Average rate on a 30-year mortgage edges higher after declining four weeks in a row

MCLEAN, Va. (AP) — The average rate on a 30-year U.S. mortgage ticked up this week, ending a four-week slide that brought down borrowing costs for homebuyers to the lowest level in nearly a year.

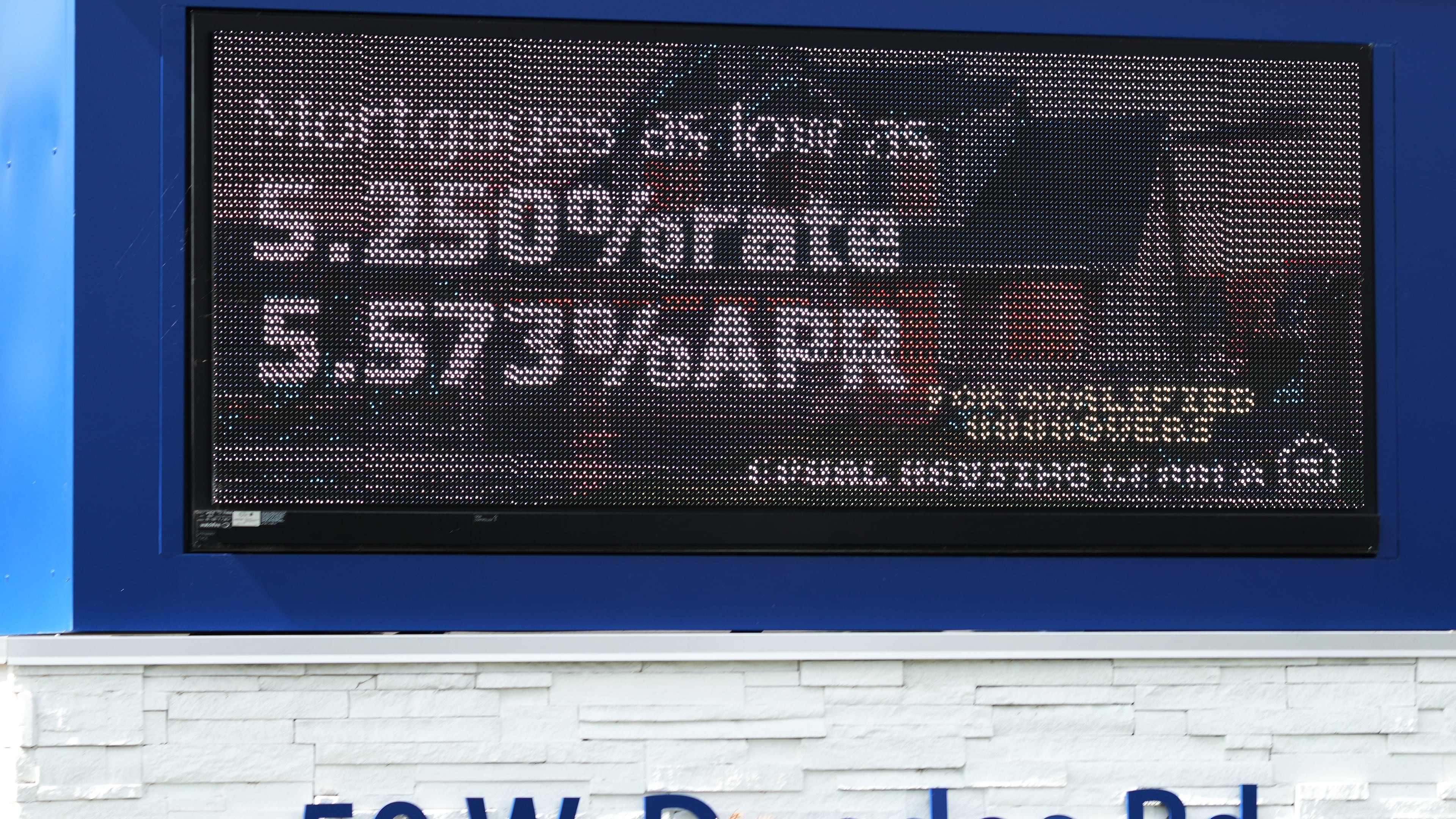

The rate rose to 6.3% from 6.26% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 6.08%.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also edged higher. The average rate rose to 5.49% from 5.41% last week. A year ago, it was 5.16%, Freddie Mac said.

Mortgage rates are influenced by several factors, from the Federal Reserve’s interest rate policy decisions to bond market investors’ expectations for the economy and inflation. They generally follow the trajectory of the 10-year Treasury yield, which lenders use as a guide to pricing home loans. The yield was at 4.19% in midday trading Thursday, up from 4.16% late Wednesday.

Starting in late July, mortgage rates mostly declined in the lead-up to the Federal Reserve’s widely anticipated decision last week to cut its main interest rate for the first time in a year amid growing concern over the U.S. job market.

The recent downward trend bodes well for prospective homebuyers who have been held back by stubbornly high home financing costs.

More Stories

The Latest