Whether you're planning to hit the road for spring break or looking ahead to your summer travels, there's a lot to think about when planning a vacation — especially if you're flying to your destination. Not only do you have to add the airline ticket to your travel budget, but you have to think about other fees too, like checking your bag or choosing a window or aisle seat. But there may be an airline-branded credit card out there to help you cut back on some of those costs. (Want more budget-saving ideas? Consider these 28 ways to help you save for this year's big adventure.)

You have a lot to consider when choosing one of these cards. Sure, you want to think about if you’re loyal to a certain airline, but you may also want to take it one step further and take note of your airport loyalty. The Federal Aviation Administration (FAA) collects passenger boarding cargo data for U.S. airports. Using its most recent data, we established this list of the 25 busiest airports in America … and then figured out which credit cards would be best to use at each of them.

Plus, before signing up for any new credit card, it's important to know where your credit stands. Travel credit cards tend to require good scores, so knowing how you fare can help you see your odds of qualifying. (You can look at your two free credit scores on Credit.com.)

Now, without further ado, here’s list of the credit cards that could get you the most rewards at some of the busiest airports in the country.

25. Salt Lake City International Airport — Salt Lake City

Best Credit Card: Gold Delta SkyMiles Credit Card

Why We Chose It: Salt Lake City is a Delta hub and there's a great Delta Sky Club lounge between concourses C and D.

Baseline Rewards: Two miles per dollar spent on Delta purchases, one mile per dollar spent on all other purchases. You can earn 30,000 bonus miles after spending $1,000 during the first three months.

Great Perk: You check your first bag free on every flight along with priority boarding, which is like saving $50 on each round-trip flight (assuming you check a bag each way).

Annual Fee: $95, waived the first year

APR: Variable 16.24% to 25.24%

24. Chicago Midway International — Chicago

Best Credit Card: Southwest Rapid Rewards Plus

Why We Chose It: CMI is a major hub for Southwest, so frequent fliers are bound to get good use of this card.

Baseline Rewards: Two points per dollar spent on Southwest Airlines and Rapid Rewards hotel and car rental partner purchases; one point per dollar on all other purchases. You can earn 50,000 points after spending $2,000 on the card in the first three months.

Great Perk: You get 3,000 anniversary gift points once you've had your card for a year.

Annual Fee: $69

APR: Variable 16.49% to 23.49%

23. Ronald Reagan Washington National — Arlington, Virginia

Best Credit Card: Citi AAdvantage Executive World Elite MasterCard

Why We Chose It: American Airlines is prominent at this airport and the list of perks with this card is great, whether you're coming here for work or going on your own adventure.

Baseline Rewards: Two miles for every dollar spent on American Airlines purchases and one mile for every dollar spent elsewhere. You can earn 50,000 bonus miles after spending $5,000 on the card in the first three months.

Great Perk: Free access to the Admirals Club.

Annual Fee: $450

APR: Variable 15.74%

22. Baltimore/Washington International Thurgood Marshall — Baltimore

Best Credit Card: Southwest Rapid Rewards Premier card

Why We Chose It: Turns out, the majority (70.34%) of this airport's traffic from December 2015 to November 2016 was tied to Southwest Airlines flights. So it makes sense to choose a Southwest card.

Baseline Rewards: Two points per dollar spent on Southwest Airlines and Rapid Rewards hotel and car rental partner purchases; one point per dollar on all other purchases. Earn 50,000 points after spending $2,000 on the card in the first three months. You'll get 6,000 bonus points on your cardmember anniversary. (Fly Southwest, but not sure if the Premier or the Plus is a better fit? We've got a guide that compares the two right here.)

Great Perk: No cap on the number of points you can earn, as long as your card is open and active.

Annual Fee: $99

APR: Variable 16.49% to 23.49%

21. Fort Lauderdale/Hollywood International — Fort Lauderdale, Florida

Best Credit Card: JetBlue Card

Why We Chose It: Fort Lauderdale is a focus city for the airline and has a strong presence in terminal 3.

