The $33 billion-plus question for Georgia lawmakers: Where to spend the money?

State revenue is flagging and economists are concerned about more slowing in 2024.

So what’s up with the continued holiday spirit as the General Assembly heads into its annual lawmaking session on Jan. 8?

Gov. Brian Kemp and legislators have big plans to spend a lot of money on raises and programs, and to still cut taxes.

While counterintuitive for a state that has always followed hyperconservative budgeting principles, the math works because the government doesn’t spend everything it takes in. It is sitting on more than $16 billion in “rainy day” and undesignated reserves, and leaders are confident Georgia will weather any economic slowdown better than most because of years of business growth.

“I don’t think our priorities will change much: We’re going to help our employees when we can, and we’re going to cut taxes when we can,” said House Appropriations Chairman Matt Hatchett, R-Dublin. “You’re not going to see crazy spending. We are going to address the needs that need to be addressed.”

Kemp has already told agencies they can ask for 3% more in spending — a rare allowance for the governor — and vowed to speed up a cut in the income tax rate. He’s called for more money for school safety programs and $1,000 bonuses for 308,000 teachers, other school staffers and state employees. And with turnover rates still an issue in state agencies, at least some workers will likely receive raises in the coming year.

Just the things Kemp has already touted — the income tax cut, school safety money and $1,000 bonuses — would cost the state $700 million.

And as he said during a press conference in mid-December: “There’s more good news coming in the weeks and months ahead. So stay tuned.”

Some Republican leaders in the Legislature are even talking about expanding the availability for Medicaid, the public health system for the poor and disabled, something the GOP has fought for more than a decade, arguing it was too expensive.

Democrats, who have been just as adamant about pushing for the expansion under the Affordable Care Act — also known as Obamacare — say it’s about time. And they’re skeptical there’s enough Republican support to get it passed.

“The Republicans’ reaction to the Affordable Care Act was to demonize it,” said state Sen. Nan Orrock, D-Atlanta, a longtime member of the Senate Appropriations Committee. “They spit in the soup, and now they don’t want to eat it.”

