After weeks of very secret negotiations, Republican leaders filed a 146 page budget deal with the Obama Administration just before midnight on Monday night, pushing ahead with a plan that would boost spending for both the military and domestic programs while also finding ways to bring down costs of some entitlement programs.

The plan would set the following top line spending numbers for the federal government in terms of discretionary spending, which represents about a third of the federal budget:

Fiscal Year 2016 - $1.067 trillion

Fiscal Year 2017 - $1.070 trillion

Those figures represent an increase of just over $50 billion for FY 2016 and an extra $30 billion for FY 2017; that money would be divided evenly between the Pentagon and domestic spending.

After those two years, the budget caps would swing back down, consistent with a 2013 budget deal reached between the two parties:

Fiscal Year 2018 - $1.065 trillion

Fiscal Year 2019 - $1.092 trillion

Fiscal Year 2020 - $1.120 trillion

Fiscal Year 2021 - $1.146 trillion

The plan would also allow the debt ceiling to go up - through March of 2017 - before the Congress would have to address the issue again.

More conservative lawmakers and groups immediately rejected the plan.

"This budget and debt deal is being brokered by a lame duck speaker and a lame duck President," said the Heritage Foundation in an early morning statement.

"It's another 'govern by crisis' deal that doesn't reflect the will of the House but rather the will of the Speaker," said Rep. Justin Amash (R-MI).

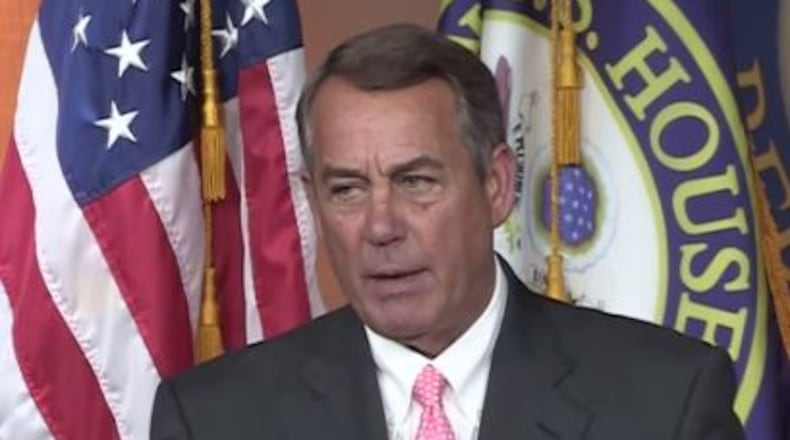

Amash was one of a group of more conservative Republicans in the House who had forced out Speaker Boehner - but even as Boehner's final days neared, he was actively negotiating this deal with President Obama in order to clear the decks for his successor, Paul Ryan.

In fact, the deal is much like one struck by Ryan two years ago, which was also rejected by Tea Party lawmakers - but they were unable to stop the plan.

Here is the section by section summary of the bill as provided by the House GOP leadership:

Title I – Budget Enforcement

Sec. 101. Amendments to the Balanced Budget and Emergency Deficit Control Act of 1985.

The limits on discretionary spending are established in section 251(c) of the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA). The limits are subdivided in each fiscal year through 2021 into two categories: revised security category and revised nonsecurity category. The revised security category is defined to be the National Defense budget function (Function 050) which includes funding for the Department of Defense, the nuclear weapons- related work of the Department of Energy, intelligence-related activities, and the national security elements of the Departments of Commerce, Justice, Homeland Security, and several independent agencies. The Department of Defense (including the intelligence programs) usually receives over 95 percent of the budget authority in this function. The revised nonsecurity category comprises discretionary spending not contained in the revised security category.

Subsection 101(a) amends section 251(c) of BBEDCA to increase the limits on discretionary spending for fiscal years 2016 and 2017. The revised levels for each category are shown in the table.

In addition to the limits on discretionary spending, section 251A of BBEDCA also includes a sequester of direct spending, the size of which interacts with the discretionary spending levels.

