Roswell officials recently approved the city’s millage rate, used to calculate property tax bills, for fiscal year 2024 at 4.949 mills.

“This year’s property tax rate reflects the mayor and city council’s commitment to lowering the maintenance and operations portion of the millage rate to its lowest level since 2004,” said Mayor Kurt Wilson in a statement. “Your elected leadership is pleased to be able to do this to help offset a portion of property taxes that go toward starting to repay the bonds that were overwhelmingly approved by voters last November.”

City taxes represent approximately 15% of residents’ annual property tax bill. Taxes paid to Fulton County Schools and Fulton County account for approximately 54% and 31% respectively. Each government entity determines its own millage rates.

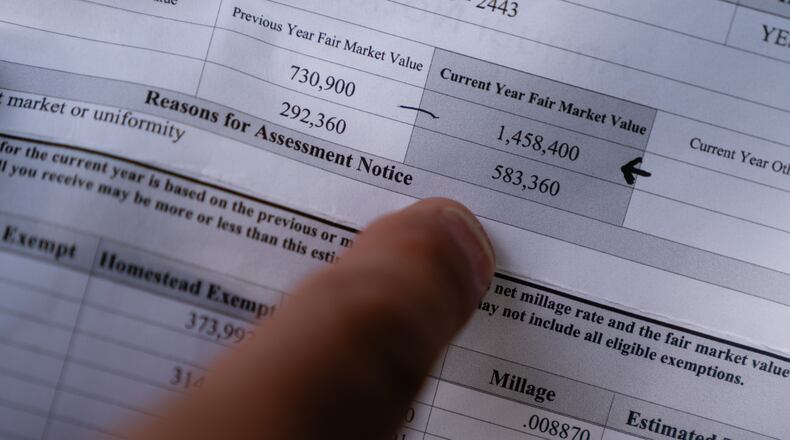

At Roswell’s 4.949 mills, a homeowner with a property valued at $575,000 (assessed value of $230,000 or 40%), will pay about $1,138.27 in property taxes to the city. Property owners with homestead exemptions will pay even less. Approximately $207 of the homeowner’s city property tax goes directly towards investments in the community through the bond program.

Additional information: www.Roswellgov.com/PropertyTaxInfo.

About the Author

Keep Reading

The Latest

Featured