Former mayors featured on Decatur Senior Exemption committee

City Schools of Decatur named a nine-person Senior Homestead Exemption Committee this week, save for one spot that remains unannounced. The headliners are city legends and former mayors Bill Floyd and Elizabeth Wilson.

Floyd, nominated for the slot by current Mayor Patti Garrett, served as Decatur commissioner from 1991-2013, the last 13 as mayor, second longest known tenure in city history.

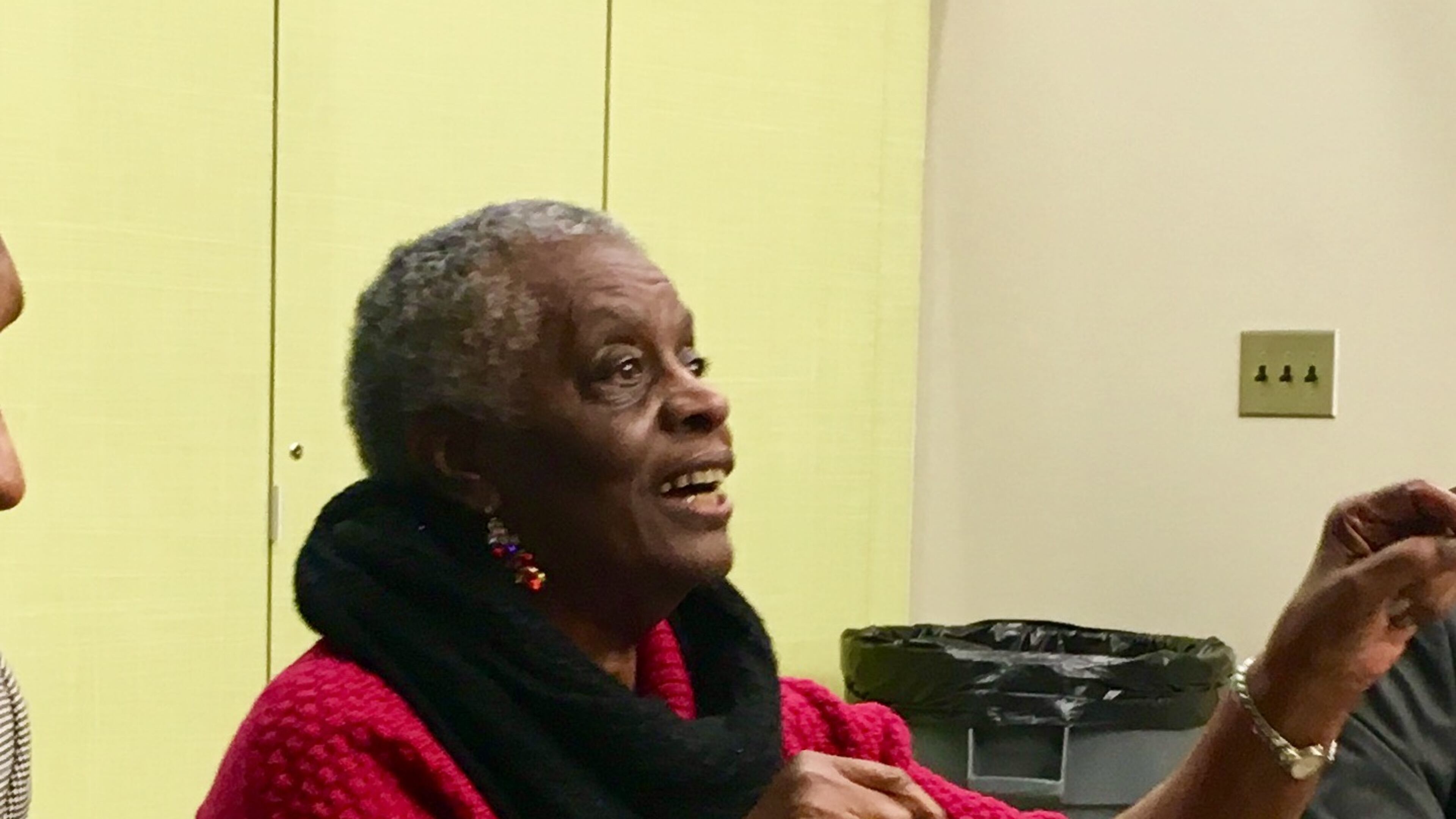

Wilson, nominated by the CSD board, is the city’s only African-American mayor, serving from 1993-99. She’s lived in the city since 1949 and has been a long time activist, instrumental in desegregating Decatur’s school system in the 1960s.

The only position yet unnamed is a representative from the Decatur Business Association.

The committee: Meg Robinson (a parent member of the CSD System Charter Leadership Team), Bill Floyd (chosen by Decatur’s city commission), Maria Pinkleton (from Decatur’s Lifelong Community Advisory Board), Elke Davidson (Decatur Affordable Housing Coalition), Phil Cuffey (Beacon Hill Black Alliance for Human Rights), Gwin Hall (an expert in municipal finance and policy), Paula Collins (expert in municipal tax law), Wilson and one member to be determined (Decatur Business Association).

The committee is charged with revising the current Senior Homestead Exemption. The collective’s first meeting should occur this month, with final recommendations coming before the school board by Sept. 1, 2020.

Beginning in Jan. 2017, residents 65 and over were given full exemption of all school taxes. That exemption included a five-year “sunset,” meaning that without any new legislation the exemption would expire Dec. 31, 2021.

Before the exemption took effect, CSD estimated it would lose $1.2 million in revenue annually. But a Georgia State University study completed last fall showed the district lost a lot more, $3.41 million in 2018 and $3.24 million in 2017. This is a predominant reason the school board has determined that a revision’s critical.

According to the committee’s charge, the revision’s budget impact should “be no greater” than the originally anticipated $1.2 million by the year 2026.

The new exemption must get approval from the 2021 general assembly to appear on a referendum, probably in Nov. 2021.