Opinion: Tax reform clears a major hurdle, faces another

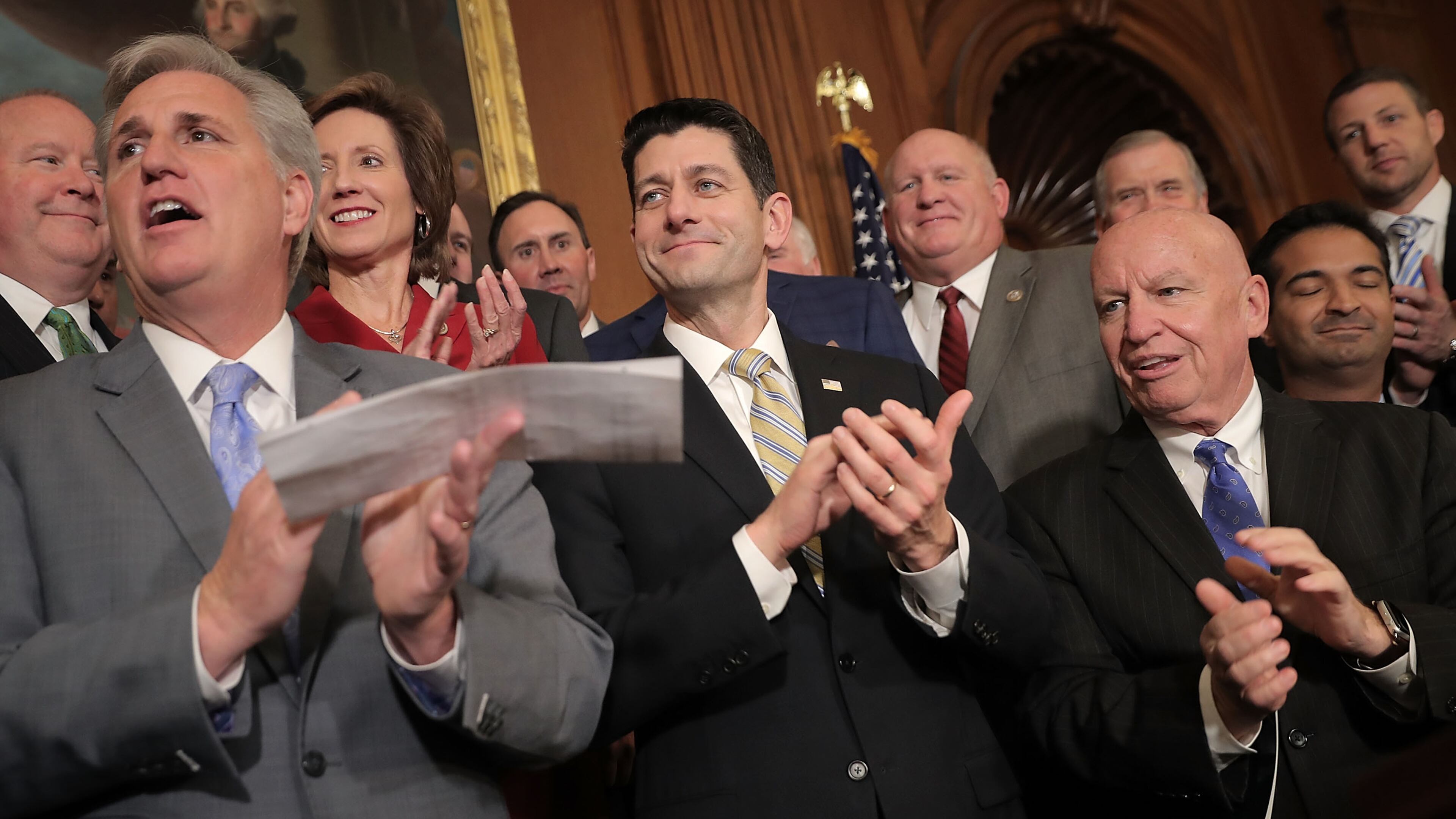

Big news out of the U.S. House just now:

That's a more comfortable margin than the razor-thin, 217-213 vote by which the House passed its Obamacare repeal-and-replace bill in the spring. Just 13 Republicans ended up opposing the bill . There were fears of more defections -- more than twice that many House Republicans come from the high-tax states of California, New Jersey and New York, where the partial removal of the state and local tax (SALT) deduction would bite hardest -- but in the end most of them voted for the bill.

The focus now shifts to the Senate, which again is flirting with legislative disaster. A number of Senate Republicans have already expressed doubts about their version of the legislation, and that's before the possibility a Democrat will replace interim Sen. Luther Strange of Alabama after the revelations about GOP candidate Roy Moore . The previous goal of passing a tax bill by year's end might have to be bumped up to beat Alabama's Dec. 12 special election.

Of course, there will have to be more than one vote. It's clear that the Senate will not -- initially, anyway -- pass the same bill the House just approved. Senators are working from a fairly different script right now: eliminating the SALT deduction entirely but adding back a few others; keeping more tax brackets but lowering the top rate; phasing in or out more of the tax provisions (to affect the scoring of the bill regarding its impact on the deficit within a 10-year window); and more. Passing one bill and then reconciling it with the House version, and then passing that, before Dec. 12 will be a challenge.

One way senators are trying to give themselves some leeway is by including a repeal of the Obamacare individual mandate. Originally sold as a penalty but upheld by the Supreme Court as a tax, the financial cost of failing to purchase insurance brings in some revenue each year. But this is vastly outweighed by the amount the government spends to subsidize some of the insurance people buy to comply with the mandate. Repealing the mandate thus is projected to save more than $300 billion over 10 years, a significant bump given that Congress has only $1.5 trillion over 10 years of wiggle room under the budget instructions they approved earlier this year.

Some of my liberal friends will describe this as taking away people's health insurance to pay for tax cuts. But "taking away" is the exact wrong thing to call this. The change would not strip anyone of their ability to obtain or even pay for health insurance as they do now under Obamacare. The people who would not be insured anymore after the change would, by definition, be people who were choosing not to be insured. I have noted before that the Congressional Budget Office's past forecasts have greatly overestimated the impact of the individual mandate. It's worth noting now that the number of people expected to drop their insurance (13 million by 2027) would include 5 million decided not to enroll in Medicaid -- a free program. Nonetheless, whatever the number is, these are people who would be making a choice about their health insurance, not having that choice forced upon them. There may be good or bad effects of that choice for themselves and others in the health-insurance market, but the point is they could continue making the same choice they made before; no one is "taking away" anything from them.

Assuming senators stick with the idea of repealing the individual mandate, that $300 billion-plus could give them the flexibility to bridge the gaps that exist among themselves as well as between the Senate and the House. Without that flexibility, it is hard at the moment to see how they get to "yes" all the way around.