Freedom Award for protecting the rights of life insurance policy owners.

A check by the AJC turned up only one instance of enforcement activity by Hudgens’ office in the life settlement industry over the past three years. In 2014, his office threatened a Duluth-based company with administrative action, accusing it of buying policies without a license based on language on its website.

Company owner Michael Sullivan assured investigators he wasn’t acquiring policies, just steering clients to licensed brokers. The state dropped the inquiry. Sullivan is Torchia’s former CFO, who’s had a bitter falling-out with him.

Asked why the state didn’t take similar action with Torchia — perhaps seeking an explanation for the brochures, perhaps admonishing him to obtain a license, or perhaps just asking if he was buying policies — Witten said she doesn’t know what the fraud unit did. The AJC asked to see the investigative file, but the Insurance office cited the Life Settlements Act, which allows such records to be withheld from the public.

‘A pretty easy case’

Hyndman, the Cobb attorney, said he's in talks to represent more than a dozen other Credit Nation investors. He plans to sue their financial advisers, who steered them to invest in the life settlement business with a company that held no life settlement licenses.

He doesn’t understand why the state’s top insurance regulator didn’t make that connection.

“That sounds like a pretty easy case to make,” Hyndman said. “I think that this is inexplicable. I think it’s a shame.”

Gaddis, the former fraud investigator, said state regulatory agencies underwent a culture shift during the Great Recession, which saw budgets slashed and workers furloughed. Investigators like himself were steered toward easier cases, he said, and Torchia’s case was as complicated as they come.

“He doesn’t want to stir the pot,” Gaddis said of Hudgens, who took office soon after Gaddis retired. “The philosophy is, big case, big problems. Little case, little problems. No case, no problems.”

About the Author

Keep Reading

The Latest

Featured