Gov. Deal signs bill to tax online sales to Georgians

Gov. Nathan Deal signed legislation calling for online retailers to start charging sales taxes on their goods.

The House and Senate approved House Bill 61, which would require online retailers who make at least $250,000 or 200 sales a year in Georgia to either collect and remit to the state sales taxes on purchases or send "tax due" notices each year to customers who spend at least $500 on their sites.

The measure could mean an extra $500 million to $600 million a year in sales tax collections for the state and local governments.

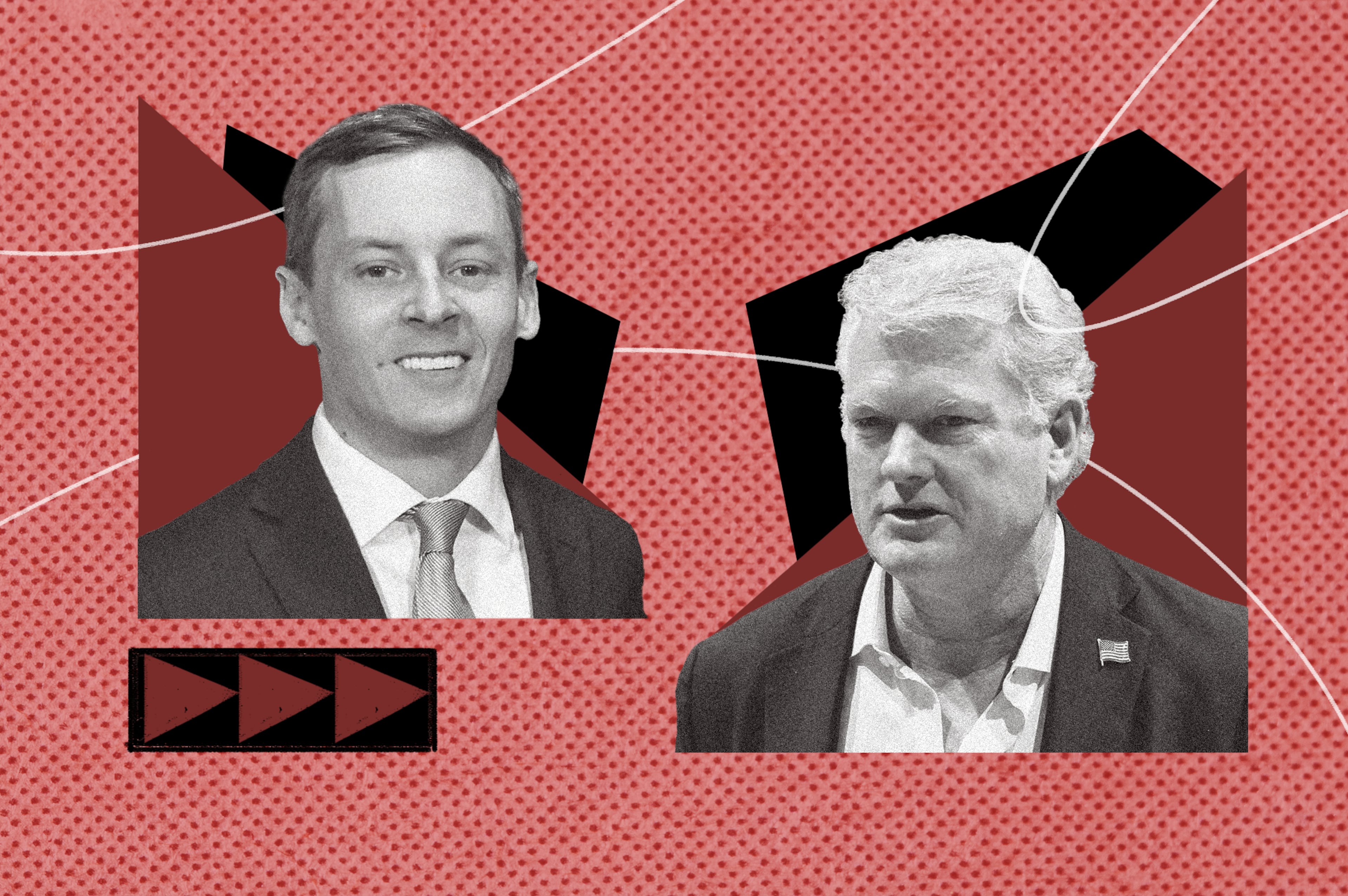

The bill's sponsor, House Ways and Means Chairman Jay Powell, R-Camilla, said the taxes are already owed, but many online retailers haven't collected them. Mega-retailer Amazon is among the exceptions, agreeing to start collecting Georgia taxes several years ago.

States across the country have been tackling the issue in recent years. But they have run up against a ruling the U.S. Supreme Court made more than 25 years ago saying governments can’t force retailers to collect and remit taxes unless they have a physical presence, such as a store, in a state.

The Supreme Court last month heard oral arguments on the issue, taking up a law passed by South Dakota's Legislature for the express purpose of testing its legality.

It is expected to rule on the issue soon.