Subsection 101(b) provides for the implementation of the sequester of direct spending as if the amendments in subsection 101(a) had not been made. The President is required by law to implement the sequester of direct spending ordered on February 2, 2015 and the one in the Sequestration Preview Report for Fiscal Year 2017 as if the amendments in subsection 101(a) had not been made.

Subsection 101(c) reduces spending by $14 billion in fiscal year 2025 by requiring the President to sequester the same percentage of direct spending in 2025 as will be sequestered in 2021. It also replaces the arbitrary dips and increases in the Medicare sequester percentages in 2023 and 2024 with a flat two-percent rate as applies under current law in fiscal years 2016 through 2022.

Subsection 101(d) establishes minimum adjustments to the defense and non-defense caps for overseas contingency operations in fiscal years 2016 and 2017 providing certainty for two years on approximate OCO levels.

Sec. 102. Authority for fiscal year 2017 budget resolution in the Senate.

Subsection 102(a) authorizes in the Senate a congressional budget for fiscal year 2017. Subsection 102(b) provides that the chair of the Senate Committee on the Budget will submit after April 15 and no later than May 15, 2014 for publication in the Congressional Record allocations of budgetary resources for each congressional committee, aggregate spending and revenue levels, and levels of revenues and outlays for Social Security that will be enforceable as if included in a conference agreement on a budget resolution. Subsection 102(c) provides that the submission pursuant to subsection (b) may also include reserve funds adopted in the fiscal year 2016 budget resolution for fiscal year 2017 updated to cover the new budget window.

Subsection 102(d) provides that this section shall expire if a budget resolution conference report for fiscal year 2017 is agreed to by the House and the Senate.

Title II - Agriculture Sec. 201. Standard Reinsurance Agreement.

Section 201 amends the Federal Crop Insurance Act to require that the Standard Reinsurance Agreement be renegotiated no later than December 31, 2016 and at least once every five years thereafter. This section also establishes an 8.9 percent cap on the overall rate of return for insurance providers under the agreement. Currently, the negotiated overall rate of return is approximately 14.5 percent.

Title III – Commerce Sec. 301. Debt collection improvements.

Subsection 301(a) amends the Communications Act of 1934 to authorize the use of automated telephone equipment to call cellular telephones for the purpose of collecting debts owed to the

United States government. This subsection also authorizes the Federal Communications Commission to issue regulations to limit the number and duration of any such calls.

Subsection 301(b) requires the FCC to issue regulations to implement this section within 9 months of the date of enactment of the Bipartisan Budget Act of 2015.

Title IV – Strategic Petroleum Reserve

Sec. 401. Strategic Petroleum Reserve test drawdown and sale notification and definition change.

Subsection 401(a) amends section 161 of the Energy Policy Conservation Act (EPCA) to require DOE to notify Congress prior to any Strategic Petroleum Reserve test sale, with an exception for emergency drawdowns, and to submit a report following any sale. Subsection 401(b) amends section 3 of EPCA to include terrorism as a qualifying cause of severe energy disruption.

Sec. 402. Strategic Petroleum Reserve mission readiness optimization.

Section 402 requires DOE to conduct a strategic review of SPR and develop proposals related to its role in national policy, relevant legal authorities, configuration and performance, and long- term effectiveness.

Sec. 403. Strategic Petroleum Reserve drawdown and sale.

Subsection 403(a) authorizes the sale of 58 million barrels of oil from the Strategic Petroleum Reserve (SPR) from 2018-2025. Subsection 403(b) prohibits sales under subsection (a) if such sales would limit the ability of the SPR to meet its strategic purpose of preventing and reducing the adverse impacts of severe domestic energy supply interruptions. Subsection 403(c) requires the proceeds of the sale to be deposited in the General Fund of the treasury to reduce the deficit.

Sec. 404. Energy Security and Infrastructure Modernization Fund.

