After First Liberty collapse, Raffensperger pushes for fraud-fighting powers

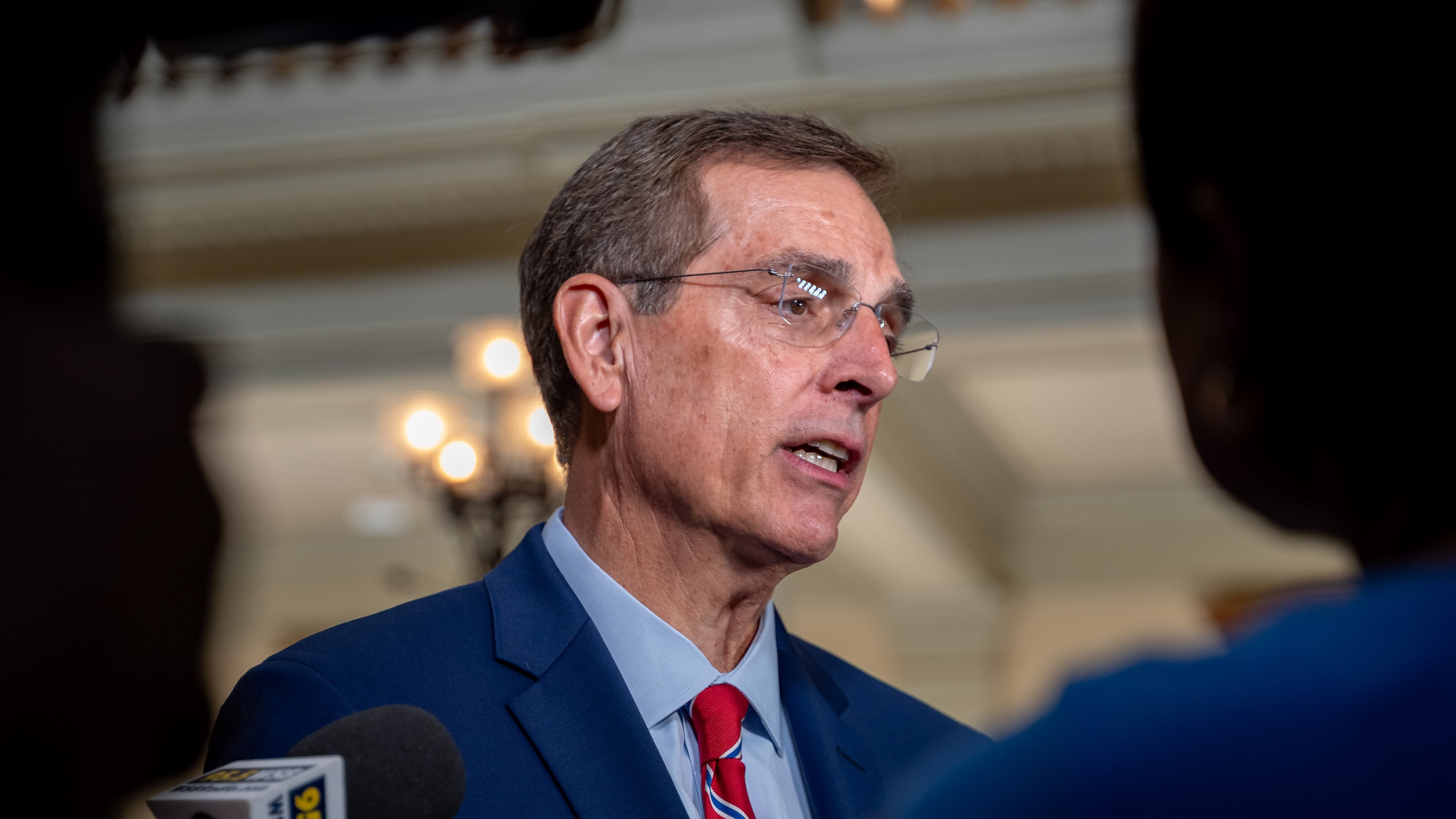

As investors reel from the collapse of Newnan-based First Liberty Building & Loan in an alleged $140 million Ponzi scheme, Georgia Secretary of State Brad Raffensperger is pushing for more authority for his office to root out financial fraudsters and recover money for victims.

