For a generation that, by most accounts, is not at all interested in racking up credit card debt, millennials across the country did something out of character this month.

The applied, in droves, for a newly issued credit card. Not just any credit card, mind you, but a credit card that comes with an astonishing $450 a year annual fee.

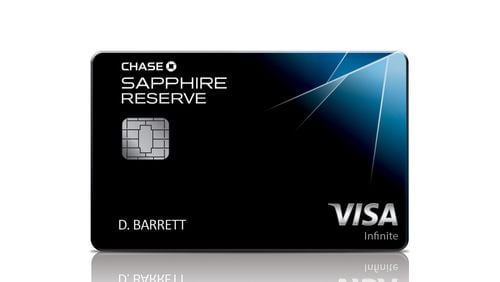

JP Morgan Chase unveiled the new credit card at the end of August called the Chase Sapphire Reserve. Within days of that program’s start, the company had run out of the physical cards – special ones made with embedded metal – and had to send out plain plastic cards.

Perhaps the even more surprising part came when Chase said a good number of those who applied – “tens of thousands” of people total – were millennials, or the generation of Americans born between 1982 and 2002.

Millennials have gained a reputation for shunning credit card debt, perhaps, a New York Times story suggests, because of staggering student debt and seeing their parent's generation struggle with paying down credit card bills. Federal Reserve data shows the average American under 35 holds 182 percent more college loan debt than students graduating in 1995 did.

“The large and sustained increase in student loan balances over the past decade or so has raised concerns that student loan borrowers are incurring debt burdens that will be difficult to repay and will hinder their ability to achieve life goals such as purchasing homes, starting families, investing in small businesses, or retiring from the workforce,” the Fed study reported.

The New York Times story reported that millennials are taking on fewer mortgage and auto loans and they use credit cards less than previous generations.

So why are they going for this one?

It’s the benefits.

Analysts say the demand for the card, especially by millennials, can be traced to the rewards it offers. What do you get for your $450? Here’s a few of the perks:

• 100,000 Chase Ultimate Rewards points (with a minimum of $4,000 spent on the card within the initial three months). Points can be transferred to airline and hotel partners along with other partners -- it has an estimated value of at least $1,500.

• 3 points per dollar on travel and dining, worldwide

• 3 points per dollar on travel Uber and Airbnb expenses

• Automatic $300 annual rebate for travel expenses

• Priority Pass Select – that lets the cardholder into more than 900 travel lounges worldwide

• $100 Global Entry credit every five years – Global Entry is a “U.S. Customs and Border Protection (CBP) program that allows expedited clearance for pre-approved, low-risk travelers upon arrival in the United States.” You have to pay $100 to sign up for the service.

• Enhanced travel protections under the Visa Infinite program

• No foreign cash transaction fees

The reason the card is so popular with those younger than 35 is its benefits. When a card like the Sapphire Reserve hits the market, credit card “churners” -- those who apply for cards just to get the free travel and cash deals then move on to the next card for its deals – line up for the deals.

Millennials also make up a large portion of the churner population.

Chase said they spent nothing on marketing the new card, they let social media do that for them. On Reddit's "churning" forum, a thread about the new card drew 10,000 comments. The forum has 53,000 subscribers.

Millennials, a Bloomberg News story explains, are not going for credit cards to run up debt, but to find cash-back deals and get bargains on travel. In the quest to get bonus sign-up points, churners will apply for several cards using them just to accrue the benefits, but making sure to pay them off monthly – something that keeps the card issuer from making money.

According to the Bloomberg story, credit card companies have begun to try to reign in some of the churners by making the deals a little less profitable. The Sapphire Reserve card application warns: "You will not be approved for this card if you have opened five or more bank cards in the last 24 months."