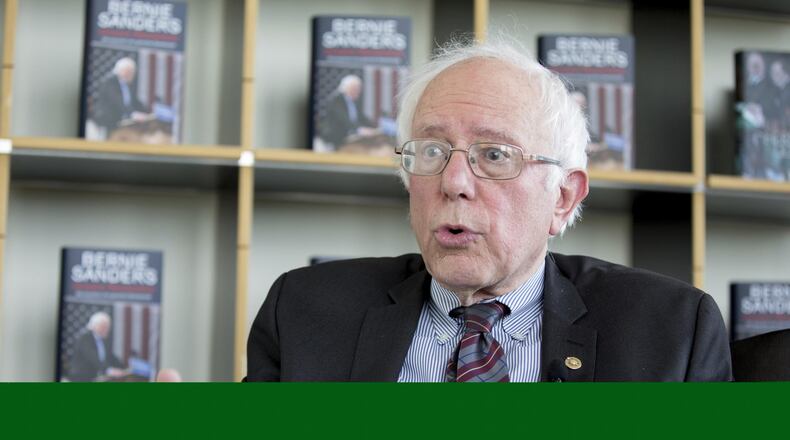

Sen. Bernie Sanders, I-Vt., called President Donald Trump’s budget a massive transfer of wealth from working families, the elderly, children, the sick and the poor to the top 1 percent.

“Why is it more important to give a $100 billion tax break to 3 of the wealthiest families than to feed, house and educate 15 million people?” Sanders tweeted May 25.

The accusation runs away with a flawed analysis of Trump’s tax plan.

Sanders' source is a report prepared by Democrats on the U.S. Senate Budget Committee. That report says the Walton family of Wal-Mart, Charles and David Koch of Koch Industries, and casino magnate Sheldon Adelson stand to gain $52 billion, $38 billion and $12 billion respectively in tax breaks under Trump's proposal, or $102 billion all together.

How? The rules for the estate tax allow a person to inherit almost $5.5 million tax free. Above that, Washington collects 40 percent. Senate Democrats took the total net worth of those three households, reduced it by the tax-exempt amount and assumed the remainder would be taxed at the 40 percent rate.

Experts said Sanders miscast Trump’s tax plan and the Democratic calculations are overly simple.

Roberton Williams, a fellow at the Brookings-Urban Institute Tax Policy Center, said Sanders is not fully capturing Trump’s proposal for the estate tax.

“Trump has proposed replacing the estate tax with a requirement that estates pay income tax on all of an estate’s unrealized capital gains,” Williams said. Unrealized capital gains are the profits made when an investment, such as a building or shares of stock, is sold.

“If a high-value estate had unrealized gains, it would pay income tax on those gains at the top rate of 20 percent rather than an estate tax at a 40 percent rate,” he said.

He gave an example: An estate worth $50 billion with $25 billion of unrealized gains would pay income tax of $5 billion under Trump’s plan — a lot less than the $20 billion that would be owed in today’s tax system, but “not zero.”

Sanders assumed those wealthy family members would pay nothing, and that’s not accurate.

Estates rarely pay the 40 percent estate tax rate. A slew of deductions including charitable bequests, among other loopholes, bring down the taxable value of the estate reduce the effective tax rate.

There’s also a big gap between the size of the estates the Democrats relied on and the size in the eyes of the IRS, said Kyle Pomerleau, director of federal projects at the right-leaning Tax Foundation.

The Democrats used estimates from Forbes magazine, and Pomerleau said by one estimate the actual number is about half that.

“And then according to the IRS, taxable estate is about 30 percent of gross estate,” he said. “Taking these together, taxable estate — what the IRS applies the 40 percent rate to — is about 15 percent of what is publicly reported on average.”

Pomerleau said by his estimate, the total value of the estate tax bill for those three families would be closer to $16 billion.

Williams at the Tax Policy Center agreed. Any person with a very large estate would bring on an estate tax lawyer to structure his or her estate in ways that would reduce estate tax. This means it is highly unlikely wealthy families would ever pay 40 percent tax on their wealth under the current estate tax law. Eliminating the estate tax thus would not save them 40 percent of their wealth relative to current law.

Trump’s budget also proposes other tax measures, including doing away with the alternate minimum tax, lowering the top individual tax rate from 39.6 percent to 35 percent, and repealing taxes on the wealthy that helped pay for the Affordable Care Act.

Our ruling

The three wealthy families Sanders had in mind would benefit handsomely under Trump's plan, but Sanders' office did not provide evidence that held up, and experts said the total would likely be less than $100 billion. We rate this claim Mostly False.

Says President Donald “Trump’s budget gives a $100 billion tax break to three of the wealthiest families.”

— Sen. Bernie Sanders, I-Vt., on Thursday, May 25, 2017 in a tweet

About the Author

The Latest

Featured