Subsection 404(a) establishes an Energy Security and Infrastructure Modernization Fund (Modernization Fund). Subsection 404(b) provides that the purpose of the Modernization Fund is to provide for the construction, maintenance, repair, and replacement of Strategic Petroleum Reserve facilities. Subsection 404(c) authorizes the sale (subject to approval in advance through the appropriations process) of up to $2 billion of oil from the SPR and for deposit of the proceeds of the sale in the Modernization Fund. It also prohibits sales under this authority if such sales would limit the ability of the SPR to meet its strategic purpose of preventing and reducing the adverse impacts of severe domestic energy supply interruptions. Subsection 404(d) establishes the authorized uses of the Modernization Fund balances for operational improvements to extend the useful life of SPR’s surface and subsurface infrastructure; maintenance of SPR cavern storage integrity; and addition of SPR infrastructure and facilities to

optimize the drawdown and incremental distribution capacity of the Strategic Petroleum Reserve. Subsection 404(e) authorizes up to $2 billion of sales under subsection 404(c) from 2017-2020. Subsection 404(f) requires the Secretary of Energy to provide detailed plans in the Department of Energy’s annual budget requests. Subsection 404(g) terminates the authority provided in subsection 404(c) after 2020.

Title V – Pensions Sec. 501. Single Employer Plan Annual Premium Rates.

Current law: Single-employer pension plans annually pay a fixed premium to the PBGC, which is indexed for inflation, and will be $64 per person in 2016. Single-employer plans also pay a variable rate premium, which is indexed to inflation and will equal $30 per $1000 of underfunding in 2016.

Provision: The single-employer fixed premium would be raised to $68 for 2017, $73 for 2018, and $78 for 2019, and then re-indexed for inflation. The variable rate premium would continue to be indexed for inflation, but would be increased by an additional $2 in 2017, an additional $3 in 2018, and an additional $3 in 2019.

Sec. 502. Pension Payment Acceleration.

Current law: The due date for premiums is generally the fifteenth day of the tenth full calendar month of the premium payment year.

Provision: The premium due date for plan years beginning in 2025 would be the fifteenth day of the ninth calendar month beginning on or after the first day of the premium payment year.

Sec. 503. Mortality Tables.

Current law: Private sector defined benefit pension plans generally must use mortality tables prescribed by the Treasury for purposes of calculating pension liabilities. Plans may apply to Treasury to use a separate mortality table. Plans qualify to use a separate table only if (1) the proposed table reflects the actual experience of the pension plan maintained by the plan sponsor and projected trends in general mortality experience, and (2) there are a sufficient number of plan participants, and the plan was maintained for a sufficient period of time to have credible information necessary for that purpose.

Provision: The determination of whether the plan has credible information shall be made in accordance with established actuarial credibility theory, which is materially different from the current rules. In addition, the plan may use tables that are adjusted from the Treasury tables if such adjustments are based on a plan’s experience.

Sec. 504. Extension of Current Funding Stabilization Percentages to 2018 and 2019.

Current Law: Single employer defined benefit pension plan liabilities may be valued by using either spot interest rates or by taking into account the interest rates on investment grade corporate bonds over the prior two years. Under MAP-21 (the 2012 highway bill) and HAFTA (the 2014 highway bill), interest rates for valuing liabilities in 2012-2017 are deemed not to vary more than ten percent from the average interest rates over the prior twenty-five years. That corridor increases by 5 percent per year through 2021, at which point it remains permanently at 30 percent, which has the effect of deferring companies’ deductible required pension contributions.

Provision: The corridor on interest rates would remain at ten percent through 2019. The corridor would increase by five percent per year through 2023, at which point the corridor would remain permanently at 30 percent. The provision would generally be effective for plan years beginning after December 31, 2015. This proposed reduction in required pension contributions would, purely at the discretion of employers that choose to take advantage of this pension funding relief, result in those employers having more taxable income (because the contributions that they elect to defer are tax-deductible when contributed). This is estimated to increase revenues as compared to the budget baseline. It is also estimated to result indirectly in increased Pension Benefit Guaranty Corporation (PBGC) premiums because employers that, purely at their discretion, choose to take advantage of this funding relief would have a larger base for purposes of computing the variable rate premium on underfunding.

Title VI – Health Care

SEC. 601. Maintaining 2016 Medicare Part B Premium and Deductible Levels Consistent With Actuarially Fair Rates.