Baseline Rewards: Three points per dollar on JetBlue purchases, two points per dollar at restaurants and grocery stores, and one point per dollar on all other purchases. You can earn 5,000 bonus points after spending $1,000 on the card in the first 90 days.

Great Perk: This card gets you 50% off your in-flight purchases.

Annual Fee: None

APR: Variable 12.49%, 20.49% or 25.49%

20. LaGuardia — Queens, New York

Best Credit Card: Platinum Delta SkyMiles Credit Card

Why We Chose It: Delta has a strong presence in this airport and it continues to grow, most recently with a 600-foot bridge linking its two main terminals, C and D.

Baseline Rewards: Two miles per dollar spent on Delta purchases and one mile per dollar everywhere else. You can earn 35,000 bonus miles, 5,000 Medallion Qualification Miles (MQMs) after spending $1,000 on the card in the first three months and $100 statement credit if you make a Delta purchase in the first three months of having the card.

Great Perk: You get a round-trip companion pass each year when you renew this card.

Annual Fee: $195

APR: Variable 16.24% to 25.24%

19. Philadelphia International — Philadelphia

Best Credit Card: Citi AAdvantage Platinum Select World Elite MasterCard

Why We Chose It: American Airlines flights went to the 10 most popular domestic destinations from this airport from December 2015 to November 2016, so this card could come in handy on your travels.

Baseline Rewards: Two miles for every dollar spent with American Airlines and one mile for every dollar spent everywhere else.

Great Perk: Earn 30,000 bonus points after spending only $1,000 in the first three months after getting the card.

Annual Fee: $95, waived the first year

APR: Variable 16.24% to 24.24%

18. Detroit Metropolitan Wayne County — Detroit

Best Credit Card: Gold Delta SkyMiles Credit Card

Why We Chose It: Delta is one of the main airlines coming and going from Detroit and several of Delta's partners also fly to and from Detroit. There are also four Delta Sky Clubs throughout the airport.

Baseline Rewards: Two miles per dollar spent on Delta purchases, one mile per dollar spent on all other purchases. You can earn 30,000 bonus miles after spending $1,000 during the first three months.

Great Perk: You can redeem your points with Delta or with any of its more than 15 airline partners.

Annual Fee: $95, waived the first year

APR: Variable 16.24% to 25.24%

17. General Edward Lawrence Logan International — Boston

Best Credit Card: The JetBlue Plus Card from BarclayCard

Why We Chose It: Whether you're headed to a seasonal destination, like St. Lucia or Martha's Vineyard, or not, JetBlue has an extensive list of places they fly.

Baseline Rewards: Six points per dollar on JetBlue purchases, two points per dollar at restaurants and grocery stores, and one point per dollar on all other purchases. You can earn 30,000 bonus points after spending $1,000 on the card in the first 90 days and receive 5,000 bonus points on your cardholder anniversary.

Great Perk: You can earn a $100 statement credit when you use your card to purchase a Getaways vacation package.

Annual Fee: $99

APR: Variable 12.49%, 20.49% or 25.49%

16. Minneapolis-St. Paul International/Wold-Chamberlain — Minneapolis

Best Credit Card: Platinum Delta SkyMiles Credit Card

Why We Chose It: If your heart can dream it, odds are Delta can fly you there from Minneapolis-St. Paul International. And why would you want to limit yourself? (For the card's major terms and conditions, see above).

15. Newark Liberty International — Newark, New Jersey

Best Credit Card: United MileagePlus Club Card

Why We Chose It: Newark Liberty is a hub for United Airlines and this airline flies the majority of passengers from this airport.

Baseline Rewards: Two miles for every dollar spent with United Airlines and 1.5 miles per dollar spent on all other purchases. You can earn a $100 statement credit after making your first purchase on the card.

Great Perk: Free access to the United Club, an annual savings of up to $550. Even with the annual fee, that's still a savings of $100 (assuming you use the card responsibly, of course).

Annual Fee: $450

APR: Variable 16.49% to 23.49%

14. Orlando International — Orlando, Florida

Best Credit Card: Citi AAdvantage Executive World Elite MasterCard

Why We Chose It: There is an Admirals Lounge coming later this year and this card can get you in to enjoy the fancy new digs. (For the card's major terms and conditions, see above).