Slower economy

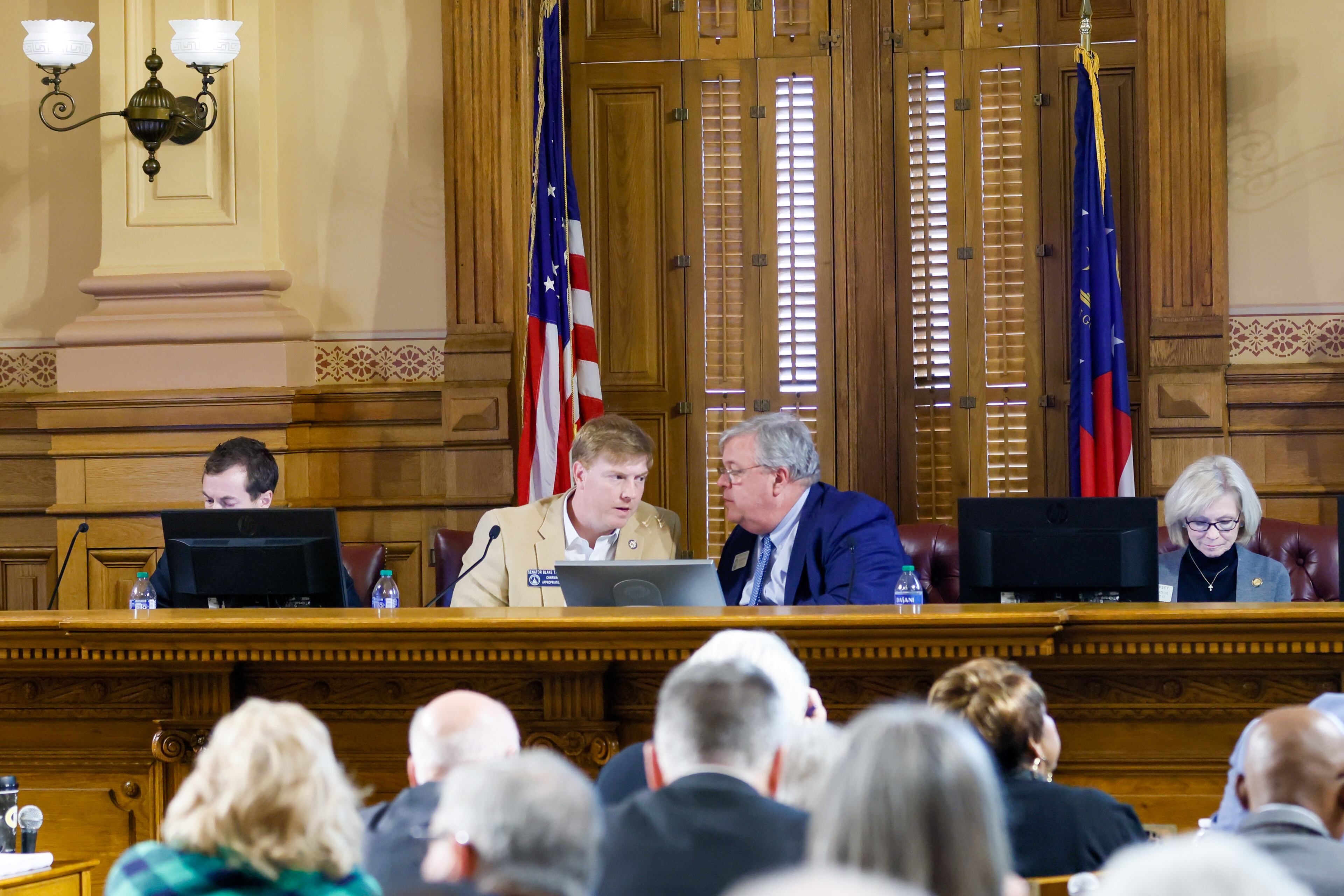

Hatchett and his counterpart, Senate Appropriation Chairman Blake Tillery, R-Vidalia, follow the economy and the state’s $33 billion budget closely, even during the nine months of the year the Legislature is not in session. They both see tax collections are slowing down, up 3.3% for the first five months of fiscal 2024, which wouldn’t have been bad in the times before the COVID-19 pandemic.

But collections were up only because during the same period in 2022 the state wasn’t collecting motor fuels taxes, a loss of $160 million to $180 million a month.

Collections skyrocketed after the COVID-19 economic shutdown ended in 2020, producing three consecutive massive revenue surpluses. The surpluses were built on factors including federal spending, inflation, higher wages, stock market gains and bigger corporate profits.

Those gains — and Kemp’s decision to limit spending — have built reserves previous governors couldn’t have dreamed of in the past. During the Great Recession reserves dropped so low the state had saved only enough to run the government for two days. It now has enough for about six months.

That cushion allows Kemp and lawmakers the confidence to boost spending.

But in the long term, most of the money the state collects to help educate 2 million Georgians, provide health care to more than 2 million people, manage and improve parks, investigate crimes, incarcerate criminals, and provide mental health services comes from income and sales taxes.

When income and sales tax collections stall or dip, that’s usually a sign of a slowing economy.

Ben Ayers, dean of the University of Georgia’s Terry College of Business, recently forecasted that while growth might slow, it won’t decelerate by as much here as in the national economy.

“The state of Georgia will experience an economic slowdown, but the good news is that we are not projecting a recession,” he said.

Robert Buschman, the state’s fiscal economist, said a mild recession in 2024 is “the most likely scenario.”

“We are expecting, given the risk of a recession or at least a slowdown, personal income tax revenues, corporate income taxes and sales taxes to lose a little ground,” said Buschman, a longtime Georgia State University economist.

That’s the message lawmakers will hear in the second week of the 2024 session as they begin tackling Kemp’s proposed budget for the coming year.

Lots of needs and wants

The cost of certain things go up every year. In a growing state, K-12 schools and Medicaid almost always see big increases in costs, typically running the state hundreds of millions of dollars more each year.

Usually governors allow for spending growth in those areas but pull back on others. Kemp, however, allowed all agencies to request “enhancements,” or spending increases. As The Atlanta Journal-Constitution reported in October, they took him up on that offer, asking for billions.

That doesn’t mean Kemp will recommend all that spending or that the General Assembly will approve it.

“There were some spending requests that seem to be wish lists, and I don’t think the taxpayers are ready for us to spend on bureaucratic wish lists,” Tillery said.

Tillery and Hatchett said pay raises would be a priority in high-turnover areas, although the biggest requests came from the state’s top judges, who proposed tying the salaries of state Supreme Court, Court of Appeals and superior court judges to what federal judges make. If approved, their plan would raise the pay of most judges by tens of thousands of dollars a year. But with a price tag of $21 million, it’s a relative drop in the bucket and would change a patchwork system where the pay of superior court judges is based on how much money local counties decide to supplement their salaries.

Traditionally the state borrows about $1 billion each year to pay for college buildings and other construction/government infrastructure, but Tillery said, “Buildings will be lower on our priority lists and people will be higher.”

Kemp will release his budget plans early in the session, and that’s typically a starting point in the process. The House will add some spending, and cut some, and the Senate will do the same. Eventually they’ll reach a spending deal, but under the law, the final total can’t be more than Kemp’s starting point.

Hatchett, the House budget chairman, said he’s bullish heading into 2024, despite concerns about the economy. Having a $16 billion cushion will do that. Georgia is in good financial shape compared with many other states, including California, which is expected to face a $68 billion deficit (or more than twice the size of Georgia’s general fund annual budget).

“I think we are in a very unique position,” Hatchett said. “I feel very positive about our state. We have got so much going on, so much industrial growth, and it’s not going to stop.”

The 2024 legislative session

The Atlanta Journal-Constitution has the Georgia’s largest team covering the Legislature during the session that ends Thursday, March 28. Readers can follow news of the House and Senate on all of our platforms, ajc.com, the AJC app and our print and ePaper editions.

- The Georgia Bill Tracker offers bills to watch from Crossover Day to Final Adjournment

- A citizen’s guide to the Georgia’s General Assembly

- Key players to watch: Governor, Lieutenant Governor, key legislators

- Track bills and lawmakers: Georgia Legislative Navigator

- FAQ: What do legislators do, how does it work?

- Legislative Lingo: How to speak like a Georgia legislator

FOLLOW UPDATES from the AJC

- Sign up for our subscriber newsletter: Updates on the Legislature and the 2024 elections by email.

- Listen to the Politically Georgia podcast daily at 10 a.m. or on demand

- Get complete daily coverage during the legislative session at ajc.com/politics

- Follow us on X, formerly Twitter at @AJCGaPolitics, on Threads at @ajcnews, and on Facebook at AJC Georgia Politics