In 2015, the monthly Part B premium rate is $104.90. Without Congressional action, the estimated monthly Part B premium in 2016 for beneficiaries not held harmless would be

$159.30. This policy would maintain the hold harmless provision in current law and prevent a dramatic premium increase on beneficiaries not held harmless. This policy accomplishes this by setting a new 2016 basic Part B premium for the beneficiaries not held harmless at $120, which is the amount the Part B premium would otherwise be for all beneficiaries in 2016 if the hold harmless provision in current law did not apply. To effectuate this policy, in 2016, there would be a loan of general revenue from the Federal Treasury to the Supplemental Medical Insurance (SMI) Trust Fund. To repay the loan, starting in 2016, beneficiaries not subject to the hold harmless would pay an additional $3 in their monthly Part B premium until the loan is repaid.

Medicare beneficiaries who currently pay higher income-related premiums would pay higher than $3, the amount of which would increase for beneficiaries in each higher-income bracket in proportion to income-related premiums under current law. If there is no cost of living adjustment increase for 2017, this provision would apply again.

SEC. 602. Applying Inflation Adjustment to Medicaid Generic Drug Inflationary Rebate.

Currently, single source and innovator multiple source drugs pay an additional rebate if the price of the drug has increased faster than inflation (CPI-U). The inflation-based rebate, however, does not apply to generic drugs. Section 602 would apply the inflation-based rebate currently paid on brand drugs to generic drugs.

SEC. 603. Treatment of New Off-Campus Outpatient Departments of a Provider

Section 603 would codify the Centers for Medicare & Medicaid Services (CMS) definition of provider-based (PBD) off-campus hospital outpatient departments (HOPDs) as those locations that are not on the main campus of a hospital and are located more 250 yards from the main campus. The section defines a “new” PBD HOPD as an entity that executed a CMS provider agreement [after the date of enactment]. Any PBD HOPD executing a provider agreement after the date of enactment would not be eligible for reimbursements from CMS’ Outpatient Prospective Payment System (PPS). New PBD HOPDs, as defined by this section, would be eligible for reimbursements from either the Ambulatory Surgical Center (ASC PPS) or the Medicare Physician Fee Schedule (PFS).

Sec. 611. Repeal of automatic enrollment requirement.

Section 611 repeals Section 18A of the Fair Labor Standards Act (29 U.S.C. 218a), as added by section 1511 of the Affordable Care Act. Section 1511 requires employers with more than 200 employees to automatically enroll new full-time equivalents into a qualifying health plan if offered by that employer, and to automatically continue enrollment of current employees.

Title IX - Judiciary Sec. 701. Civil monetary penalty inflation adjustments.

Section 701(a) establishes the short title for this section as the “Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015.” Section 701(b) amends the Federal Civil Penalties Inflation Adjustment Act of 1990 (28 U.S.C. 2461 note) to:

- Require all agencies with civil monetary penalties covered by the statute to update penalties based on their value in the last update prior to 1996 and the change in the CPI between that date and October 2015. The increase in penalties that results from this "catch up" calculation would be capped at 150% (so a penalty now set at $10,000 could not increase to more than $25,000).

- Require all agencies to adjust their civil monetary penalties annually based on changes in the CPI, using data from October of each

- Replace current rounding rules with a simple rule that penalties be rounded to the nearest

- Apply these provisions to the Occupational Safety and Health Act and civil penalties assessed under the Social Security

- Allow a Secretary of a covered agency to increase one or more penalties covered by these provisions by less than the new formula through a rulemaking only if the Secretary finds that increasing the penalty by the required amount will have a negative economic impact or that the social costs outweigh the benefits and the Director of the Office of Management and Budget concurs with this

- Speed implementation by:

- requiring OMB to issue guidance on how to implement the inflation provisions by January 31, 2016 and annually thereafter by December 15th;

- requiring agencies to publish the first adjustment in the penalties by at latest July 1, 2016 through Interim Final Rulemaking (specified in statute) to become effective by at latest August 1, 2016; and

- starting in January 2017, and annually thereafter, require agencies to publish annual updates by January 15th each year in the Federal Register (specified in statute). These annual inflationary adjustments would not require

- Improve oversight and agency compliance by (a) requiring agencies to include information about penalties and their adjustments in agency annual financial statements, and (b) calling on GAO to assess compliance with required inflation adjustments as part of its annual agency

Subsection 701(c) makes a conforming change to the Debt Collection Improvement Act of 1996 (28 U.S.C. 2461 note).