13. Seattle-Tacoma International — Seattle

Best Credit Card: Alaska Airlines Visa Signature card

Why We Chose It: Seattle is a hub for Alaska Airlines as well as several of its partners.

Baseline Rewards: Three miles for every dollar spent on Alaska Airlines purchases and one mile for every dollar spent on all other purchases. You can earn 30,000 bonus miles after spending $1,000 on purchases in the first 90 days.

Great Perk: This card offers the flexibility of choosing which airline you redeem your points with, from American Airlines to Emirates.

Annual Fee: Depends on which version of the card you're approved for (based on creditworthiness): $75 for Visa Signature card or $50 for Platinum Plus accounts. You can find an explainer on the difference between the two cards here.

APR: Variable 12.74% to 19.74%

12. George Bush Intercontinental/Houston — Houston

Best Credit Card: United MileagePlus Explorer card

Why We Chose It: There are some great renovations coming this year to terminal C that will help this card come in extra-handy.

Baseline Rewards: Two miles per dollar spent on United Airlines tickets and one mile per dollar on all other purchases.

Great Perk: You get 50,000 bonus miles after spending $3,000 in the first three months.

Annual Fee: $95

APR: Variable 16.49% to 23.49%

11. Miami International — Miami

Best Credit Card: Citi AAdvantage Executive World Elite MasterCard

Why We Chose It: There are two Admirals Club lounges in terminal D you can enjoy whenever you are at Miami International, whether you're heading there on vacation or waiting for a flight home after a Caribbean cruise. (Again, for the card's full terms and conditions, see above.)

10. Phoenix Sky Harbor International Airport — Phoenix

Best Credit Card: Southwest Rapid Rewards Premier card

Why We Chose It: Southwest recently announced plans to expand their presence at the Phoenix airport, including eight new gates and more flights, so this card just makes sense. (For the card's full terms and conditions, see above.)

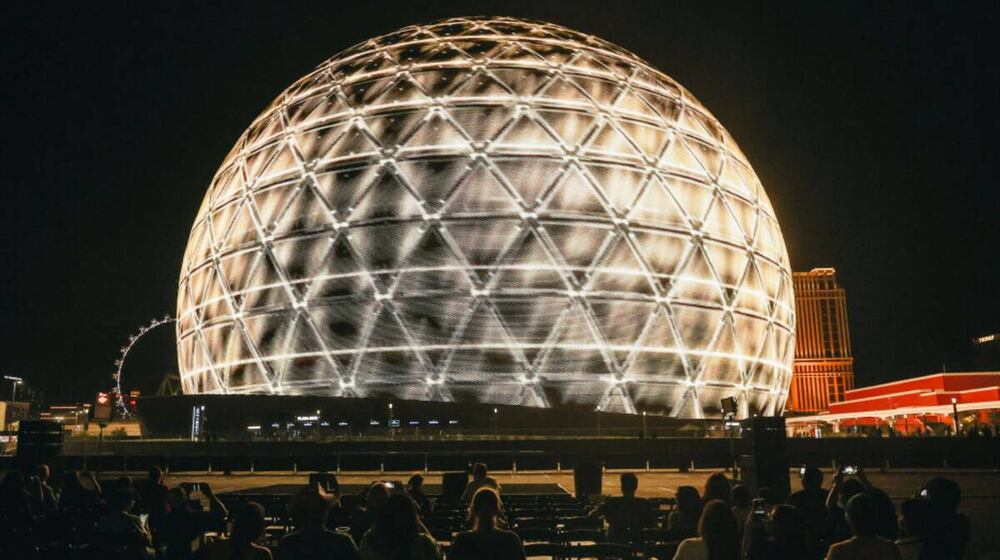

9. McCarran International Airport — Las Vegas

Best Credit Card: The Platinum Card From American Express

Why We Chose It: Nothing says Vegas like a little flash of luxury, and American Express's premium credit card can get you into the airport's swanky Centurion lounge.