In an opinion piece published in The Atlanta Journal-Constitution on Sunday, Raffensperger said Georgia’s securities division, a unit within his office, “currently lacks the tools and authority to proactively stop schemes like this or to move quickly on behalf of victims.”

His office, he added, has “limited enforcement power in a state where financial fraud can too easily take root and too slowly be punished.”

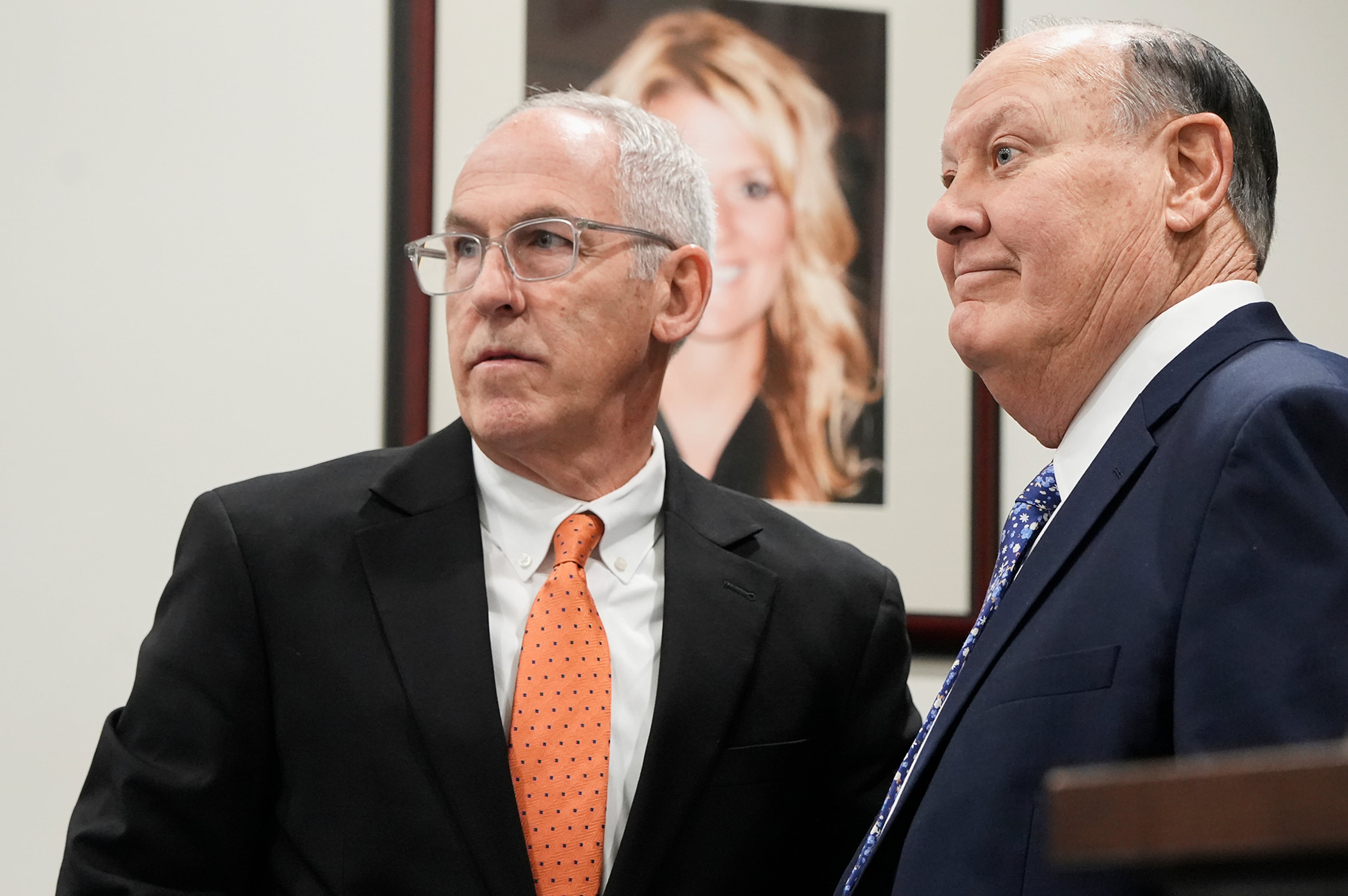

The U.S. Securities and Exchange Commission has accused First Liberty founder Brant Frost IV in a lawsuit of orchestrating a $140 million Ponzi scheme that funneled millions to enrich the family and boost conservative causes. Frost IV has publicly apologized and urged investors to work with a court-ordered receiver who is working to recoup money for investors.

In an interview, Raffensperger said he is already working with lawmakers to build support for the proposal.

“This is financial fraud. These are people who have worked all their lives, and all of a sudden it’s gone,” he said, adding that Georgia must “shore up” its regulatory system to prevent future abuses.

Raffensperger’s call for more anti-fraud powers comes after the AJC reported that First Liberty operated within gaps in state law that allowed some lenders to operate without scrutiny, and sidestepped laws that would require it to register investments it was selling with the state.

His office regulates Georgia’s securities market and enforces the state Securities Act. But Georgia’s securities division does so with a staff of just 10 investigators compared to 50 in similarly sized states.

A bill to expand the state’s enforcement powers and give state officials more power to recover stolen funds fell short in the most recent legislative session.

But Raffensperger, who is widely seen as a potential 2026 candidate for governor, said he will push next year for even broader measures. His proposals include stronger penalties to deter fraud, authority to appoint special enforcement attorneys, more authority to recover stolen funds and increased investigative resources.

“We remain committed to working side by side with the General Assembly to deliver the protections Georgians deserve,” he wrote.