Sec. 702. Crime Victims Fund.

Section 802 rescinds and permanently cancels $1.5 billion from the Crime Victims Fund. This provision preserves adequate balances to meet programmatic funding needs for the foreseeable future.

Sec. 703. Assets Forfeiture Fund.

Section 703 rescinds and permanently cancels $746 million from the Department of Justice Asset Forfeiture Fund.

Title VIII – Social Security

Subtitle A: Ensuring Correct Payments and Reducing Fraud Sec. 811. Expansion of cooperative disability investigations units

Requires nationwide coverage by Cooperative Disability Investigations (CDI) units, jointly run by the Social Security Administration (SSA) and the Office of the Inspector General (OIG), and consisting of staff from local SSA offices, the OIG, State Disability Determination Services (DDS), and local law enforcement. CDI units generally investigate suspected fraud before benefits are awarded.

Sec. 812. Exclusion of certain medical sources of evidence

Prevents evidence submitted by unlicensed or sanctioned physicians and health care providers from being considered when determining disability. (Effective for determinations made on or after one year after enactment)

Sec. 813: New and stronger penalties

Creates a new specific felony for conspiracy to commit Social Security fraud, punishable by up to 5 years in prison, fines generally up to $250,000, or both. Increases the maximum felony penalty from 5 years to 10 years for individuals in positions of trust (including claimant representatives, doctors and other health care providers, translators, and current or former SSA employees) who use their specialized knowledge to defraud the SSA, in addition to fines (generally up to $250,000).

Increases the maximum Civil Monetary Penalty (CMP) that the SSA can levy against individuals in a position of trust from $5,000 to $7,500 for each false statement, representation, conversion, or omission the individual makes or causes to be made.

Disqualifies individuals from receiving benefits during a trial work period if they are assessed a CMP for fraudulently concealing work activity. (All provisions effective upon enactment)

Sec. 814. References to Social Security and Medicare in electronic communications

Clarifies that the prohibitions and penalties contained in Section 1140 of the Social Security Act, regarding the misuse of symbols, emblems, and names associated with Social Security and Medicare, also apply to electronic and Internet communications, and treats each Internet viewing as a separate offense. (Effective upon enactment)

Sec. 815. Change to cap adjustment authority

Increases the level of the cap adjustment spending for program integrity as allowed under the Budget Control Act. Additional funding totals $484 million FY 2017-2020. Expands the use of funds to include CDI units, Special Assistant United States Attorneys who prosecute Social Security fraud, and work-related continuing disability reviews.

Subtitle B: Promoting Opportunity for Disability Beneficiaries

Sec. 821. Temporary reauthorization of disability insurance demonstration project authority.

Reinstates the Social Security Administration’s demonstration authority through December 31, 2021 and requires all projects using the authority to terminate on December 31, 2022.

Sec. 822. Modification of demonstration project authority.

Updates requirements for the Congressional review period, under which the Commissioner must notify Congress in advance of any experiment or demonstration project conducted under this authority. Requires additional information to be sent to the Committee on Ways and Means and Committee on Finance prior to beginning. The proposal must now include a description of objectives, expected annual and total costs, start date, and end date. Specifies that participation in demonstration projects is voluntary and requires informed consent.

Sec. 823. Promoting opportunity demonstration project.

