A proposal to continue a 1 percent sales tax to pay for hundreds of new school projects in the Cobb County and Marietta school districts passed by nearly a 3-to-1 ratio Tuesday, unofficial results showed.

Officials in the two school districts want to collect about $860 million from the tax during a five-year period that begins in 2019. Cobb, the state’s second-largest public school district, would get about $797 million from the sales tax while Marietta’s school district would get about $62.5 million.

“I am so excited,” said Connie Jackson, president of the Cobb County Association of Educators. “This will allow us to expand and rebuild our schools…It is a testament to how much people believe in public schools.”

In another education-related vote Tuesday, Kerry Minervini edged past Patricia Echols in a Marietta school board race, unofficial results showed.

In other parts of metro Atlanta, voters were casting ballots for the first mayors and city council members of the new cities of South Fulton and Stonecrest.

Referendum supporters pushed for approval, saying much of the money from the tax would be collected from non Cobb County residents visiting popular attractions such as Six Flags and the new Atlanta Braves ballpark. They cited statistics that only about 10 percent of Cobb's budget goes to things such as school maintenance and school buses.

The Cobb Taxpayers Association criticized the plan after school board members added $40 million to the cost estimate. Opponents said that was included without proper vetting. Cobb officials say they added the $40 million in case they need more classrooms.

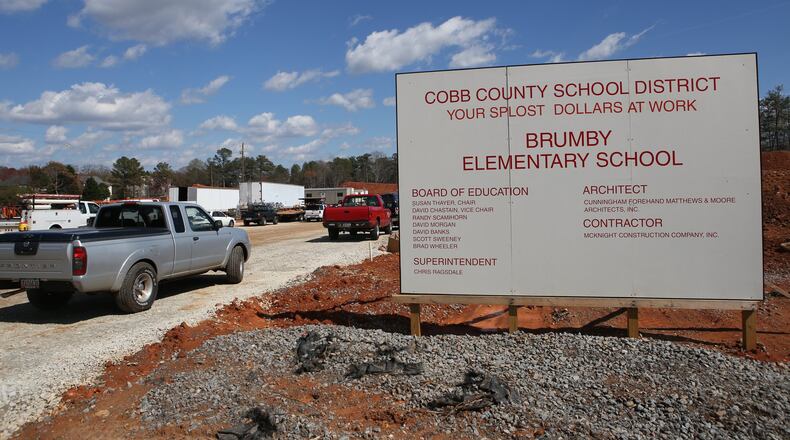

Each Cobb school is in line for some improvements under the proposed SPLOST, special purpose local option sales tax. The majority of the major improvements are in Mableton, Smyrna and south Cobb, where officials say they’re now seeing the fastest population growth.

Selling south Cobb residents on SPLOST wasn't easy. Many south Cobb parents and community leaders have been frustrated that several major SPLOST projects are under construction in more affluent parts of the county. A 2016 Atlanta Journal-Constitution investigation found nearly two-thirds of the schools built with sales tax funds in the past 20 years in Cobb opened to student bodies with affluent majorities.

Here are some key numbers about the referendum:

$859.5 million - the amount of money officials hope to collect from the tax.

$797 million - how much money would go to Cobb from the tax.

$62.5 million - how much money would go to Marietta from the tax.

$40 million - the amount of money Cobb school board members added to the proposed total to fund potential additional classroom space.

210 - the number of new classrooms that would be built in Cobb’s school district.

$4 million - how much Marietta proposes to spend on school buses.

About the Author

Keep Reading

The Latest

Featured