In addition to mid-term elections, Milton voters will be able to vote Nov. 8 on whether to lower taxes for seniors.

Voters in the city will have three questions related to expanding the number of seniors who qualify for homestead tax exemptions.

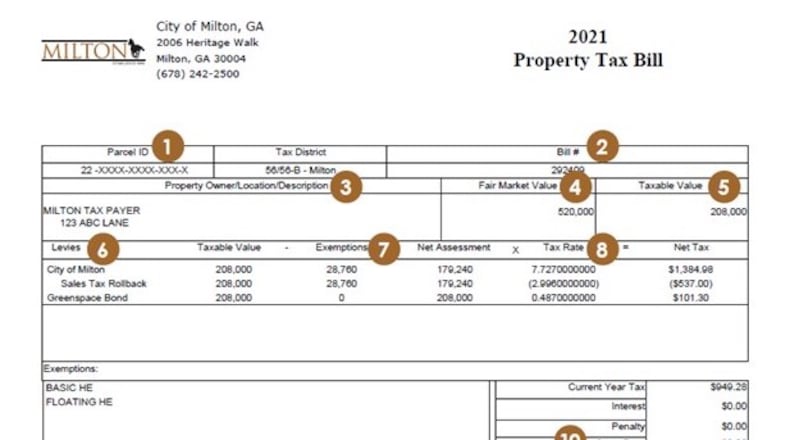

One will look at combining the senior basic and senior additional exemptions to increase the tax break from $15,000 to $25,000 for all seniors 65 and older.

A second question on the ballot will ask voters to raise the qualifying income threshold for homestead exemption for those 70 and older from $72,264 to $100,000. Voters will also decide if existing homeowners who currently qualify will keep the benefits they receive under the present exemption structure.

No property tax increase is planned for any senior homeowner.

Non-senior homeowners will continue to receive Milton’s basic homestead exemption of $15,000 off the assessed value plus a 3% floating homestead for maintenance and operations.

Details about Milton’s current property tax and all homestead exemption opportunities information: www.miltonga.gov/government/finance/property-taxes.

About the Author

Keep Reading

The Latest

Featured