Some companies offer paid help with taxes. County officials say it’s free.

Editor’s note: This story has been updated to correct the number of properties Ownwell represents in Georgia and clarify what types of services the company provides.

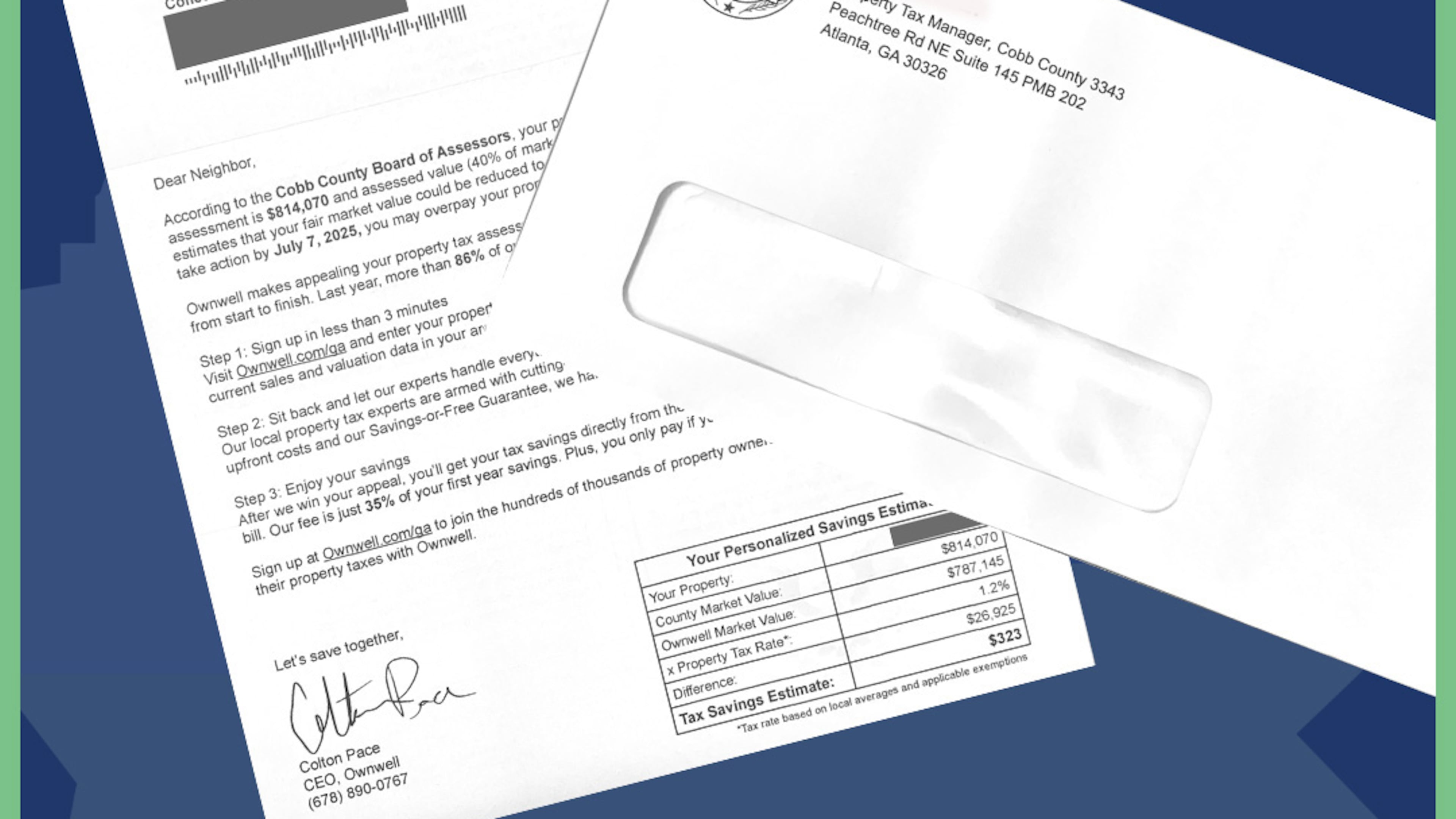

In June, multiple mailers addressed “Dear Neighbor” started landing in mailboxes around Georgia, offering help for a fee with appealing property taxes.

It wasn’t long before the phones at metro Atlanta tax commissioners’ offices began ringing more than usual. Confused residents were calling in, and they wanted answers.

As a result, tax commissioners in Cobb, Fulton and DeKalb counties said they felt they had to inform the public that residents could get those services from the county — for free.

“We are trying to reinforce and get the word out that these are services that taxpayers, homeowners, can receive at no cost just by visiting the tax office,” Cobb Tax Commissioner Carla Jackson told The Atlanta Journal-Constitution this month.

Even officials were not immune from the advertisements.

Dante Handel, the associate director of governmental affairs for the Association County Commissioners of Georgia, received mailers from the company Ownwell offering services to file tax appeals. The Cobb resident chose to ignore them.

“In my role, I work with this stuff a lot more than your average citizen,” Handel said. “If I’d wanted to appeal, I would just do it myself instead of going through an outside company.”

Angela Walton, the DeKalb Tax Commissioner’s Office’s communications manager, said the calls about Ownwell started around June 9, shortly after assessment notices went out from the property appraisal department. Those notices typically start the appeal process.

Commissioners reported an increase in confused calls from citizens inquiring about Ownwell’s legitimacy, noting that the mailers the company sent out look like official county documents.

Ownwell said its goal is simply to provide a service: helping homeowners save time.

“There’s always the option to self-appeal, and every state has that option,” Eleanor Bonner, a representative for Ownwell, said in a statement to the AJC. “Ownwell has a pretty strong success rate, and it mostly just takes all the work out of it.”

The company said it takes a 35% fee if the appeal is successful. It launched in Georgia in 2022 and currently represents more than 50,000 properties in the state, Ownwell said in its statement.

Fulton County Chief Appraiser Roderick Conley said Ownwell is responsible for about 25% of the residential appeals filed in his county.

“Mr. Conley has expressed concerns to the company about some of their business practices (particularly correspondence that may appear to be official and filings that appear to duplicate those made by property owners),” Jim Gaines, public affairs manager for Fulton, wrote in a statement to the AJC. “He has also discussed their practices with chief appraisers from other counties.”

Ownwell declined to comment on concerns about their letters’ similar appearance to official documents.

The Cobb Tax Commissioner’s Office said other companies have also offered tax appeal assistance to citizens over the years.

To raise awareness, Jackson’s office created a social media campaign warning residents about third-party companies offering assistance with appealing property taxes. The message’s headline is “Don’t Be Fooled by Solicitors and Junk Mail!” The post is accompanied by a graphic of a mailer and images of the county seal.

“The point of our social media post is, not to begrudge this company in particular or any company, but just to let the citizens know that Cobb County doesn’t charge a fee for services such as appealing their values, filing a homestead exemption application, or even making a claim for excess funds,” Jackson said.

She said she encourages residents to reach out to her office with concerns or questions and to beware about what they are paying for.

Ownwell said it takes the headache out of tax appeals. The company’s website touts its “deep understanding of local tax laws” and market data, which it says gives homeowners “the best chance of securing a favorable outcome” on appeals.

“Our mailer makes no claim that the county charges for the appeal process,” Ownwell said in its statement. “Homeowners always have the opportunity to self-appeal through their local office, but property tax services exist because property tax law is typically overly complicated and time-consuming for the average person.”