Requires the Social Security Administration to test the effect on beneficiary earnings of changing how earnings are treated for purpose of ongoing benefit eligibility. Under the demonstration, the existing “cash cliff” would be replaced with a benefit offset, under which the DI benefit would be reduced by $1 for every $2 of earnings in excess of a threshold. The SSA could test multiple thresholds at or below the current level of earnings that constitute a trial work month ($780 in 2015). Under the demonstration, there would be no trial work period and no extended period of eligibility, but beneficiaries could receive partial benefits if their earnings in a month exceeded the substantial gainful activity amount ($1,090 a month in 2015). In addition, the threshold amount could be adjusted upward to reflect an individual’s itemized Impairment Related Work Expenses. Once an individual’s benefit is fully offset, entitlement to benefits would end, but Medicare coverage would continue for 93 months.

Sec. 824. Use of electronic payroll data to improve program administration

Authorizes Social Security to obtain, with beneficiary consent, data on beneficiary earnings from payroll providers and other commercial sources of earnings data through a data exchange. Individuals for whom the SSA obtains earnings data from these sources would be exempt from the requirement to report their own earnings. The SSA would be required to publish regulations governing this process prior to implementation. (Effective one year after enactment)

Sec. 825. Treatment of earnings derived from services.

When a DI beneficiary works, the SSA must consider which month the income was earned in determining whether the individual’s earnings exceed the Substantial Gainful Activity amount. The SSA would be permitted to streamline the process of evaluating a beneficiary’s earnings by presuming that wages and salaries were earned when paid, unless information was available to the SSA that showed when the income was earned. Beneficiaries would receive a notification

when such presumption is made, and afforded an opportunity to provide additional wage information regarding when the services were performed. (Effective upon enactment)

Sec. 826. Electronic reporting of earnings.

Requires the SSA to permit DI beneficiaries to report their earnings via electronic means, including telephone and internet, similar to what is available to Supplemental Security Income recipients. (Effective not later than September 30, 2017)

Subtitle C: Protecting Social Security Benefits Sec. 831. Closure of unintended loopholes

Closes several loopholes in Social Security’s rules about deemed filing, dual entitlement, and benefit suspension in order to prevent individuals from obtaining larger benefits than Congress intended. (Effective for individuals who attain age 62 after 2015, with respect to dual entitlement and deemed filing; and effective for benefits payable beginning 6 months after enactment, with respect to benefit suspension.)

Sec. 832. Requirement for medical review.

In order to make an initial determination of disability, the Commissioner must make every reasonable effort to ensure that a qualified physician, psychiatrist or psychologist has completed the medical portion of the case review. (Effective for determinations made beginning one year after enactment)

Sec. 833. Reallocation of payroll tax revenue.

Reallocates to the Disability Insurance Trust Fund an additional 0.57 percentage points (for a total of 2.37 percentage points of the total combined 12.4 percent payroll tax) in 2016, 2017 and 2018. This would be sufficient to pay benefit until 2022, and the total rate would not change.

Sec. 834. Access to financial information for waivers and adjustments of recovery

When an individual requests waiver of an overpayment because they are without fault and are unable to repay the funds, the SSA would be permitted to verify their financial information using its Access to Financial Institutions system (which provides data on beneficiary financial accounts). (Effective for determinations made 3 months after enactment)

Subtitle C: Relieving Administrative Burdens and Miscellaneous Provisions Sec. 841. Interagency coordination to improve program administration.

Under current law, the Office of Personnel Management (OPM) must reduce disability payments made to a Federal Employee Retirement System (FERS) annuitant who also receives

Social Security disability benefits. In some cases, OPM pays the FERS annuity before the SSA has determined whether the annuitant is also entitled to Social Security disability, resulting in a FERS overpayment. SSA would be permitted to repay OPM the amount of overpaid FERS benefits if an individual is found eligible for DI and is entitled to an award of past-due benefits, and deduct this overpaid amount from the past-due Social Security payment. This shall apply to past-due disability insurance benefits payable 1 year after enactment.

Sec. 842. Elimination of quinquennial determinations relating to wage credits for military service prior to 1957.

Eliminates the requirement that the SSA make quinquennial determinations for pre-1957 military service wage credits after the 2010 determination; the trust funds have been reimbursed for all costs attributable to granting these wage credits.

Sec. 843. Certification of benefits payable to a divorced spouse of a railroad worker to the Railroad Retirement Board.

Adds divorced spouses to the list of beneficiaries whose information is certified electronically.

