Atlanta CPA heading to federal prison for tax dodge scheme

An Atlanta area accountant sold his clients on what he assured them was a lucrative, guaranteed investment. For every dollar they paid in, they would get tax deductions of about $4.50. It didn’t take much convincing for wealthy clients to sign on.

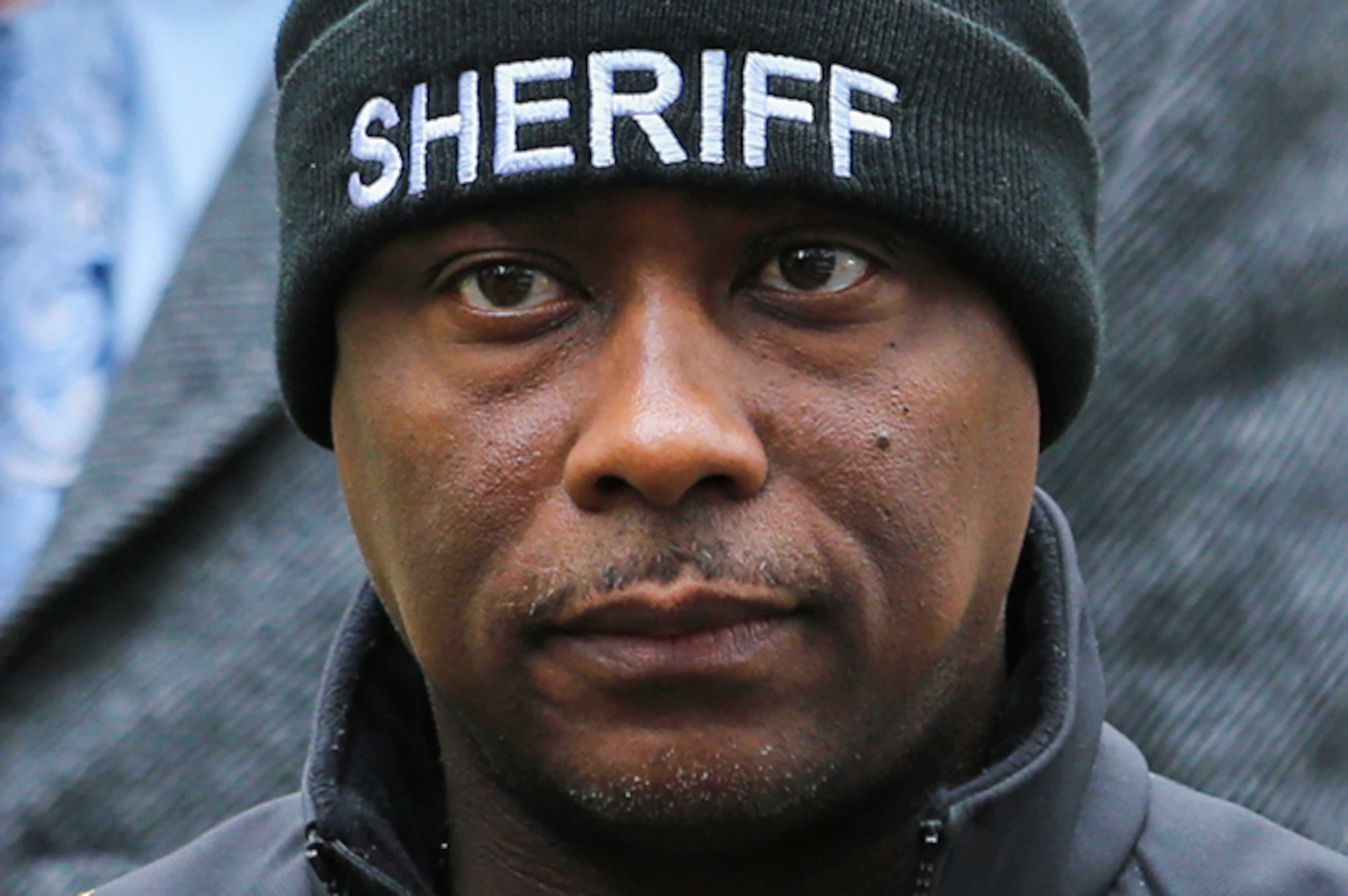

Now that longtime accountant, Herbert Lewis, is heading to federal prison for his role in promoting and selling illegal tax shelters. He was sentenced in federal district court Friday to 28 months and ordered to pay almost $4.9 million in restitution.

Prosecutors said Lewis sold units in illegal tax shelters created by others, with clients claiming almost $14 million in deductions.

Recorded conversations quoted in court documents illustrate his sales pitch. “I think this thing is the best safe tax savings tool I have seen in a long time; probably ever. I recommend (a client) putting in $25,000, which will save about $41,000 in federal and state tax expense …”

But the government said Lewis knew the transactions were not permitted and that he also told clients to backdate some documents to conceal they hadn’t met IRS rules. “Lewis’s corruption was blatant,” prosecutors said in a sentencing memorandum.

Lewis is among a dozen people convicted in the scheme, which involved conservation easements — tax deductions landowners can claim as charitable contributions by agreeing to permanently limit uses of environmentally sensitive land.

The masterminds of the scheme syndicated the easements, allowing investors to buy units of a property. Then, rather than having the tax deduction reflect the property’s fair market value, the organizers devised a way to make the tax savings more lucrative.

They hired appraisers to grossly inflate land values, as high as 600% to 700% above their purchase price in some instances, a judge in the case said. That allowed investors to claims more than $1 billion in false tax deductions.

It was a sinister level of greed, the judge said.

Those masterminds were convicted after a lengthy trial last year. In January, Jack Fisher of Alpharetta was ordered to serve 25 years and attorney James Sinnott of Suwanee to 23 years. They were also ordered to pay restitution of about half-billion dollars.

Prosecutors said Lewis wasn’t involved in obtaining the fake appraisals or overinflated deductions, but as a CPA he knew the promised savings were too good to be true. He also prepared tax returns for clients with deductions he knew to be false.

For that work, he earned more than $1 million in commissions, though he didn’t tell clients he was getting paid for selling the shelters, court records show. On his own income tax filings, according to court records, he also underreported his commission income from the scheme by $400,000.

Lewis was the first indicted in the criminal scheme but the last to accept a plea offer, according to the Department of Justice. He pleaded guilty to conspiracy to defraud the United States and fraud and false statements June 14, three years after being indicted. His attorney did not respond to a request for comment.

Nine other people — six CPAs, an appraiser and two attorneys — previously pleaded guilty in the case.