A citizen's group on Wednesday night pressed Hapeville officials to remove Ruth Barr from office amid allegations that she preyed on her tax clients and may have defrauded the state of millions.

The call for her removal from the council comes as the Georgia Department of Revenue is investigating Barr following stories in the Atlanta Journal-Constitution/Channel 2 Action News investigation that revealed a trail of her victims and allegations of fraud.

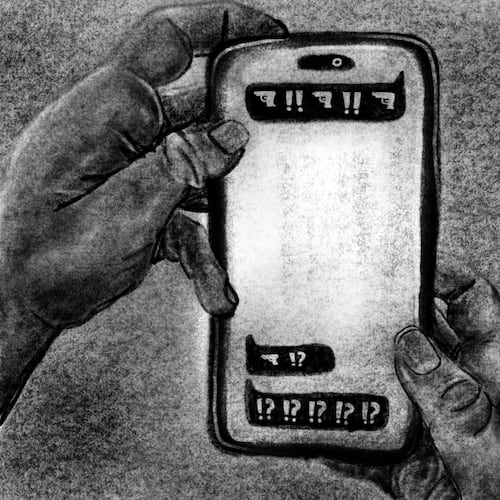

On Wednesday, the AJC/Channel 2 reported how Barr, whose company prepares thousands of people's tax returns each year, targeted firefighters and public safety workers. Scores of them now could face back taxes and penalties.

"Ms. Barr's behavior was that of predator, preying on her innocent clients," said Mickie Williams, president of Hapeville Community Coalition.

Credit: Brad Schrade

Credit: Brad Schrade

State tax agents raided Barr's business May 6 and removed thousands of tax files in what they are describing as one of the largest tax preparer fraud investigations the agency has ever undertaken. Agents are reviewing $7.6 million in refunds covering 7,704 taxpayers and 11,404 returns that Barr's business, B & B Accounting and Tax Services, prepared the past three years. An initial audit sample found as many as 80 percent appear suspicious.

"Her actions have shocked the public conscience and tarnished the city's reputation," Williams told the five-member council on Wednesday. She asked Barr to resign.

Barr initially had no comment to reporters before Wednesday's meeting, but later denied wrongdoing.

"I've been in business 50-something years," Barr said. "I'm not in business that long by lying."

Barr's attorney, Steve Adkins, who is representing her in a criminal case in Gwinnett County, said his client is not ready to resign.

“With regard to the public safety employees she doesn’t victimize them she specializes in them,” he said. “She simply knows and utilizes a lot more valid deductions for them than most accountants based on simple criteria such as whether they work overtime.”

About the Author

Keep Reading

The Latest

Featured