Sec. 844. Technical amendments to eliminate obsolete provisions.

Technical change to remove subsections 226(j) and 226A(c) which are obsolete.

Sec. 845. Reporting requirements to Congress.

Requires the SSA to report on:

- Fraud Prevention Activities and Improper Payments

- Work-Related Continuing Disability Reviews

- Overpayment Waivers

Sec. 846. Expedited examination of Administrative Law Judges

SSA hires new ALJs through the Office of Personnel Management, which holds periodic examinations for potential ALJ candidates. SSA would be allowed to request additional examinations for Administrative Law Judges (ALJs) when the need arises.

Title IX – Temporary Extension of Public Debt Limit Sec. 901. Temporary extension of public debt limit.

Subsection 901(a) provides for the temporary suspension of the limit on public debt through March 15, 2017. Subsection 901(b) further provides that on March 16, the public debt limit will be increased, but only to the extent that: (1) the face amount of obligations issued and the face amount of obligations whose principal and interest are guaranteed by the federal government (except guaranteed obligations held by the Secretary of the Treasury) outstanding on March 15,

2017, exceeds (2) the face amount of such obligations outstanding on the date of enactment of this Act.

Sec. 902. Restoring Congressional Authority Over the National Debt.

Subsection 902(a) limits the adjustment under section 901(b) by prohibiting an obligation from being taken into account unless its issuance was necessary to fund a commitment incurred by the federal government that required payment before March 16, 2017.

Subsection 902(b) prohibits the Secretary of the Treasury from abusing the suspension of the debt ceiling to build up cash balances above normal operating balances.

Title X – Spectrum

Sec. 1004. Identification, Reallocation, and Auction of Federal Spectrum.

This section requires the NTIA to identify 30 MHz of spectrum below 3 GHz (excluding 1675- 1695 MHz) by 2022 in preparation for an auction by the FCC no later than July 1, 2024.

Requires the FCC to hold said auction.

Sec. 1005. Additional Uses of Spectrum Relocation Fund.

This section expands the eligible uses of the Spectrum Relocation Fund to include research and development of spectrum technologies and systems to improve government spectrum efficiency. It also allocates $500 million for such purposes and includes ongoing funding of 10% of funds deposited in the SRF. This funding will increase the ability of the Federal government to identify opportunities for spectrum reallocation and sharing with commercial systems.

Entities requesting funds from OMB must submit a plan to the technical panel established under the Middle Class Tax Relief and Job Creation Act of 2012 in order to make a determination whether the plan is likely to produce tangible positive results.

Sec. 1006. Plans for Auction of Certain Spectrum.

Establishes a series of reports from the FCC to Congress detailing new opportunities to reallocate spectrum from government to commercial or shared use.

Sec. 1007. FCC Auction Authority.

Extends expiring FCC auction authority from 2022 to 2025 for the specific spectrum identified under Section 1004.

Sec. 1008. Report to Congress on Rules Changes Relating to 3550-3650 MHz Spectrum.

Requires a report to Congress on the efficacy of the Spectrum Access System rules being implemented in the 3650-3750 MHz band to enable sharing between licensed, unlicensed, and government incumbents.

Title XI – Revenue Provisions Related to Tax Compliance Sec. 1101. Partnership Audits and Adjustments.

Three different regimes currently exist for auditing partnerships. For partnerships with 10 or fewer partners, the IRS generally applies the audit procedures for individual taxpayers, auditing the partnership and each partner separately. For most large partnerships with more than 10 partners, the IRS conducts a single administrative proceeding (under the so-called TEFRA rules, which were adopted as part of the Tax Equity and Fiscal Responsibility Act of 1982) to resolve audit issues regarding partnership items that are more appropriately determined at the partnership level than at the partner level. Under the TEFRA rules, once the audit is completed and the resulting adjustments are determined, the IRS must recalculate the tax liability of each partner in the partnership for the particular audit year.

