When the lawyers for Connie James’ homeowners association garnished her bank accounts to recover delinquent dues, she was curious. She didn’t know how the accounts had been located, nor had she given anyone consent to access them.

More than a year later, her curiosity gave way to anger as she learned how the law firm found out. It had hired a private investigator who, in turn, discovered not only where her accounts were located but how much she had in them.

"I just felt violated," she said. "That's what I felt initially, and it's what I feel to this day."

What happened to James, a 61-year-old software designer, offers a rare look at how attorneys use private investigators and other so-called information brokers to obtain supposedly private financial information.

Turning to a private investigator to find a bank account can allow a law firm to avoid post-judgment discovery, a process that can be both expensive and lengthy, and recover the debt — and the firm’s fee — in a matter of days.

Indeed, that’s what occurred in a Decatur firm’s pursuit of the money James owed her HOA.

‘Common practice’

James said the HOA dues were assessed while she was in New Orleans dealing with her elderly parents and her daughter was occupying the Lawrenceville home.

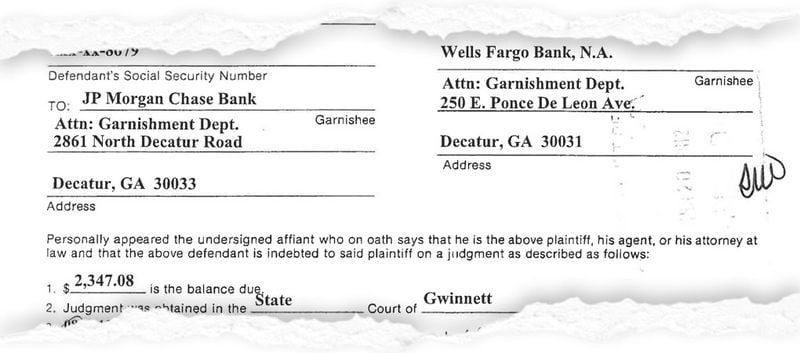

Dorough & Dorough was the law firm for the HOA, the Westchester Commons Swim & Tennis Association, and it obtained a judgment for $2,180, including $1,115 in attorney’s fees. With the judgment, the firm could garnish any bank accounts it could identify.

James said she learned of the judgment and the garnishment proceeding from one of her banks — Wells Fargo — after the proceeding had been initiated. After the process was complete, she felt the law firm had crossed the line in several aspects of the case, so she filed a grievance with the State Bar of Georgia.

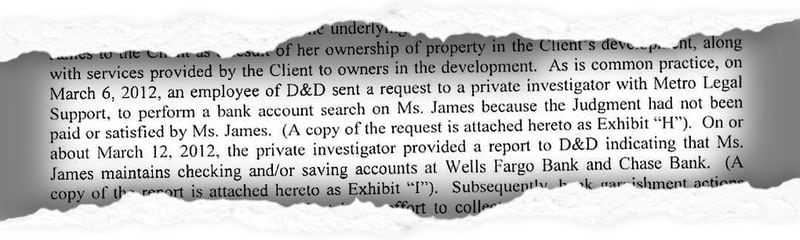

The grievance procedure required the lawyer who handled the case, Mary Beth Sierra, to respond, and that’s where James learned how the firm knew where she banked.

“As is common practice,” Sierra wrote, Dorough & Dourough used a private investigator to “perform a bank account search” to satisfy the judgment.

Documents Sierra submitted to the bar association show that the search for James’ accounts was one of nine requested by a firm employee in an email to the P.I., Garfield Trumble, on March 6, 2012.

Six days later, Trumble provided a report showing James’ personal and business checking and savings accounts at Wells Fargo and Chase Bank. The balances were listed to the penny.

“A diligent search was conducted for any cash banking accounts matching the above information provided,” Trumble wrote, listing James’ address, date of birth and Social Security number.

Trumble wrote that his search was conducted using two methods of “legal asset location,” but he did not specify what those were.

Two days after receiving Trumble’s report, Sierra began the garnishment proceeding. The firm ultimately recovered $2,624 from one of the Wells Fargo accounts.

Trumble, who is based in Johns Creek, did not respond to requests from The Atlanta Journal-Constitution for comment.

Records show that he has held a Georgia private investigator’s license since 2005 and that he hasn’t been subject to public disciplinary action.

The website for Trumble’s firm, Metro Legal Support, says the company conducts bank searches.

“All searches are NO HIT NO FEE,” the website says. “If we are unsuccessful, you pay nothing.”

Sierra and another Dorough & Dorough attorney who used the information discovered by Trumble, G. Lanier Coulter Jr., have since formed their own firm, Coulter & Sierra. They referred all comment to the firm’s attorney, Jason Graham.

In an email, Graham wrote that Sierra and Coulter “relied on the fact that the third party private investigators are licensed and regulated by the state.”

David Dorough, the founding partner at Dorough & Dorough, declined to be interviewed, saying he couldn’t discuss firm business publicly.

No violation found

Although the documents Sierra submitted to the bar indicated that James’ banking information had been accessed without her consent, the bar did not find the attorney violated its regulations.

William P. Smith III, who signed off on the decision as the association’s ethics counsel and has since retired, said he doesn’t remember the matter. The current general counsel, Paula J. Frederick, said she couldn’t shed any light on the decision because James’ file was expunged one year after the grievance was dismissed, per bar rules.

The AJC obtained portions of the file from James, who, as the complainant, was allowed to review it.

The Dorough & Dorough email asking Trumble to perform the March 2012 bank searches in fact indicated that the firm regularly contracted with him to perform such work, noting his success at finding accounts at Chase and Bank of America the previous year.

One of those accounts belonged to a Mableton couple, Samuel and Graciela Zamarron, who also owed money to their HOA. Their account at Bank of America was garnished through a proceeding initiated a month after Trumble located it, records show.

Informed recently how the firm learned where she and her husband banked, Graciela Zamarron said she found the matter troubling.

"Of course, we're upset," she said. "We did not give them access to the bank account, nor did we give them any indication where we banked."