Stop using Georgia seniors as a piggy bank. Give them property tax relief.

Nobody likes taxes — except, perhaps, elected officials and government workers who rely on them.

Americans feel besieged: Earn money? Taxed. Spend money? Taxed. Save money? The tax man still wants a piece.

Yet, most of us agree some level of fair taxation is necessary to keep our communities safe and provide essential services like schools, roads and public safety. But one tax stands out as uniquely oppressive, an eternal burden that haunts homeowners long after they’ve paid their dues: the property tax.

Unlike income or sales taxes, which hit once and are done, property taxes are relentless. They stalk you from the moment you buy a home, through decades of mortgage payments, and even into retirement when your income is fixed.

Pay off your house? Doesn’t matter. The tax persists, rising year after year, and if you can’t keep up, you risk losing your home. When you sell or pass away, the tax resurrects, zombie-like, to plague the next owner. It’s a system most Georgians find not just frustrating, but fundamentally unfair. I agree.

Seniors face threat of leaving their homes

The most heart-wrenching consequence of this tax falls on our senior citizens.

These are folks who’ve paid property taxes for decades, funding schools for their children, grandchildren, and even great-grandchildren.

They’ve paved roads through countless upgrades, supported generations of police officers and firefighters, and built the communities we cherish.

Yet, in their golden years, many face a cruel reality: Skyrocketing property taxes outpace their fixed incomes, forcing them out of homes they’ve spent a lifetime building. This isn’t just a financial strain — it’s a tragedy.

