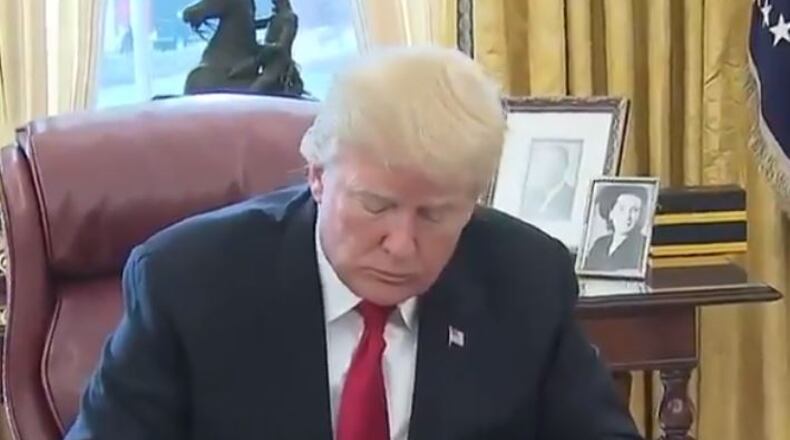

Delivering on a central campaign promise, President Donald Trump on Friday signed into law a sweeping Republican package of tax cuts for individuals and businesses, putting the exclamation point on a tumultuous first year in office, which saw him wait until just before Christmas for his most significant legislative accomplishment.

"The bottom line is that this is the biggest tax cuts and reforms in the history of our country," the President said to reporters gathered in the Oval Office.

Instead of a big signing ceremony with members of Congress beside him, the President opted to have a few top aides on hand, as he told reporters confidently that the new tax law would spur more economic growth and create new jobs.

"We're very proud of it. It's going to be a tremendous thing for the American people, it's going to be fantastic for the economy," Mr. Trump added.

Mr. Trump expressed confidence that polls would turn around on the tax bill matter, even as Republicans plan a big public relations push in 2018 to reinforce the income tax rate cuts for individuals.

"I think it's selling itself," the President added.

It was a much different scene back in October of 1986, when President Ronald Reagan signed into law the last big package of tax cuts and reforms, as he was surrounded by key Republicans and Democrats.

That law received 290 votes in the House and 73 in the Senate - this time, not one Democrat voted for the GOP plan.

"One thing you can say about this year, it was pretty partisan," Senate Majority Leader Mitch McConnell said at a news conference at the Capitol, just moments before the President signed the new tax law.

The signing ceremony came after a series of morning tweets in which the President jabbed at the news media, complaining that his accomplishments will be ignored in the press.

"Sadly, the Fake Mainstream Media will NEVER talk about our accomplishments in their end of year reviews," the President tweeted.

In Congress, GOP lawmakers were confident that the new tax law would benefit Republicans, who are facing polls that show Democrats with a large advantage heading into the 2018 midterm election year.

"The tax reform bill as a whole is going to bring consumer confidence up," said Rep. Barry Loudermilk (R-GA), as Republicans predicted more economic gains in 2018.

"Come February, when people are seeing more money in their bank account, I think they're going to see that less government is the right idea, not more," Loudermilk added, as GOP lawmakers echoed the President's focus on the tax bill.

"It's a huge issue, something that hasn't been done in thirty one years," said Rep. Dan Webster (R-FL).

"That is something to work on, ride on, and run on," Webster added.

As for what the Trump Administration and Congress might focus on in 2018, the President again hinted at a push on money for new roads and bridges.

Mr. Trump can ponder his next move from the warmth of Florida, as he left soon after signing the tax bill for his Mar-a-Lago retreat in Palm Beach.

The Congress returns to session on January 3. It was not immediately clear when the President would return to the nation's capital.

Some of the highlights of the GOP plan include:

+ Seven individual tax brackets of 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The current individual brackets are 10%, 15%, 25%, 28%, 33%, 35% and 39.6%.

Credit: Jamie Dupree

Credit: Jamie Dupree

+ Standard deduction almost doubled $6,350/$12,700 to $12,000/$24,000

+ State and local taxes change will only allow you to deduct up to $10,000 for sales, income and property taxes - this is a big change for those who itemize.

+ Mortgage interest deduction limit lowered to $750,000 from $1 million. No change for current mortgages (they are grandfathered in).

+ Zeroes out the individual mandate tax penalty in 2019 under the Obama health law - note the date - not in 2018. Still in effect next year.

+ Does not change tax exemption on reduced tuition awards for graduate students, and employer tuition aid at colleges and universities.

+ Alternative Minimum Tax lives on for individuals, but the exemption limit is increased.

+ Federal estate tax is not abolished, but the plan doubles the amount of the inheritance exemption.

+ Corporate tax rate lowered to 21% - original plan was 20%.

+ Almost all business tax changes are permanent in the GOP bill.

+ Almost all individual tax changes in the bill expire after 2025 (8 years).

If you want to read more about the details of the bill, this is the 570 page explanation that has been put out by Republicans in the Congress.

About the Author

The Latest

Featured