A third audit regime applies to partnerships with 100 or more partners that elect to be treated as Electing Large Partnerships (ELPs) for reporting and audit purposes. A distinguishing feature of the ELP audit rules is that unlike the TEFRA partnership audit rules, partnership adjustments generally flow through to the partners for the year in which the adjustment takes effect, rather than the year under audit. As a result, the current-year partners’ share of current-year partnership items of income, gains, losses, deductions, or credits are adjusted to reflect partnership adjustments relating to a prior-year audit that take effect in the current year. The adjustments generally do not affect prior-year returns of any partners (except in the case of changes to any partner’s distributive share).

Under the provision, the current TEFRA and ELP rules would be repealed, and the partnership audit rules would be streamlined into a single set of rules for auditing partnerships and their partners at the partnership level. Similar to the current TEFRA rule excluding small partnerships, the provision would permit partnerships with 100 or fewer qualifying partners to opt out of the new rules, in which case the partnership and partners would be audited under the general rules applicable to individual taxpayers.

Under the streamlined audit approach, the IRS would examine the partnership’s items of income, gain, loss, deduction, credit and partners’ distributive shares for a particular year of the partnership (the “reviewed year”). Any adjustments would be taken into account by the partnership (not the individual partners) in the year that the audit or any judicial review is

completed (the “adjustment year”). Partners would not be subject to joint and several liability for any liability determined at the partnership level. Partnerships would have the option of demonstrating that the adjustment would be lower if it were based on certain partner-level information from the reviewed year rather than imputed amounts determined solely on the partnership’s information in such year. This information could include amended returns of partners opting to file, the tax rates applicable to specific types of partners (e.g., individuals, corporations, tax-exempt organizations), and the type of income subject to the adjustment (e.g., ordinary income, dividends, capital gains). As an alternative to taking the adjustment into account at the partnership level, a partnership would be permitted to issue adjusted information returns (i.e., adjusted Form K-1s) to the reviewed year partners, in which case those partners would take the adjustment into account on their individual returns in the adjustment year through a simplified amended-return process. As a result, partnerships generally would no longer issue amended Form K-1s after the partnership return is filed, but instead would use the adjusted Form K-1 process.

A partnership would also have the option of initiating an adjustment for a reviewed year, such as when it believes additional payment is due or an overpayment was made, with the adjustment taken into account in the adjustment year. The partnership generally would be permitted to take the adjustment into account at the partnership level or issue adjusted information returns to each reviewed-year partner. The provision would be delayed for two years, so that it applies to returns filed for partnership tax years beginning after 2017.

Sec. 1102. Partnership Interests Created By Gift.

A partnership generally is an unincorporated organization in which the parties (typically referred to as partners) have joined together with the purpose of conducting an active trade or business. A person also may be recognized as a partner if capital is a material income-producing factor, whether such interest was obtained by purchase or by gift. Congress intended this rule to clarify that a family member who receives via gift a capital interest in a partnership, where capital is a material income-producing factor, should be respected as a partner in the partnership and should be taxed on the income from that partnership. Some taxpayers have argued that this family partnership rule provides an alternative test for determining who is a partner without regard to how the term is generally defined in the partnership tax rules. Thus, they assert that if a partner holds a capital interest in a partnership, the partnership must be respected regardless of whether the parties have demonstrated that they joined together to conduct an active trade or business.

The provision would clarify that Congress did not intend for the family partnership rules to provide an alternative test for whether a person is a partner in a partnership. The determination of whether the owner of a capital interest is a partner would be made under the generally applicable rules defining a partnership and a partner. In addition, the family partnership rules would be clarified to provide that a person is treated as a partner in a partnership in which capital is a material income-producing factor whether such interest was obtained by purchase or gift and regardless of whether such interest was acquired from a

family member. The rule, therefore, is a general rule about who should be recognized as a partner.

Title XII – Designation of Small House Rotunda Sec. 1201. Designating Small House Rotunda as “Freedom Foyer”.

This section designates the first floor area of the House of Representatives wing of the U.S. Capitol known as the small House rotunda as “Freedom Foyer.” Busts of Winston Churchill, Lajos Kossuth, and Vaclav Havel are on display in the Freedom Foyer.

About the Author

The Latest

Featured