Breaking up with China cost Jim Howard a sizable chunk of his business.

The split wasn’t by choice, but triggered by government policy. His Mableton business, AHC Hardwood Group, had grown its exports of fine hardwoods to China to about $1 million a month. That crashed to less than $100,000 after China slapped tariffs of 5% to 25% on American wood in 2018 in retaliation for President Donald Trump’s tariffs on $360 billion of Chinese goods.

“This is the worst year we’ve had since probably 2012,” as the state was emerging from the Great Recession, Howard said.

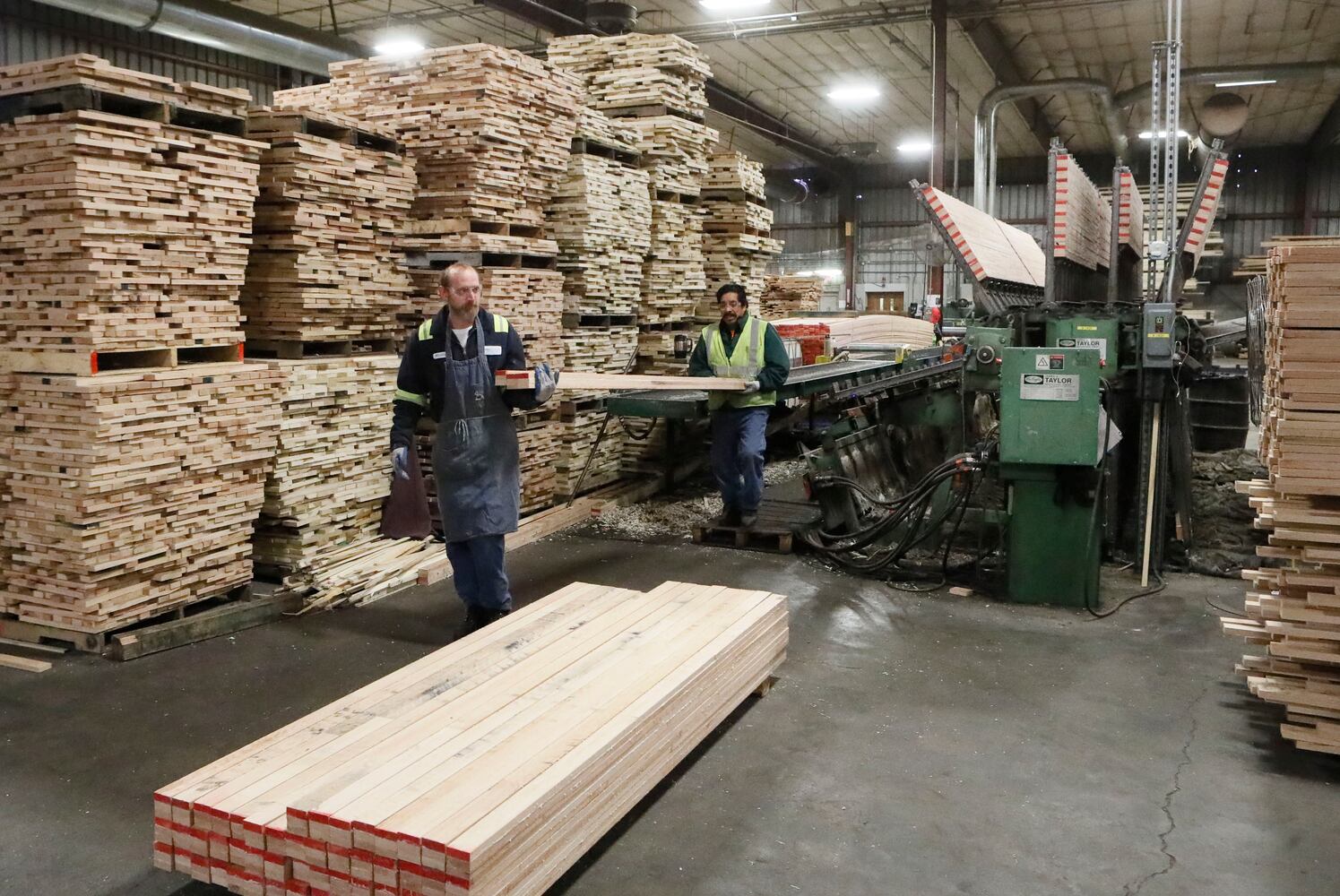

Georgia is a major player in softwood and hardwood, boasting more acres of forest than any other state east of the Mississippi and employing more than 50,000 workers. But the weight of the tariffs has cracked the industry, with some businesses laying off workers, freezing investments and losing millions of dollars in sales.

It’s been a double whammy for growers, sawmillers, buyers and exporters. The wood unsold to China is now flooding U.S. markets, depressing prices. For species popular in China like red oak, prices have dropped by about 40%.

The industry also hasn’t received federal or state government payouts to help cover tariff losses, unlike Georgia’s cotton, pecan and soybean farmers also hit by the trade war. Behind soybeans, lumber is the second-largest U.S. agricultural export to China.

The value of all forest products shipped from Georgia to China totaled $233 million in 2017. That plummeted to about $99 million from January to September of this year, according to the U.S. Department of Agriculture.

