She thought it was Chase Bank calling. Then her money vanished.

It’s not often a victim of a financial scam ever sees their money again.

Gloria and Gary Moss are a rare exception.

After a scammer posed as a Chase Bank fraud department employee and emptied their account of nearly $50,000, it was months before the couple got their money back. On Aug. 14, the woman behind the scam was convicted in a Gwinnett County courtroom.

“The other day in court when she was crying, I felt bad for her. And I do forgive her, because as a Christian, that’s what we are supposed to do. But you know, I hope that she learned her lesson,” Gloria Moss told The Atlanta Journal-Constitution during a phone call Tuesday.

Investigators and prosecutors for the Gwinnett District Attorney’s Office discovered that the scammer, 26-year-old Audrey Michelle Townsend, devised an elaborate plan to steal from the couple’s bank account and wire the money to her own account in February 2024.

Detailed phone and bank records helped crack the case for investigator Tony Scarbrough.

But not all victims are as fortunate, especially when scams involve cryptocurrency, the dark web or offshore banking. Gloria and Gary Moss, who have been married for nearly 50 years, are two of the lucky ones.

“It’s just rare that you get full restitution in a case. Restitution is always ordered, but then just the ability to pay can be a factor as well, and sometimes our victims, unfortunately, are never fully recovered,” said Deputy Chief Assistant District Attorney John Williams, who prosecuted the case. “This was just a very, very unique case.”

‘It didn’t occur to me at all that I was being scammed’

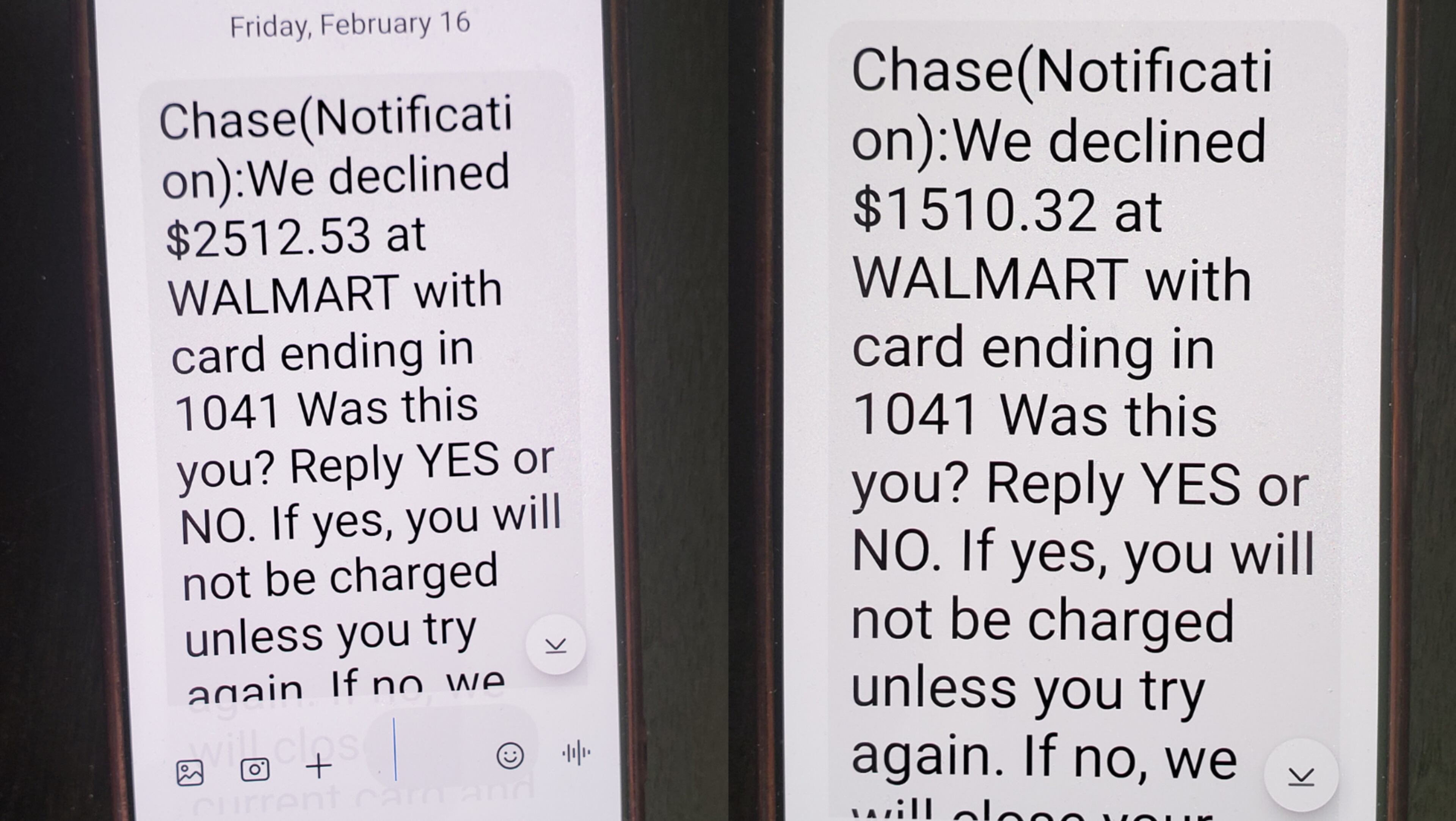

Gloria, 67, thought her husband’s debit card had been compromised after receiving text messages from an 847 number stating large purchases at a Walmart were declined. The Feb. 16, 2024, messages included the last four digits of Gary’s card number.

