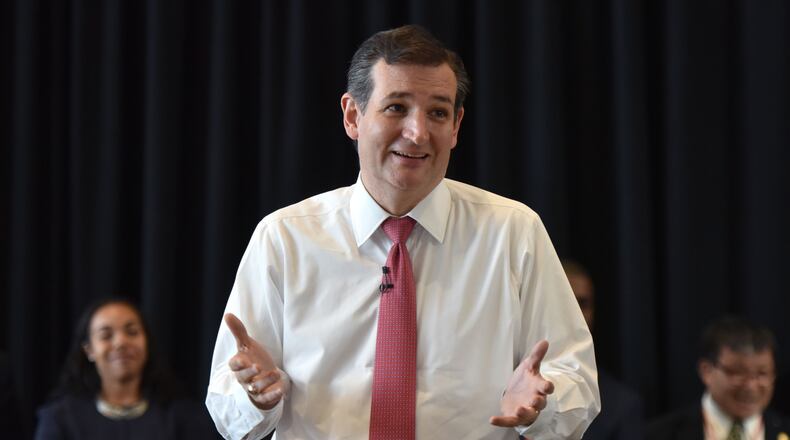

In last night's debate about the economy, which (unlike the CNBC debate last month ) had the benefit of sticking mostly to topics about the economy, there was one note in particular that appeared to strike viewers as odd. Judging by some of the reactions I saw on social media, Ted Cruz's support for "sound money" came across as tantamount to one of those gold advertisements you saw all the time on cable television a few years ago.

It needn't be that way, though Cruz needs to flesh out what he meant when he said, during his answer to a question about bailouts, that one of the Federal Reserve's main jobs should be "keeping our money tied to a stable level of gold." At other times he stuck to "sound money", although he also noted at one point that "we had a gold standard under Bretton Woods, we had it for about 170 years of our nation's history, and enjoyed booming economic growth and lower inflation than we have had with the Fed now."

That's not entirely true: There were some wild economic swings and periods of inflation prior to the demise of the Bretton Woods monetary system under Nixon, and inflation has remained lower than many of us expected as the Fed engaged in quantitative easing over the past several years. However, there is something to be said for sound money in general, even if it's unclear what exactly Cruz proposes to do about it. The "gold standard" has been employed in different ways in the past , and any return to something along the lines of it (for example, gold itself need not be the object to which exchange rates are tied) would have to be adapted to the way the world has changed.

Still, the Texas senator was right to name sound money as one of the three levers (along with taxes and regulation) that were used effectively by Coolidge during the 1920s, Kennedy during the '60s and Reagan during the '80s. Unless they've studied the economic history of the time, Americans my age and younger don't have a good grasp of just how devastatingly bad U.S. monetary policy was during the 1970s and early '80s. Inflation rates, which had averaged 1.7 percent a year during the Eisenhower, Kennedy and Johnson administrations, averaged 7.5 percent during the Nixon-Ford-Carter years and were in the double digits from 1979-81. That meant rapidly rising prices and mortgage rates in the mid- to high teens, all while the economy disproved the Keynesian theory that high inflation was part of a trade-off that brought us lower unemployment rates. Instead, we suffered from high levels of each in what came to be known as "stagflation."

That's not the situation now, but we do suffer in ways for the benign neglect of the dollar by our policy makers. If you care about income inequality, you should know the Fed's policy of keeping the dollar down is why your savings account (and similar tools, such as CDs) earns virtually nothing in the way of a return, while returns have been stronger for stocks and other riskier investments that middle- and low-income Americans generally don't own unless they have retirement accounts such as 401(k)s. And it's not as if stock-market returns, when adjusted for inflation, have been home runs for all but the very wealthiest Americans, either.

Some observers insist a weak dollar is vital if our manufacturers are to be competitive, but plenty of other factors, including energy prices, are at least as influential. Taking currency volatility out of the equation would force producers to focus on other ways they can be more competitive with rivals both foreign and domestic, which is better for growth in the long run. And getting back to lower energy prices, they are one reason inflation looks as tame as it does. A number of other household essentials have continued to grow more expensive in recent years, in large part because a dollar doesn't go as far as it once did. That's not good for growth.

So Cruz was right to argue that sound money would contribute to a stronger economy. But we need to know what, exactly, he would do to ensure we have it.

About the Author

The Latest

Featured