Experts say Georgia lags far behind other states. Andrew Jennings, an Emory University law professor who studies white-collar crime, said in an interview that the Alabama Securities Commission is the “crown jewel” of state regulators. The independent agency has its own law enforcement powers and more than 50 employees solely focused on investment issues, Jennings said.

Jennings said in written comments Sunday Raffensperger’s calls for more enforcement capabilities in Georgia “tick important boxes.” He called it “critical” to expand personnel with funding to attract highly skilled investigators and lawyers.

Jennings also said other states have used a system similar to special enforcement attorneys, with securities lawyers from the state agency available to help local district attorneys and law enforcement navigate complex financial frauds in their jurisdictions.

“Although the SEC gets the national headlines, state regulators are the Main Street cops on the securities beat,” Jennings added. “When they’re properly resourced and empowered, they’re well positioned to stop a local investment fraud — such as what’s alleged in the First Liberty case — before it claims more victims.”

Raffensperger’s office has been investigating First Liberty since its collapse. He has urged lawmakers to return campaign donations from the firm’s executives, saying roughly $300,000 has already gone back to the receiver. Investigators have interviewed about 150 victims so far, he said.

Filed in early July, the SEC complaint placed the number of potential victims at about 300. But in the interview with the AJC, Raffensperger estimated as many as 500 people may have been affected.

In mid-August, the office issued a new round of subpoenas to First Liberty executives and a politically connected financial adviser, signaling a widening probe. Other subpoenas recently went out to a national investment firm and cryptocurrency company, officials said.

“It’s all hands on deck. And we’re continuing to issue subpoenas, because each one we get back yields more information. And then that pulls in another company,” he said. “We’re following the money.”