Woodmen are waiting for good news amid conflicting reports in recent weeks of a potential trade deal between the U.S. and China. But they’ve been waiting for a while and the ill effects are accumulating.

“The longer this goes on, we reach a point of no return,” said Andreas Villegas, president of the Georgia Forestry Association.

After the Great Recession, a China godsend

Wood is big business in Georgia. It pumped $3.8 billion in salaries into the state, according to a 2017 Georgia Tech study, and created a $21.3 billion impact on Georgia when totaling output, employment and ripple effects through suppliers and services the industry uses.

When the Great Recession 11 years ago hit Georgia’s wood industry hard, China helped it rebound.

As U.S. housing starts plummeted in 2008, pummeling the sale of softwood used in house framing, demand for new floors and furniture made from hardwoods tumbled. Also, new competitors such as vinyl plank flooring that looks like wood began nibbling away at the market.

China bought American softwood for construction and hardwoods for turning into products to sell back to the U.S. Then, China’s growing middle class began buying their own glistening floors or fine furniture. Now, from Kunming to Beijing, Chinese walk on red oak apartment floors and dine on tables of walnut or white oak that grew within a leaf-peeping drive from Atlanta.

Even as the U.S. housing market began to rebound, the real industry growth took place in wood sales to China. Before the tariffs hit, China was taking about 50% of all the top-grade hardwood lumber — used for consumer products such as cabinets and furniture — on the U.S. market. It was also taking a growing cut of the softwood industry.

Lumbermen say the beauty of the product is that it will never run out. Georgia has more growing wood on its soil than it did in the 1940s, and that amount is increasing every year.

Cogent Forest Products was one of many who set up a wood yard near Savannah for shipping pine logs to China in containers. The Chinese cut the logs into lumber for framing poured concrete. Rob Mantrop’s crew of eight Cogent workers was buying and shipping logs from local sawmills.

Then came the tariffs. The industrywide export of pine logs out of Savannah fell from $81 million in 2018 to zero this year.

“It has decimated the industry,” Mantrop said.

The log yard the company rented stands empty, the eight employees laid off in the summer of 2018. He said he knows more than a dozen others who have shut down similar operations.

U.S. hardwood exports to China, meanwhile, dropped between June 2018 and June 2019 by $794 million.

“That loss to China was more than our total exports to the European Union and all of Southeast Asia combined,” said Michael Snow, executive director of the American Hardwood Export Council.

Some in the industry warn of more shuttered businesses if the trade war continues much longer.

“I think by the first quarter (of 2020) we’ll see some going under,” said Craig Miller, vice president of Battle Lumber, whose massive operation in the tiny midstate town of Wadley can churn out 10 million board feet of Georgia hardwood in a year.

It was selling about 300 containers of Georgia hardwood to China every month, mostly red oak. That has dropped to about 70, he said.

Fears of long-term impact, even as many continue to support Trump

Battle Lumber has changed its business model to focus on providing industrial wood products for the U.S. market, such as railroad ties, and is hoping for increased sales to overseas markets such as India or Europe. But there’s no way to make up for the losses in sales to China.

Miller said the tariffs have probably hurt the hardwood industry more than the housing crash.

“We have about 425 employees. We will probably have to reduce that in the next month or so,” he added.

Jim Howard in Mableton has avoided layoffs by not filling empty positions and by no longer hiring temporary workers. About 22% of his business used to be in exports, the rest going to the U.S. About 6.5% is now exports.

He believes even if an end comes to the trade war the U.S. wood industry will take years to recover, if ever. Countries from South America to Russia are rushing in to fill the void left by the U.S. The erosion of the industry in Georgia is whittling away at the infrastructure here. Sawmills, logging companies, wood mills and yards will go under and find it tougher to return, Howard predicted.

The tariffs leave some feeling like the fall guys in the trade war. Selling their raw product to Chinese companies has nothing to do with disputes such as China requiring U.S. companies to transfer technology or the theft of intellectual property.

But, as in many rural areas, many woodmen still support Trump’s get-tough policy.

“I agree with Trump standing up to China,” said Battle Lumber’s Miller. “At some point in time, you had to address those problems. Unfortunately, we are on the bad end of the stick here.”

Nordeck Thompson, whose Tennessee company Thompson Appalachian Hardwoods does business in north Georgia, said most people in the business are finding it very hard to make money. But he’s also playing the long game.

“You don’t plant a crop that you harvest in 20 years without being an optimist,” Thompson said.

What’s Georgia’s foresty industry worth?*

Jobs 53,933**

Salaries $8.3 billion

Revenue generated from salaries, goods and related services $21.3 billion

Net revenue to the state $96.6 million

Georgia accounts for 21% of U.S. paper and pulp exports.

Georgia is #1 in U.S. wood pellet sales at $136 million

*Source: Georgia Tech’s 2017 Economic Benefits of the Forestry Industry in Georgia and Georgia Forestry Commission

**from logging and forest management to associated jobs such as making paper and bioenergy.

The story so far

University of Georgia economist Jeffrey Humphreys calls the trade war the strongest headwind the economy is facing. The Atlanta Journal-Constitution has checked in this year with Georgia industries, from farmers to makers of quartz countertops and boatbuilders to Home Depot to see how the tariffs are affecting their businesses.

About the Author

The Latest

Featured