The Deal administration is filing legislation to eat into the massive windfall the state is expecting from the federal tax plan that Congress approved in December.

It would also give some Georgians the chance to lower their state tax bill, which might jump as a result of the federal tax changes.

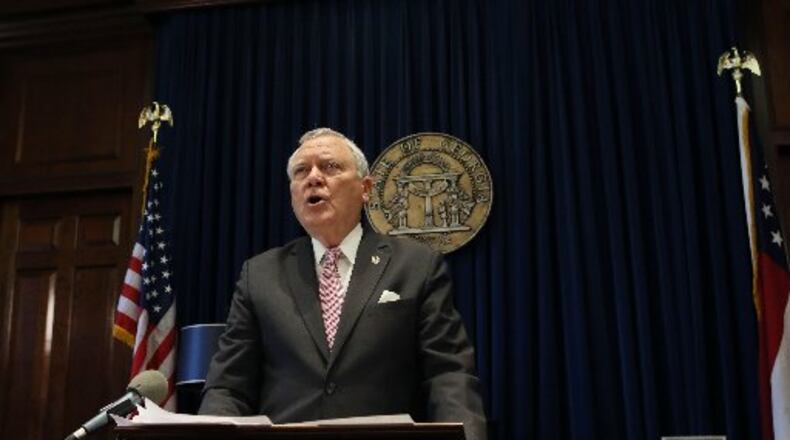

“It will mean the state is not collecting as much money from them as it would have been had we not made these changes,” Gov. Nathan Deal told The Atlanta Journal-Constitution on Monday.

The AJC reported last month that the federal tax plan could result in a $3.6 billion windfall for the state over the next five years if no changes are made in state tax law. New state estimates put the figure at $4.7 billion, with the biggest impact beginning in fiscal 2020.

Deal initially said he wanted lawmakers to wait until the state's 2019 legislative session to figure out how to address the windfall because the state can now only estimate the impact of the federal law. But Deal changed his mind after lawmakers — most of whom are either running for higher office or seeking re-election this year — began calling for tax cuts.

Administration officials said their bill would cut the estimated windfall by 75 percent over five years and all but eliminate it this year.

Under the measure, Georgia taxpayers would be allowed to take the enhanced federal standard deduction — which will about double under the plan approved by Congress — but itemize deductions when they do their state taxes.

Currently, if Georgians take the standard deduction on their federal tax return, they must do the same on their state form. That is an issue in part because the state standard deduction — $3,000 for joint filing couples — is fairly low.

In addition, Deal’s bill would increase the state personal exemption by 25 percent.

The state tax code changes would have a 10-year shelf life, just like the federal law.

State Rep. David Wilkerson, D-Austell, a certified public accountant, said the decoupling of federal and state returns is a good start toward reducing the windfall. Wilkerson and state Rep. Howard Mosby, D-Atlanta, filed House Bill 824, doing much the same, last week.

“That is the right answer. If you decouple, at worst, you will be the same as you were before,” Wilkerson said. “I think we are getting there, but the devil is in the details.”

Wilkerson, like many other lawmakers, said the General Assembly needs to act on the issue this session.

“I don’t like the word windfall, it is a tax increase,” he said. “If we do nothing, we are raising taxes.”

Lt. Gov. Casey Cagle, who is running this year to replace the retiring Deal, said, “I look forward to reviewing Governor Deal’s proposal and working with him to give hardworking Georgia families the tax cut they deserve.

“Ultimately, I’m committed to moving forward with comprehensive tax reform that will — at a minimum — return every surplus dollar collected back to Georgia taxpayers.”

Deal officials said while the changes would eat up a sizable part of the windfall, other possible tax cuts — such as the proposal moving through the Georgia House to eliminate sales taxes on jet fuel — would decrease state revenue as well.

Georgia — and many other states — would receive a windfall because the federal law limits or eliminates some of the deductions Georgians have used when figuring their state taxes in the past and made it far more likely that ratepayers will use the standard federal deduction, rather than lowering their state taxable income using itemized deductions.

So while many Georgians may pay less in federal taxes, at least some could wind up with bigger state tax bills unless lawmakers make some changes in the tax code.

Harold Cohen of Sandy Springs, a retired actuary and volunteer tax preparer, voiced support for allowing Georgians to itemize deductions on their state returns even if they take the standard deduction on federal taxes.

But he said it may make state tax returns more complicated for some individuals and the Department of Revenue. He also said the state may lose money from people who now take the low state standard deduction but would now have the opportunity to itemize, meaning they could deduct more income.

Cohen suggested it might just be simpler for the state to change tax brackets so that the first $100,000 of income is taxed at 5 percent. Currently, a married couple filing jointly pays 6 percent on income above $10,000.

Some Republican lawmakers have proposed lowering the top state income tax rate. Deal administration officials looked at the possibility but found that lowering the top rate from the current 6 percent to 5.5 percent would leave the state in a hole over the next three years, even with the projected windfall from the federal bill.

State income taxes are the single biggest source of revenue for the state, and Deal officials have indicated that the governor would likely fight any effort to cut the rate and veto any bill that contained rate cuts.

Some lawmakers, however, may object to the governor’s proposal because, after this year, the state would still likely take in more tax money. Even with Deal’s bill, it is estimated the state would take in about $300 million more a year in income taxes starting in fiscal 2020.

That may make lawmakers squeamish about the prospect of running against opponents who say the state is raising income taxes.

When asked about his bill’s prospects, Deal said he was sure legislators “would have some fun with it.”

But the governor also said he was looking ahead to a time when he would no longer be governor. Deal leaves office in January.

“My criteria have been, let’s make sure we don’t jeopardize state revenue by getting carried away (with tax cuts) because there is going to be a windfall,” Deal said. “Let’s do it in a very select way, let’s make sure the benefits we convey in a tax reform are benefits we can sustain over a long period of time.”

Never miss a minute of what's happening in Georgia Politics. Subscribe to PoliticallyGeorgia.com.

About the Author

Keep Reading

The Latest

Featured