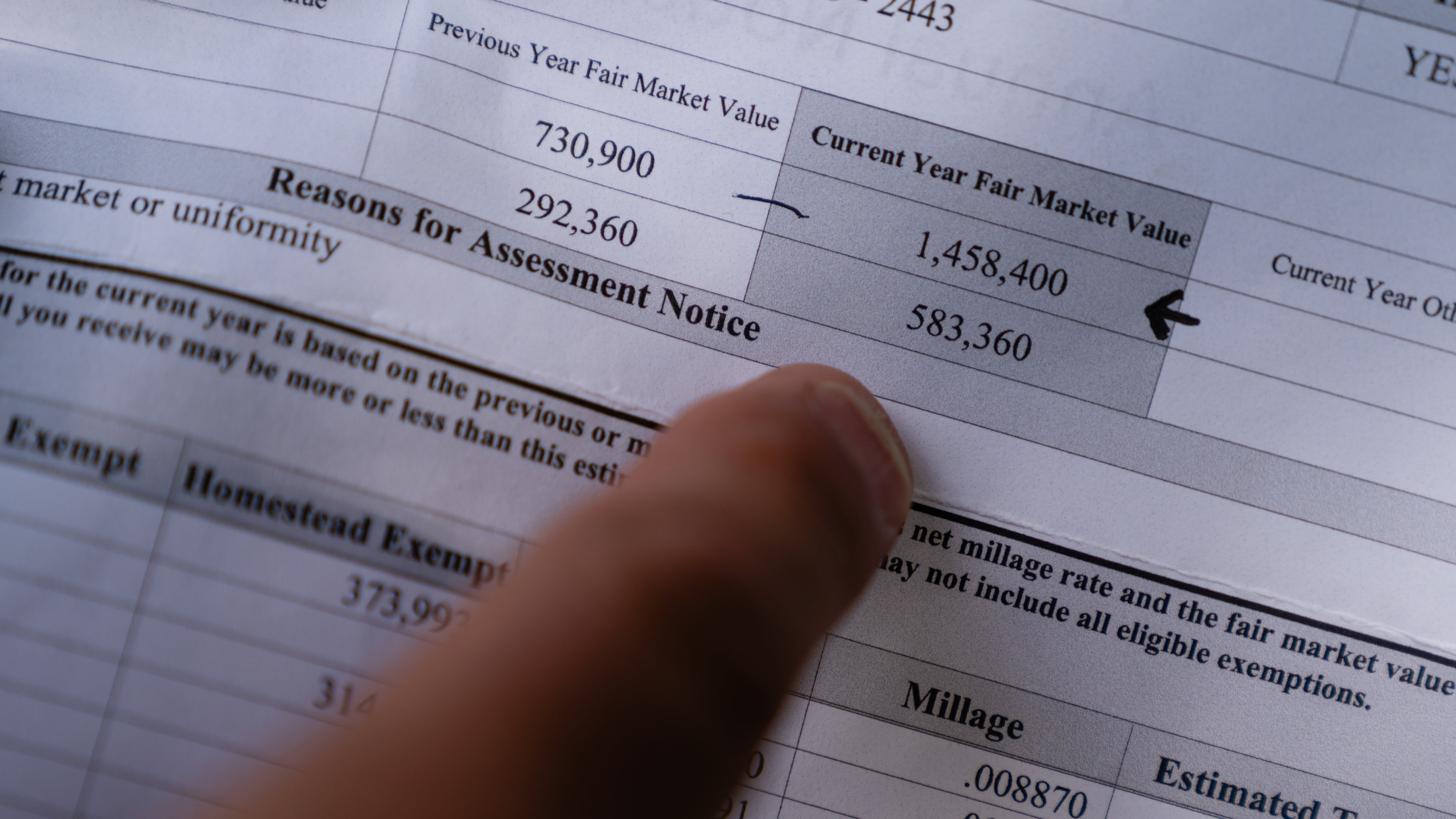

In Georgia, where property taxes have surged alongside inflation, this crisis is acute. Seniors on fixed incomes — often Social Security or modest pensions — watch helplessly as tax bills climb, sometimes doubling in a decade.

According to the Washington, D.C.-based Tax Foundation, Georgia’s effective property tax rate ranks mid-tier nationally, but for seniors in fast-growing counties like Fulton or Gwinnett, assessments can spike dramatically, with median bills exceeding $3,000 annually in counties including Fulton, Forsyth, Gwinnett, Fayette and Oconee, according to the Georgia Public Policy Foundation. For someone living on $20,000 a year, that’s a devastating hit.

Too many are forced to sell their homes or face foreclosure, a fate no one should endure after a lifetime of contribution.

Seniors Security Act would protect homeowners

That’s why I’m proposing the Seniors Security Act, a bold plan to eliminate property taxes for Georgians over 60. The legislation, which I’ll introduce in the 2026 Legislative Session for a statewide referendum in the primary election, would raise Georgia’s homestead exemption to $500,000 for seniors’ primary residences.

This would effectively erase property taxes for most retirees, as the median home value in Georgia hovers around $330,000, per recent Zillow data. For those with delinquent taxes, the Act would ban foreclosures on primary residences, converting unpaid taxes into liens collectible only upon sale or transfer. This ensures seniors can stay in their homes without fear of losing them to the tax collector.

It’s time we stop using our senior citizens as a piggy bank. These are people who’ve paid their fair share — often more than their share — funding schools, roads, and public safety for decades. They don’t deserve to be priced out of their homes in retirement.

This Act promises relief, allowing seniors to bank extra dollars for health care, travel, or simply enjoying their golden years with dignity. It also gives them certainty, letting them plan retirement without the looming threat of unpredictable tax hikes.

Property taxes are inherently un-American

But my vision goes further. I believe property taxes on homes are inherently un-American, a form of perpetual rent to the government that undermines the dream of true homeownership. My long-term goal as lieutenant governor is to phase out this tax entirely for all Georgians, replacing it with fairer revenue streams that don’t punish people for owning a piece of the American Dream.

I’m open to ideas — whether consumption-based taxes or streamlined budgets — to achieve this while maintaining essential services.

Local officials may balk, citing budget constraints. I get it: Government loves to grow itself, often at the expense of taxpayers. But the horror of seniors losing their homes far outweighs the challenge of trimming bureaucratic fat.

In 2024, Georgia’s state budget hit $37.8 billion, yet we still see waste — like $1.7 million for “arts and culture programming” or redundant administrative offices. Surely, we can prioritize our seniors over pet projects.

As we craft the Seniors Security Act, I welcome input to ensure it puts retirees first. Let’s make Georgia a state where growing old doesn’t mean losing your home. Together, we can end this unfair tax burden and give our seniors the security they’ve earned.

Rep. David Clark, R-Buford, represents House District 100 in the Georgia General Assembly. He is a Green Beret and a 2026 candidate for state lieutenant governor.