In late 2017, Georgia Power conditionally agreed to borrow a $1.67 billion-dollar loan from the federal government to complete construction at Plant Vogtle. The terms of this loan, which the Department of Energy released on April 11th to the Southern Alliance for Clean Energy — a nonpartisan-nonprofit advocacy group dedicated to fostering sustainable energy development in the Southeast — reveal that Georgia’s largest public utility received yet another sweetheart deal. It’s hard to keep track of just how many breaks Georgia Power has caught.

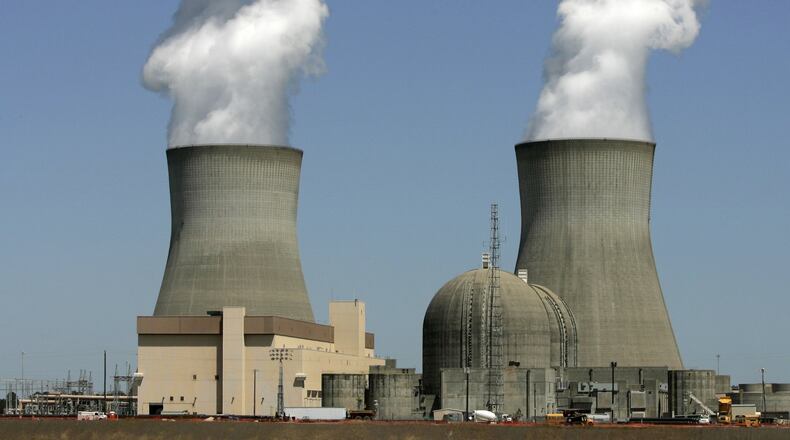

The two nuclear reactors being built at Plant Vogtle are the only reactors being constructed in the United States, and if completed, would be the first nuclear reactors built in nearly 30 years. The Department of Energy has already heavily subsidized Georgia Power’s efforts at Plant Vogtle, providing a $3.4 billion-dollar loan to the utility in February 2014. This is in addition to the $1.67 billion Georgia Power is set to receive in 2018.

While the federal government doling out funding for energy projects may come as no surprise to many, what is truly surprising is that the federal government sees absolutely no risk in issuing them, as reflected by the zero dollars it requested from Georgia Power in credit subsidy fees — fees designed to protect the government if Georgia Power defaults. Georgia Power also put zero dollars down on the $3.4 billion it received in 2014. It is difficult to fathom getting such a good deal. For the sake of comparison, the utility is putting less down for its loans to build two nuclear reactors than the average American puts down for a loan to buy an already-constructed home.

Both the federal government and Georgia’s government have been overwhelmingly supportive of the increasingly expensive, risky project. When announcing the Department of Energy’s 2017 loan to Georgia Power, Secretary Rick Perry lauded the future of nuclear power as, coincidentally, “bright.” This despite the cancellation of the only other new nuclear project in the country, at SCANA’s V.C. Summer in neighboring South Carolina after more than $9 billion was spent. Tim Echols, a commissioner on Georgia’s Public Service Commission, has written articles and even traveled to Washington to lobby in an effort to ensure the reactors are completed.

Although both the federal and state governments celebrate the project’s continuance, it remains troubled. Construction began in 2009, with the two reactors expected to be operational by 2016 and 2017. Currently, the reactors are expected to be operational by 2022, meaning that the estimated construction schedule has doubled in the years since construction began. But, the construction schedule is not the only thing that has doubled. The $14 billion estimated cost of the project is now more than $27 billion.

Look no further than to Georgia’s neighboring state, South Carolina, to see what happens when costs and construction schedules explode. The V.C. Summer plant in South Carolina was approved along with Vogtle, but after repeated construction delays and cost overruns (sound familiar?), Santee Cooper, South Carolina’s largest public utility, abandoned the project. SCANA then had to cancel the project given they no longer had a partner. It is still unclear what Santee Cooper and SCANA’s future holds because of the financial damage caused by the failures at V.C. Summer.

And if all of this isn’t enough to make the project’s risks apparent, Georgia Power is involved in ongoing legal battles challenging the project’s continuance.

Despite all of the facts underscoring the risks of new nuclear projects, Georgia Power, Rick Perry, Tim Echols, and other proponents will say there is no chance that Vogtle will fail. Such assurances are backed by hope instead of facts. And, hope cannot repay billions of dollars if Vogtle goes the way of many other new nuclear proposals in the U.S. over the last 30 years.

If Georgia Power and its utility partners in Vogtle cannot repay their loans, the federal government will take a loss equal to the amount in default. The subsidy fees are meant to protect taxpayers should default occur. But Georgia Power’s zero dollars in down payments means taxpayers are entirely on the hook if the project fails. Fortunately, the federal government still has time to act before this last set of loans are finalized. It should increase the credit subsidy fee and force Georgia Power, perhaps for the first time in Vogtle’s troubled history, to put its money where its mouth is.

Mindy Goldstein is a clinical professor of law and director of the Turner Environmental Law Clinic at Emory University Law School. Jesse Sutz is a third-year law student at Emory Law School.

About the Author

Keep Reading

The Latest

Featured