Opinion: We are urging Georgia students to attend college while making it harder for them to do so

Jessica Cooke was a lecturer with the English Department at the University of North Georgia. She recently resigned her position to protest the ongoing tuition increase in Georgia, including a 5 percent tuition hike at UNG.

In a note to her students, she explained:

That's not fair, and that's not the higher education system I signed up to work in.

In this essay, Cooke focuses on the impact of rising tuition and crushing college debt on one of her students, a young woman who delayed college and could not apply for HOPE. ( From state website : "Students are only eligible to receive the HOPE Scholarship until seven years from the date of the student's high school graduation, home study completion, or successful GED test.")

By Jessica Cooke

In 2008, Jemmy Case was a fresh-faced 19-year-old breaking away from a life of homeschooling and heading toward adulthood and freedom. She moved into an apartment, elected not to go to college, and got a full-time job. It was a big time for her in 2008, but Jemmy said she “quickly learned that a degree was necessary for any type of employment that paid more than the minimum wage,” and by her mid-20s Jemmy recalls, “I found myself feeling left behind on the staircase to success.”

What she could not foresee was that delaying her college education was going to cost her massively. As Jemmy’s former writing instructor, I can say she is precisely the type of student the University System of Georgia should welcome and support in every way possible — including financially. She is committed, intelligent, hard-working, and savvy.

Yet, Jemmy’s reward for not starting college in 2008 is paying 65 percent more in tuition. To put that in perspective, a gallon of regular, unleaded gasoline today sells for $2.55, but at a 65 percent discount in 2008, it would have cost $1.66. (In 2008, that gallon of gas actually cost about $2.45.) Except for higher education, there is no other product or service in Georgia that has seen such price increases and has been endured for so long by education consumers.

It shouldn’t be.

Part of the problem lies with students and parents who reasonably believe that a four-year degree is necessary and, ultimately, worth more to have than it costs to get. A four-year degree is one way to career opportunity, but it is not the only way. Technical programs, two-year degrees, and training certificates also provide lasting opportunities at significantly lower costs.

Additionally, many large companies, including Starbucks and Chrysler Motor Company, now offer tuition reimbursement options to eligible employees. Responsible education consumers should explore all options instead of instinctively racing to the doors of the four-year degree-granting institutions. Here’s why.

There are actually two different tuition rates paid at every institution of higher learning. The first tuition is the one paid out-of-pocket. Those rates are posted at the time of matriculation, and in Georgia, tuition rates go up almost yearly. (Georgia Tech’s tuition increased 9 percent in both 2014 and in 2015.)

The second tuition rate — the one Jemmy pays — is funded through borrowed money, such as subsidized and unsubsidized federal financial aid. Over time, borrowing students pay a much higher tuition rate because of the accumulated interest over the term of the loan — 10 years, 20 years, even 30 years.

Imagine, for a moment, Jemmy’s frustration, disappointment, and economic hardship with the life and career decisions she made seven years ago. She describes, “I have become increasingly frustrated and appalled by the fact that an MBA could potentially end up costing me nearly as much as a mortgage if I attend any of the major universities in Georgia.”