Baseline Rewards: Right now, cardholders receive five times the points on airfare booked directly with a carrier or American Express travel and one times the points on everything else, but those rewards, along with the card's annual fee, are set to go up, effective March 30.

Great Perk: You'll get a $200 airline free credit, good for baggage fees and more at one airline.

Annual Fee: Currently $450; but that'll go up to $550 once the new benefits come online

APR: The Platinum is a charge card, meaning you're required to pay your balances off in full each month.

8. Charlotte/Douglas International Airport — Charlotte, North Carolina

Best Credit Card: Citi AAdvantage Platinum Select World Elite MasterCard

Why We Chose It: This civil-military public international airport is a major hub for American Airlines. (For the card's full terms and conditions, see above.)

7. San Francisco International Airport — San Francisco

Best Credit Card: The Virgin America Premium Visa Signature Card

Why We Chose It: Take one look at the Virgin Atlantic Clubhouse and you'll see why we couldn't pass this one up.

Baseline Rewards: Eight points (five points for being an Elevate member and three for card usage) per dollar spent on Virgin America purchases and one point per dollar spent on all other purchases. You can earn 15,000 bonus points after spending $1,000 on the card in the first 90 days.

Great Perk: This card is a member of the Visa Signature family, which offer additional perks like lost baggage reimbursement or an auto rental damage collision waiver.

Annual Fee: $149

APR: Variable 16.48%, 20.49% or 25.49%

6. Denver International Airport — Denver

Best Credit Card: Frontier MasterCard

Why We Chose It: Frontier is one of five airlines at the Denver airport that offers the convenience of curbside check in.

Baseline Rewards: Two miles per dollar on FlyFrontier.com purchases and one mile per dollar on any other purchases. You can earn 40,000 bonus miles after spending $500 on the card in the first 90 days.

Great Perk: You get a $100 voucher toward a flight after spending $2,500 during your first (anniversary) year.

Annual Fee: $69

APR: Variable 16.49% or 25.49%

5. John F. Kennedy International Airport — New York City

Best Credit Card: The JetBlue Plus Card from BarclayCard

Why We Chose It: There's a lot to see and do in the recently-renovated terminal 5, including the exciting Airspace Lounge — and that's all before you even board the plane. (For the card's full terms and conditions, see above.)

4. Dallas-Fort Worth International Airport — Forth Worth

Best Credit Card: Citi AAdvantage Platinum Select World Elite MasterCard

Why We Chose It: While there are some updates being made to the Admirals Club lounge in terminal A, there are others you can use, getting perks like free Wi-Fi and access to showers in case you come straight to the airport from the office. (For the card's full terms and conditions, see above.)

3. Chicago O’Hare International Airport — Chicago

Best Credit Card: United MileagePlus Explorer credit card

Why We Chose It: O'Hare is a major hub for United Airlines. (For the card's full terms and conditions, see above.)

2. Los Angeles International Airport — Los Angeles

Best Credit Card: Alaska Airlines Visa Signature card

Why We Chose It: Alaska and several of its partners are a big presence at this airport and offer deals for passengers. (For the card's full terms and conditions, see above.)

1. Hartsfield–Jackson Atlanta International Airport — Atlanta

Best Credit Card: Delta Reserve Credit Card from American Express

Why We Chose It: Atlanta is a major hub for Delta. Atlanta is also popular connection airport, so you'll get more bang for your buck with this high-annual-fee card.

Baseline Rewards: Earn two miles per dollar spent on Delta purchases, one mile per dollar spent on all other purchases. Earn 10,000 MQMs and 10,000 bonus miles after your first purchase on the card.

Great Perk: Cardholders get complimentary first-class upgrades and Delta Sky Club access.

Annual Fee: $450

APR: Variable 16.24% to 25.24%

Note: It’s important to remember that interest rates, fees and terms for credit cards, loans and other financial products frequently change. As a result, rates, fees and terms for credit cards, loans and other financial products cited in these articles may have changed since the date of publication. Please be sure to verify current rates, fees and terms with credit card issuers, banks or other financial institutions directly.

Related Articles

This article originally appeared on Credit.com.

About the Author