There was a time when banks would use 1-800 numbers, but Scarbrough explained that financial institutions now use a variety of prefixes. Gloria said she didn’t think much of the 847 number and gave it a call.

“That’s when I spoke to Audrey Townsend for a good 30 minutes. That’s how long she kept me on the phone,” Gloria recounted. “At the time, it didn’t occur to me at all that I was being scammed.”

She remembered being assured by Townsend, who used an alias, that the fraud would stop and her account would be secured. Gloria admitted to giving the scammer a one-time password that was sent to her phone while Townsend was trying to access her account.

Several hours later, she noticed she had been locked out — and her money was gone.

At first, she tried calling the scammer back, still thinking it was Chase Bank. When that call didn’t go through, she called the number on the back of her card. But it was too late.

Difficult to investigate, prosecute

The scammers knew Gloria banked with Chase. Scarbrough said scammers often target victims whose personal data, such as name, birth date or banking information, is available on the dark web. Townsend was part of a scammer group, though Scarbrough said the others have not been identified.

While Townsend kept Gloria on the phone, another scammer was on a separate line with Chase pretending to be her, officials said. After convincing Gloria to share that password the bank had texted her, the scammers gained access to her account. They then changed her passwords, shifted funds and used personal information stored in the account to further convince Chase they were speaking with the real customer.

“(The scammer) posed as her to the bank to OK the transaction. … When they contacted the bank, the bank basically asked her to confirm the wire transfer and were on the phone with the suspect at the time,” Scarbrough said.

To the bank, Williams said it appeared to be an authorized transaction. That led Chase to initially refuse to return the money.

Phone records obtained by the district attorney’s office showed how the scam played out. Bank records then led authorities to the suspect. The $49,000 had been wired to a Wells Fargo account belonging to Townsend in Texas, Williams said.

That traceability made the case stand out. It’s rare that victims ever get justice or their money back in such cases.

“Banks keep good records. Financial institutions keep good records. But the dark web keeps no records at all,” Williams said. “It’s very difficult to track and trace the money, especially in the case of cryptocurrency. When it leaves the victim’s wallet, that can become challenging, but we’re working on different ways to overcome that.”

Williams said Gwinnett police receive around 100 complaints every week about internet scams and only about 2% of those result in arrests. He suspects even less result in convictions.

In some cases, prosecutors prioritize restitution over prison time.

“Sometimes you have to make arrangements to pay restitution instead of even prosecution just to make the victim whole,” Williams said.

Townsend pleaded guilty to theft by taking over $25,000 and four counts of elder abuse and exploitation. She was sentenced to 20 years, with five to serve.

Setbacks from the scam

Gloria hadn’t realized how often online scams happen. Since then, she’s been hesitant to answer unknown calls or trust emails.

In July 2024, with the criminal investigation well underway, authorities said Chase Bank returned the money to Gloria’s account. But until that point, she felt uneasy contacting the bank.

“The whole time that I was dealing with this for the five months, I always felt like I never could trust who I was talking to because (the scammer) did a very good job when she first called me,” Gloria said.

The Mosses have since closed their Chase account, and Gloria changed her phone number.

In his 30 years as a prosecutor, and 15 handling white collar crimes, Chief Assistant District Attorney John Melvin said he had never seen victims get back such a large amount of money.

But the theft still set them back financially. Gary, 72, said they had to dip into their savings and put off plans to buy a home.

Amid the stress, Gary said he suffered a heart attack in March and had quadruple bypass surgery. Before losing the money, Gloria had been dealing with her breast cancer diagnosis.

“We went through a lot in the five months it took us to get that money back, and both of us are basically just now getting ourselves together,” Gary explained.

‘Tsunami of financial crimes out there’

This type of scam is nothing new, and officials at the district attorney’s office think they will only continue to rise.

“Baby boomers are coming into their retirement and different things like that. So, we’re going to see a lot more of these types of crimes,” DA Patsy Austin-Gatson said.

Austin-Gatson said her office has visited day centers and churches to educate seniors on scams. As they continue to occur at an alarming rate, Melvin said many law enforcement agencies across metro Atlanta aren’t equipped to keep up.

“It’s exceedingly a lack of experience, and then just being overwhelmed with the tsunami of financial crimes out there,” Melvin said about what makes white collar crimes tricky.

He said they were “blessed” in the Moss case since the money was wired to a U.S.-based Wells Fargo account, making it easier to trace and gather the records needed to prove fraud.

But for Gloria, the emotional toll hasn’t been as easy to overcome.

“I felt foolish, and I felt ashamed and embarrassed and couldn’t believe that this happened to me,” she said.

Tips to avoid becoming a victim of a banking scam:

- Your bank will never ask for your PIN, password or request that you move money to another account.

- Beware of spoofed numbers. Scammers can fake caller ID to make it look like your bank or another trusted source is calling.

- If someone calls claiming to be from your bank, hang up and call the number on the back of your debit or credit card.

- Don’t click on links in emails or text messages, even if they appear to come from your bank.

- Don’t utilize voice recognition with your bank. Scammers only need a short recording of your voice to train AI to impersonate you in full conversations.

- Freeze your credit to prevent scammers from opening new accounts, taking out loans or making large purchases in your name.

- Use a credit card instead of a debit card.

- Use multifactor authentication.

- Teach friends and family how to spot online scams and where to report suspicious activity.