Opinion: Of the elite, by the elite, for the elite

The "major tax reform proposal" trotted out by the Trump administration Wednesday -- supposedly the product of weeks of grueling work by his top economic experts -- consisted of a one-page set of "principles" that could have been cribbed off a Heritage Foundation website in two minutes.

Most of the provisions on the wish list -- a slashing of the corporate tax rate, the elimination of the alternative minimum tax and the estate tax -- would benefit those already wealthy; for example, its passage into law would almost certainly produce a multi-billion-dollar bonanza for President Trump and his family.

Conversely, the cost to the federal treasury would be enormous. An early estimate by the Committee for a Responsible Federal Budget puts the lost-revenue figure at $5.5 trillion over the next decade, adding significantly to the national debt.

Nonetheless, Treasury Secretary Steve Mnuchin and others argued Wednesday that such changes are necessary to spur economic growth, suggesting that after-tax corporate profits are currently too low to encourage the necessary investment that leads to job growth.

Is that premise true? Have corporate after-tax profits fallen to such a degree that investors are no longer willing to risk their capital in return for the meager profits they would reap? A glance at the stock market would suggest not.

So does this:

The chart above from the Federal Reserve Bank in St. Louis shows us that in the past 15 years, corporate AFTER-TAX profits have almost quadrupled. Over the last 25 years, they have almost septupled. So if Mnuchin is correct, if higher after-tax corporate profits produce rampant growth, why aren't we already experiencing that economic utopia?

The answer is that some people already are.

Last year, the Congressional Budget Office released an analysis that it titled "Trends in Family Wealth, 1989 to 2013," and the data it contained were quite illuminating:

As the CBO put its findings:

"Between 1989 and 2013, wealth held by families in the top 10 percent of the distribution increased by 153 percent, whereas wealth held by families in the bottom half of the distribution declined by 19 percent."

And that's just the beginning. According to the CBO, the bottom 50 percent of American families shared just 3 percent of the nation's wealth in 1989, and those were the good ol' days. By 2013, the bottom 50 percent of Americans possessed just 1 percent of the nation's wealth, or basically the crumbs that had fallen from the table. If you do the math, that's an effective wealth redistribution from poorer Americans to the more wealthy of more than $2 trillion, and that did not occur because poorer Americans got lazy or spoiled. It happened because of systemic changes -- macro-economic and technological changes -- that are beyond the power of most individuals to buck.

Meanwhile, the share of national wealth held by the richest 10 percent rose from 67 percent to 76 percent, and the concentration was even greater among the wealthiest 1 percent. The CBO cites two different assessment methods: Under one approach, the share held by the wealthiest 1 percent rose from 31 to 37 percent. Under another, it rose from 28 percent in 1989 to 42 percent in 2012.

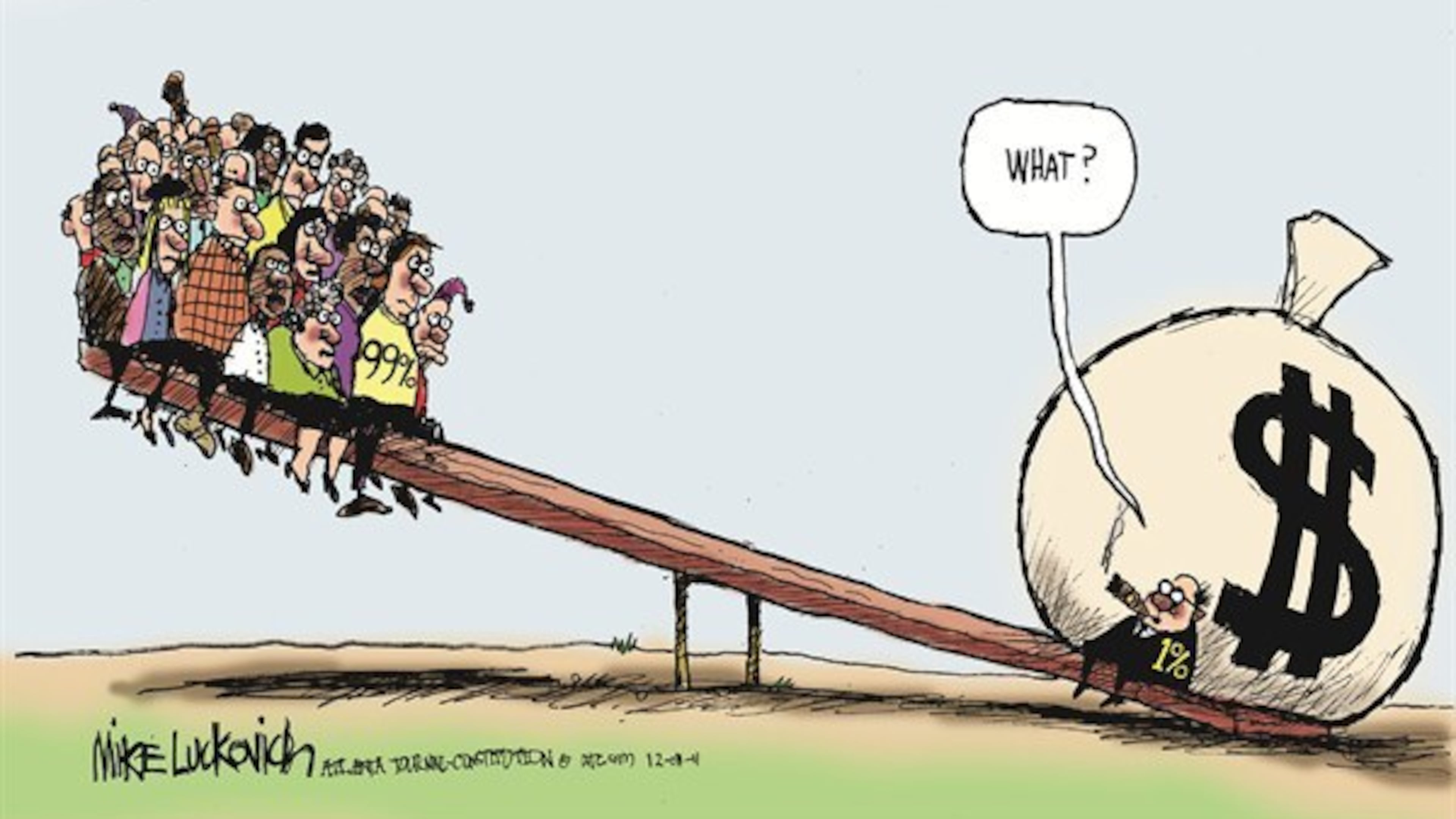

Think about that: If I told you that the richest 1 percent controls as much wealth as the bottom 50 percent of Americans combined, that might seem like a lot. The reality is much more harsh: The richest 1 percent controls 40 times as much wealth as the bottom 50 percent.

In some minds, we're not supposed to notice such things. To even point out the massive shift in wealth and income away from the poorest 50 percent of Americans toward those with already significant resources is to indulge in the politics of envy. But it's not envy to wonder how on earth you're going to pay to get your kid through college, or how you can afford to get the alternator fixed on your 2001 Accord so you can continue to get to your $35,000-a-year job.

Nor is it envy to marvel at a political culture that proposes massive cuts in services and support for those Americans struggling economically so that those already reaping immense benefits from the system can become even wealthier. That's not theoretical; it's playing out right in front of our eyes.