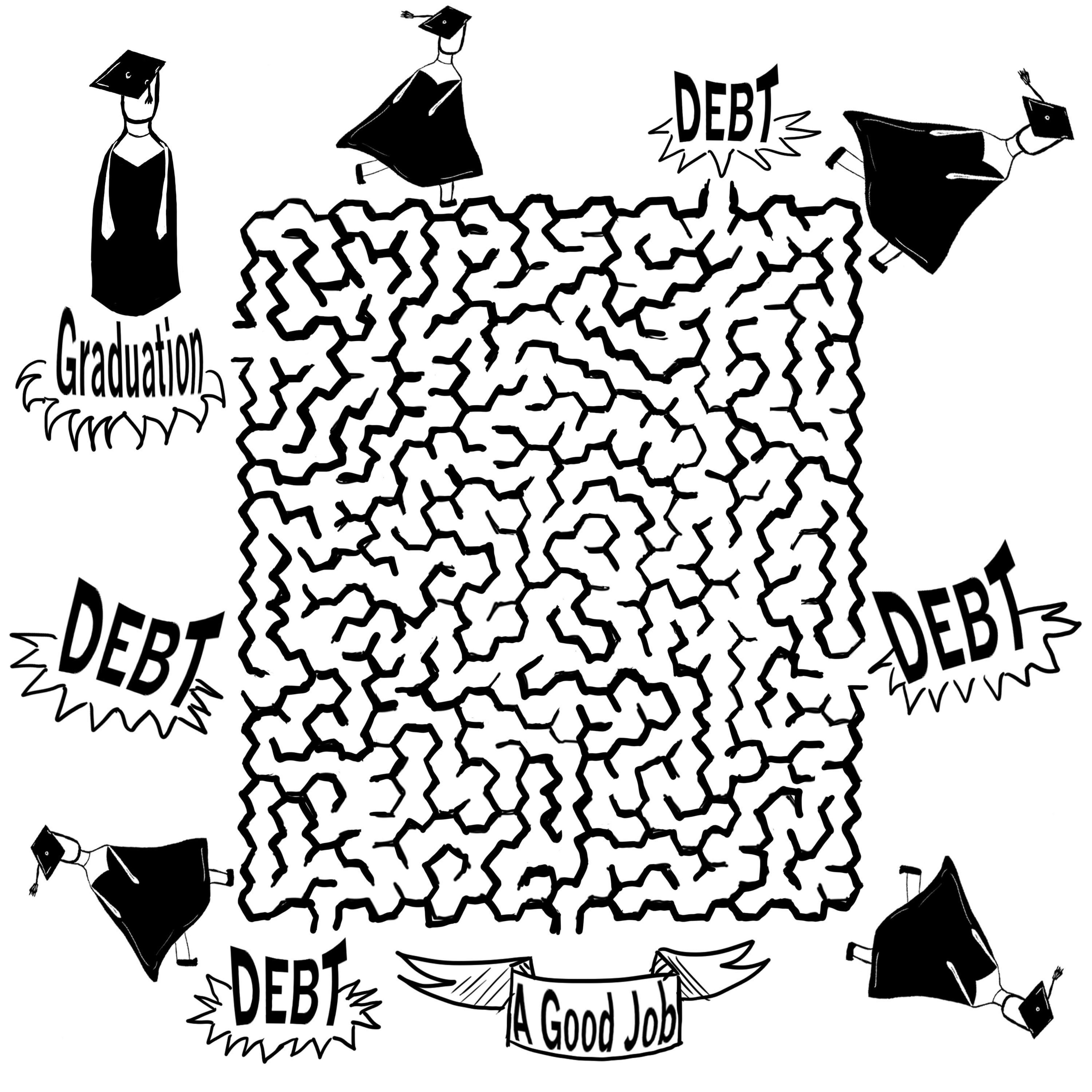

Attending college used to be a race to the top of the academic achievement ladder, but it has since turned into a race to see who graduates with the lowest debt. The race is hardly fair, though, specifically because so many USG students like Jemmy have no choice but to leverage their futures to secure a degree that — just seven years ago — cost 65 percent less.

Some current USG students will be tethered to outrageous student loan debts, and as a result, they will begin their lives’ journeys from behind the starting line. Beyond the financial liability itself, those with student loan debt often are forced to sacrifice or delay major life milestones, such as getting married or starting families, not to mention buying large durable goods, such as houses, cars, and more, or — heaven forbid —saving for their retirement. The delays and sacrifices then rob Georgia and our nation of economic growth.

Jemmy laments, “I started college in order to make a better life for myself and my family, but I also genuinely wanted the education. I was homeschooled for the entirety of grade school and wanted to experience what it was like — not just to go to school — but to go to college. I have that experience now, but it is difficult for me to fully enjoy it knowing how much it is costing me now and how much it has already cost me. The debts that I have accrued since I began college are not exclusively monetary either. There are large chunks of time that have been taken from my personal life to pay for this education, increased stress and anxiety over how to pay for it, and lost time with my family and friends. These are payments toward my educational investment that may never show a return in the future, years of my life that I will never get back. I know that I am the kind of person who will find a way to benefit from my education out of sheer stubbornness and determination, but right now I am unsure if 20 years from now I will be able to look back and say that it was worth it just to be able to make it to the top of the staircase to success.”

That Georgia higher education has experienced decreased state funding since 2008 is scandalous but certainly explains — at least in part — why tuition rates in 2008 were 65 percent cheaper. Georgia state legislators should be mortified by repeatedly placing the entire burden of state-level funding cuts on education consumers, like Jemmy, essentially pushing them down the staircase to success. Moreover, it is time for USG employees, students, and parents to be stronger consumer advocates, to ask more pointed questions, and to demand answers.

The University System of Georgia and the Board of Regents cannot possibly reconcile urging a student like Jemmy to pursue her college education while simultaneously raising her in-state tuition by 66.5 percent since 2008. I don’t mind saying either that these tuition and fee hikes come at an onerous price, often unaffordable and frequently unrepayable by the many the USG and the Board of Regents claim to serve.