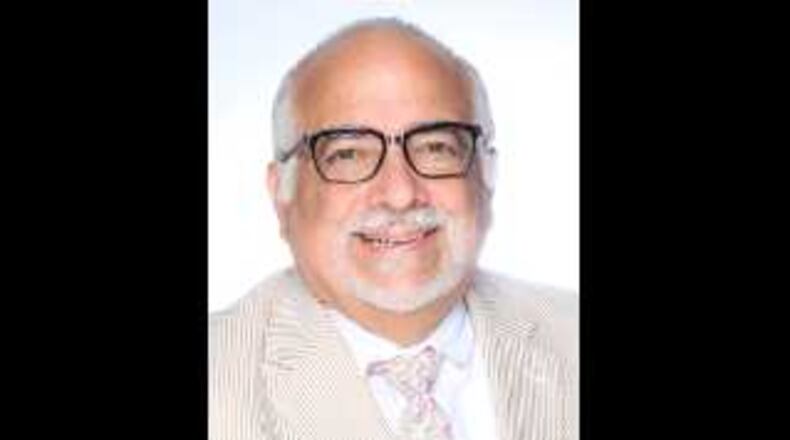

Robert Morales, who took over the DeKalb County School District's financial oversight amid concerns about missed financial audits and public questions over spending, is no longer with the school district.

District officials said Morales’ last day as interim chief financial officer was March 18, a week after the district announced that schools would close to help curb the coronavirus’ spread.

He had been with the district just three months.

“We thank him for his service and contribution to the district,” a spokeswoman said.

District officials did not give a reason for Morales’ departure, or mention who would replace him.

Morales, who retired from Fulton County Schools at the end of the 2018-2019 school year, replaced longtime Chief Financial Officer Michael Bell, who left the district in December. Morales was immediately praised by DeKalb County School District officials for his explanation of resources and plans to shore up the district's general fund balance, used as a rainy-day fund. He also was praised for helping turn around two financial audits submitted to the state in late December, including information for a 2018 financial audit that was due the previous year.

Early in his tenure, he explained to board members at a retreat that a software integration system would cost them about $5 million more than originally expected, mostly due to several leadership changes and having to retrain people in the process.

Morales also was working to re-establish a credit rating after Moody's Credit Service withdrew the district's rating for not having financial documents available from 2018.

“Upon taking the role in November, the interim superintendent immediately formed a team to implement a corrective action plan and submit the requested financial information as quickly as possible,” the district said when Moody’s announced the rating withdrawal.

When the audits are complete, district officials said they will share the information with Moody’s, which is expected to then reassign a credit rating. When Moody’s announced it was placing the district “on review with direction uncertain” in January, officials were still toying with the idea of a general obligation bond to seek tax funds pay for capital project cost overruns and projects not covered under the district’s Education-Special Purpose Local Option Sales Tax program.

About the Author